Insurance letters are letters from insurers to their clients. These can also be letters sent by clients to the respective companies to make a specific claim or to know something important about their insurance policy. The insurance letters are confidential and carry important information regarding health, life insurance claims or objects, and their insured values. The insurance letter is written with a strong intent to convey all essential details about the specific insurance to their clients. The information and statements written in the insurance letter are considered very important and are supported by the company’s claims as mentioned in the official insurance policy documents. These letters are directed towards the client, mentioning their outstanding premiums, fringe benefits, and lapse policy terms.

Insurance Letters Examples

-

Sales Insurance Agent Resume

Download our Sales Insurance Agent Resume template in DOCX format. Craft a winning resume to showcase your sales skills, business acumen, and ability to connect with customers. Stand out from the competition with a professional and impressive resume. -

Insurance Agent Agreement Template

Download our Insurance Agent Agreement Template in PDF format. This customizable agreement is designed to establish a clear understanding between the agent and the company, ensuring both parties' rights and obligations are defined. Don't miss out on this invaluable tool for your insurance business. -

-

Injury Witness Statement

Download our Injury Witness Statement template in DOCX format to accurately record incident details, ensure the injured person's statement is completed, and gather crucial information for legal purposes. Act today! -

How to write an insurance letter?

The insurance letters should be carefully dated and addressed to a specific person. If the company is presenting the letter, it should follow the uniform letterhead format. Start with formal greetings and then move on to the main content. All the essential details about the policy, annual premium, allocations, and benefits should be clearly stated in the insurance letters. Make the reader read the terms and conditions at the bottom or back of your letter and ensure its feasibility before moving on with the process. All specifics must be covered to avoid any uncertain mishap due to miscommunication of information. End with proper greetings and salutations to make the reader feel valued and honored.

If the client directs the insurance letter to the insurance company, he must highlight the date and place at which the accident or casualty occurred. The sender should always write his valid emergency contact number and emails to establish swift communication. The writer must mention the insurance number of the person at fault and his contact details.

Why keep a record of all insurance letters?

The importance of insurance letters is understood at the time of uncertainty. If any accident or unwanted tragedy occurs, the person can refer to these insurance letters to work out the best possible way out. Insurance letters are highly confidential and contain all vital information about you and companies' coverage policies. Many insurance letters clearly state the insurance of vulnerable products and their insured value. One can always keep a track record of his insurance period's starting and ending date and other premium details.

-

Question & Answers related to Insurance Letters Examples

-

Medical Insurance Complaint Letter Template

Download our Medical Insurance Complaint Letter Template to effectively voice your concerns about medical treatment. Advocate for yourself or your loved ones with a professionally crafted letter. -

Financial And Insurance Call Log

Efficiently track and manage all your financial and insurance calls with our user-friendly Call Log. Stay organized with important details like called institution, date, and time. Download now in PDF format. -

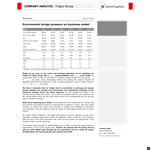

Insurance Company Analysis Template

Supercharge your insurance company analysis with our Insurance Company Analysis Template. Analyze market trends, company performance, and group metrics. Download now in PDF format from Triglav-EUR and get ahead in the insurance industry! -

What is an insurance experience letter?

Experience insurance letters prove your past track record and identify your past risks. People safely document their insurance experience letters to prove their history of being insured and get new coverage at lower costs. While issuing a new insurance policy, the company goes through your insurance experience to determine your risk level. In the case of no claims in the past, you can avail of benefits and discounts while renewing your lapsed policy.

How to write an insurance claim?

When writing an insurance claim letter, you should always remember to prove your identity first. Next, clearly state the specific insurance policy for which you are filing the claim. Mention your registered contact details and valid insurance number to fast track your process to settle the claim.

-

Insurance Administrative Services Agreement Template

Get your Insurance Administrative Services Agreement Template - include all necessary details, exclude deductible costs, even after partnering with Aetna. Download now in PDF format. -

Medical Insurance Claim Letter Template for Patient Treatment

Download our Insurance Claim Letter Template to effortlessly file insurance claims. Safeguard your rights as a patient and simplify the process of seeking reimbursement for medical treatment. Get your copy today! -

Insurance Sales Promotion Letter

Boost your sales with our Sales Promotion Letter template. Craft persuasive and engaging letters that will captivate your audience. Download now in customizable DOCX format. -

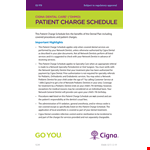

Patient Charge Schedule for Dental Procedures and Dentures

Get organized with our Patient Charge Schedule template. Simplify dental procedures and track patient charges effortlessly. Download in PDF format now.