How to Write Loan Contracts?

If you’re new to the world of loans, you may not be fully aware of what a loan contract actually is and how it works. A simple loan agreement is a contract between you and your creditor that outlines the terms of your loan. If you have your own business or are planning on applying for small business loans, it is good to know what a loan contract looks like and what it entails.

In fact, most loans in the U.S. are done through contracts because they provide both lender and borrower with the legal protections they need to ensure that each party fulfills their responsibilities appropriately throughout the duration of the loan. From personal loans to commercial mortgages, here’s what a personal loan is, why it is crucial to understand loan contracts, and how you obtain one.

What is a Loan Contract?

A loan contract is a legally binding agreement between a lender and a borrower that outlines the terms of a loan. It can be used for both personal and business loans. In most cases, there are two types of loans with two different kinds of contracts: secured loans and unsecured loans. Secured agreements are backed by collateral, while unsecured do not have any collateral backing them up.

Elements of a Loan Contract

A private loan agreement can be a long and confusing document. However, the contract contains all the information needed for borrowers and lenders. These details should include;

- Grabbing Details - The fundamental and crucial components that a contract must include are name, contact number, address, and other relevant information about the borrowers and lenders.

- Loan Terms - This remains the core of any agreement because the terms laid down the other significant details that include the start date, loan amount, interest payable, and other things of the loan.

- Repayment Schedule - Another essential detail of a private loan agreement is defining the borrower’s repayment schedule. The borrower can set the repayment schedule as per requirements.

- Late Charges - The key to a successful loan agreement is to ensure that the borrower repays the loan amount according to the schedule. Therefore, the lenders must write clearly the penalty a borrower has to pay in case of late payments.

How to Write a Loan Agreement?

Writing a loan agreement can be daunting, but this guide will assist you in doing so effectively. Nonetheless, you can find loan agreement templates online and download them.

Let us explore the steps to craft a perfect loan contract;

Step 1 - Writing Contact Points

The first step toward writing an agreement is to mention the contact points of both parties. It should include their legal names (not nicknames) and formal address. And all this should be covered in the first section of your agreement.Step 2 - Write Loan Details

In the next step, you must write down the loan amount which is known as the “Principal Sum.” Apart from this, the section should include the repayment details of the loan payment. The repayment can be done at regular intervals with a fixed amount for a duration. Also, the borrower can pay a single amount once and for all, as specified by the lender.Step 3 - Choose the Loan Collateral

A secured loan comes with some or the other kind of security that the borrower gives to the lender. Here the borrower can attach any personal belonging such as any property or gold that acts as collateral.Step 4 - Mention Interest Rate

As we know, every loan comes with some percentage of interest. And therefore defining the interest rates in your contract is a wise move to avoid any further issues. The interest rate is levied on the principal amount of the loan. This section must also include any late fees imposed if the borrower fails to repay the loan amount within the time frame specified.Step 5 - Provide Provisions for Prepayment

Every loan provides the provision to pay the loan ahead of schedule. In such cases, you can specify whether penalties will be enforced if the borrower pays off the loan early. A penalty is usually applied to discourage early loan repayment and to encourage long-term payments.Step 6 - Include Relevant Signatures

The last thing that a loan agreement should include is the signatures of both parties. This part also has the signature of any personal guarantors or co-signers.Conclusion

Finally, a loan contract is an agreement between a borrower and a lender that establishes the terms of a loan. It is an important document, and you can use this for personal loans, business loans, or any other type of loan agreement. It is essential because it sets forth the rights and obligations of the parties, and can help prevent disputes. You can create your own contract using a personal loan agreement template that you can customize according to your needs.You May Also Like

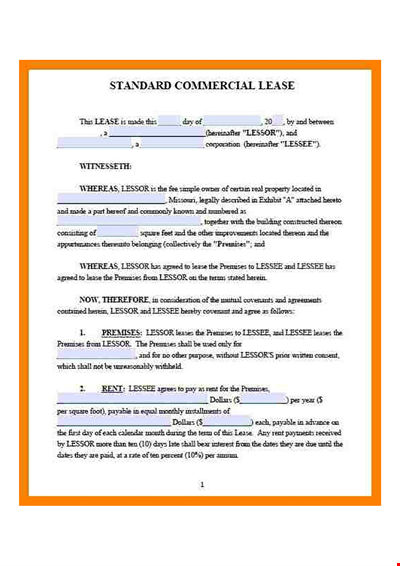

Sample Property Lease Agreement TemplateFree Download

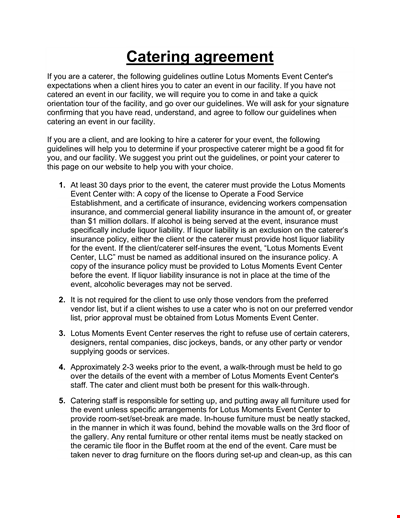

Event Catering Agreement Template - Plan Your Event with Center Lotus Moments

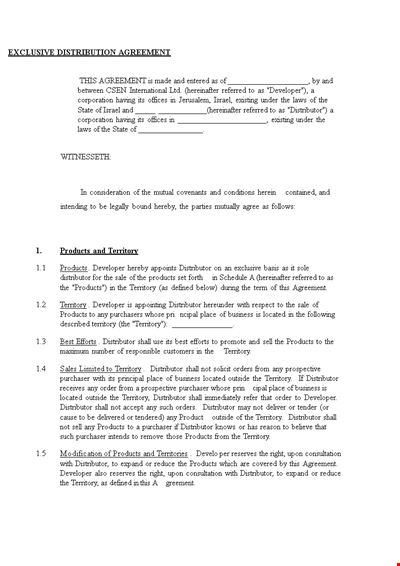

Exclusive Distribution Agreement Form Sample | Agreement for Developer & Distributor

Create a Schedule Contract Payment Template for Corporations

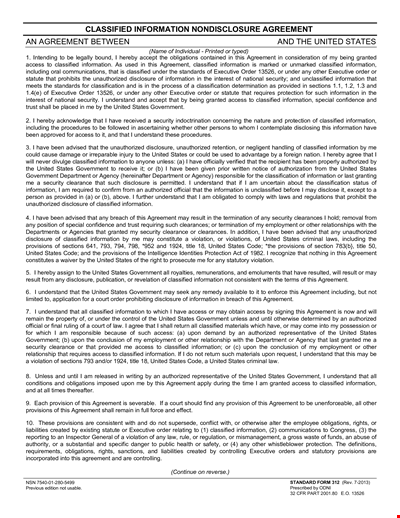

Free Non-Disclosure Agreement Form | PDF Format | United States Classified Information

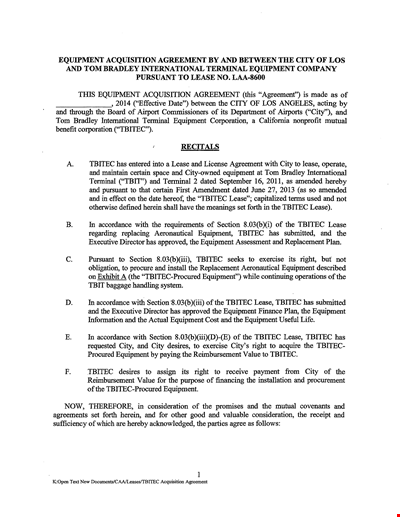

Equipment Acquisition Agreement Template: Ensure a Smooth Equipment Acquisition Process | TBITEC

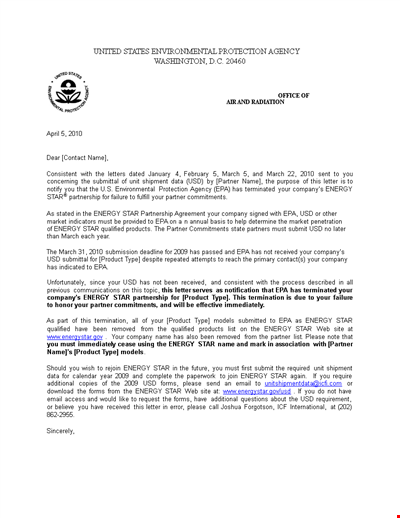

Download Partnership Termination Letter Template - PDF Format | Energy Partner Template

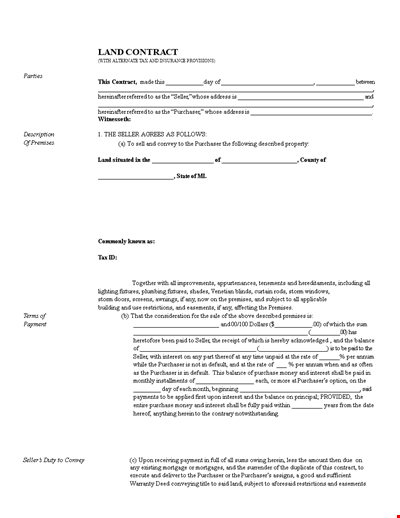

Free Printable Land Contract Form - Create a Contract for Purchaser and Seller