Business Have Some Essential Financial Statements – What are They?

While running your business, you must ensure that its operations are going smoothly. To achieve this purpose, you have to keep a check on your finances as the topmost priority. It is important to maintain a good financial position and keep the financial statements updated. If you are a beginner, you may need information regarding the financial statements of your business. This article lets you know what is to be prepared and what is the purpose of each financial statement. If you also want to learn the basic kinds of financial statements, keep reading ahead.

What are the financial statements?

Tracking the financial statements of your business helps you know if business is going on the right track and will sustain in the coming years. The financial statement serves as the financial report of your business that indicates the wealth coming in, the wealth going out and where your money is going.

Financial statements also show the assets and liabilities held by the business. Every business, irrespective of its nature and scale, must keep its financial statements updated. This way you can always access the latest and most accurate financial picture of your business.

The Significance of Financial Statements

Your financial statements record all monetary activities of the business and help you determine the clear picture of the business in the industry. Following are the points showing importance of the financial statements.

- Financial statements help you decide the best approach regarding your marketing strategies. Here you can find marketing strategies checklist samples and templates to make a sound marketing strategy easily for your business.

- With the business growth goal, you would want more investors to invest in the business to help its expansion. To make your business look like a profitable opportunity, you have to show that your business is having a firm position in terms of finances. By having a financial statement analysis, you will determine the areas of the business that are the best for investments.

- Keeping a check on financial statements, you remain aware of the expanses and hence you can control the spending better.

The Basic Financial Statements for a Business

Having a stable financial position on a consistent basis is of critical importance, especially when you want your business to grow radically and attract more investors. Financial statements can show if your business performance is according to the latest trends and the prices of your offerings are competitive enough to keep the business sustaining in the long run. You can download income statement samples here.

Starting a new company is challenging as you need to know the ins and outs of the financial activity of your business. Here we explain the basic financial statements used in any business. These are:

-

Balance Sheet

Having the word “balance”, the balance sheet is the financial statement that shows if your liabilities as well as the equity or the capital is equal to your business assets. In equation form, it is represented as Liabilities + Owner’s Equity = Assets. These elements are usually listed in the columns of the sheet. Both equations must be equal at the end of the specified financial period in the sheet. To help you better understand it, read the explanation of these elements:-

Assets

Assets are the property owned by your business. These are cash equivalent and can be used to pay your business liabilities. There are two kinds of assets; current assets and fixed assets:-

Current Assets

These are also called current accounts. These can be cash or things that can easily be converted into cash within a year. Examples are:- Cash (both local and foreign cash)

- Prepaid expenses or expenses paid in advanced

- Accounts receivables or any payment that is to be received within the year

- Investments

- Inventory

-

Fixed Assets

These are the assets that have been bought for long-term use and are hard to changed into cash easily. These are mostly tangible assets and often used in manufacturing of goods and products sold by the business. Examples are:- Machinery

- Equipment

- Land

- Buildings

- Furniture

-

Current Assets

-

Liabilities

It is common for the business to incur debts and other financial liabilities. The liabilities in business are of two types, current liabilities and long-term liabilities.-

Current Liabilities

Current liabilities, also called short-term liabilities are the financial obligations and debts of the business that are to be paid within a year. These are:- Accounts payable to the suppliers usually mentioned in sales invoice template

- Taxes payable like payroll taxes, sales taxes, and income taxes

- Short-term bank advances

- Deposits

- Short-term loans that are payable within a year

- Matured long-term debt or the percentage of a long-term debt due within a year.

-

Long-Term Liabilities

These are financial debts that you can be paid after a year. They are also called non-current liabilities. Examples are:

Deferred payments for revenues, compensations and income taxes- Capital leases

- Bonds payable or payables issued by the corporations, hospitals and governmental entities

- Retirement investments

- Pension liabilities

- Other derivative liabilities

-

Owner’s Equity

Owner’s equity is the amount invested by business owners. In equation term, it is total assets minus the total liabilities (Total Assets – Total Liabilities = Owner’s equity). Examples are:- Stocks, preferred and common

- Excess cash got from the shareholders

- Retained earnings from the last years

- Accumulated income

- Investors interested in your business first see your business financial statements.

- This is because the balance sheet is the summary of the overall financial performance of your business. It is a sound indicator of company’s stability and liquidity, the most common factors that investors look for.

-

Current Liabilities

-

Assets

-

Cash Flow Statement

The cash flow statement keeps the record of how much cash enters and goes out of the business.- Cash Inflow

This is the money coming in the business. This usually include cash sales and receivables. - Cash Outflow

This is the money going out of the business because of purchases, inventory, paid expenses, and other payments made during a specific time period. Cash flow statement provide your with information whether your business has enough cash to keep on running. However, it doesn’t essentially imply that your business is profitable. This is because the cash comes in and goes out not with the same rate. It sometimes happens that your business cash is spended faster than it comes in. You have to keep a good balance so as to have enough cash.

- Cash Inflow

-

Income Statement

An income statement or profit and loss statement the financial statement that helps determine if you have profits or loss our of your business operations. This also lets you see the sales and expenses you had within the year. Usually, these are the parts of an income statement:

- Total Revenues.

It is the cash generated by a business before it begins paying expenses. It is calculated as: Price of the Good Sold multiplied by Quantity Sold or P × Q. - Total Expenses. These are the total sum of financial obligations spent during the specified period. This include utilities, purchases, rent, credit card payments, etc.

- Net Income. This is the Gross Profit Minus Total Operating Expenses.

Your income statement format should be standard. By seeing an income statement, you get an idea about the risks involved and can decide whether to extend spending, credit, and capital for the business. - Total Revenues.

You May Also Like

Event Risk Management Plan

Sample Leadership Retreat

Non Profit Agenda Example

Perfect Christmas Birthday Gift List

Corporate Development Agenda Template - Streamline and Enhance Development Initiatives Globally

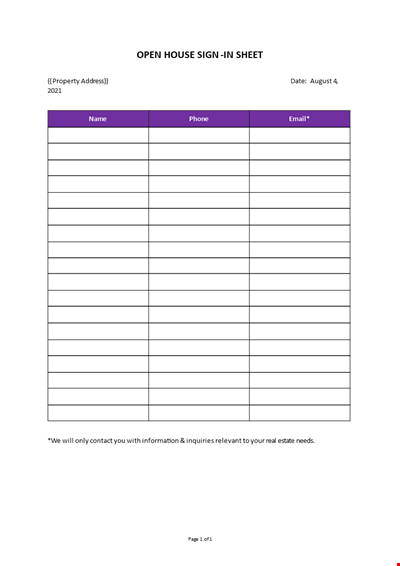

Open House Sign-in Sheet

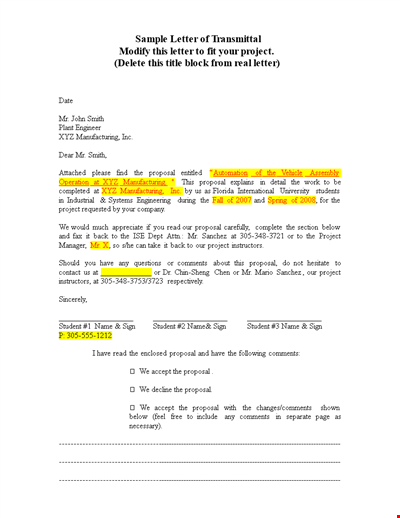

Letter Of Transmittal Template - Create a Professional Project Transmittal Letter

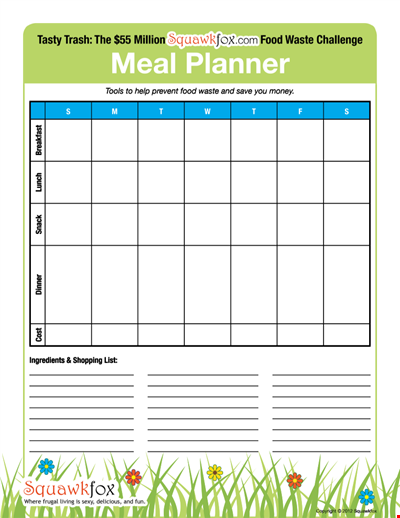

Create an Efficient Meal Planning Calendar for Easy Meal Preparation