/832456dc-6b72-432b-a779-47075a1b59ef.png)

Example Simple Budget Worksheet For Family

Review Rating Score

Creating and managing a budget is crucial for any family to achieve financial stability and reach their goals. To help you get started, we have developed an example simple budget worksheet for families. This easy-to-use template will assist you in tracking your income, expenses, and savings, all in one place.

The Importance of Budgeting

A budget is essentially a financial roadmap that allows you to plan your spending, prioritize your expenses, and allocate your income wisely. Here are some key reasons why budgeting is important:

- Financial Awareness: By tracking your income and expenses, you gain a clear understanding of where your money is going and can identify areas where you can make adjustments to meet your financial goals.

- Goal Setting: A budget helps you set and achieve financial goals, whether it's saving for a vacation, paying off debt, or creating an emergency fund.

- Expense Control: With a budget, you can take control of your spending habits and avoid unnecessary expenses. It enables you to make informed decisions about what is essential and what can be minimized or eliminated.

- Financial Stability: By living within your means and consistently saving, budgeting helps you build financial stability, reduce debt, and prepare for unexpected expenses.

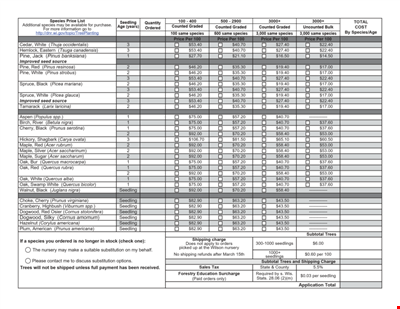

Using Our Example Simple Budget Worksheet

Our example simple budget worksheet for families provides a straightforward and organized way to manage your finances. It consists of several sections:

- Income: In this section, you can record all sources of income for your household, such as salaries, freelance work, or investments. Calculate your total monthly income.

- Expenses: Track all your monthly expenses, including fixed expenses like rent/mortgage, utilities, groceries, transportation, and variable expenses like entertainment, dining out, and clothing. Categorize your expenses and note the amounts for each category.

- Savings: Determine how much you want to save each month. It can be a fixed amount or a percentage of your income. Set savings goals, such as emergency funds, education, or retirement, and track your progress.

- Net Income: Calculate your net income by subtracting your total expenses and savings from your total income. This will give you an overview of your financial situation.

Download the Example Simple Budget Worksheet

Ready to take control of your family's finances? Visit BizzLibrary.com today to download our example simple budget worksheet for families in PDF format. It's free to download, easy to use, and will assist you in managing your income, expenses, and savings. Start your journey toward financial security and meet your long-term financial goals.

At BizzLibrary.com, we offer a wide range of useful document templates to help you streamline your business and personal life. Explore our website for other helpful resources, such as legal documents, business plans, and more!

Is the template content above helpful?

Thanks for letting us know!

Reviews

Hermine Franklin(9/19/2023) - DEU

Grateful!!

Last modified

Our Latest Blog

- A Guide to Make a Business Plan That Really Works

- The Importance of Vehicle Inspections in Rent-to-Own Car Agreements

- Setting Up Your E-mail Marketing for Your Business: The Blueprint to Skyrocketing Engagement and Sales

- The Power of Document Templates: Enhancing Efficiency and Streamlining Workflows

Template Tags

Need help?

We are standing by to assist you. Please keep in mind we are not licensed attorneys and cannot address any legal related questions.

-

Chat

Online - Email

Send a message

You May Also Like

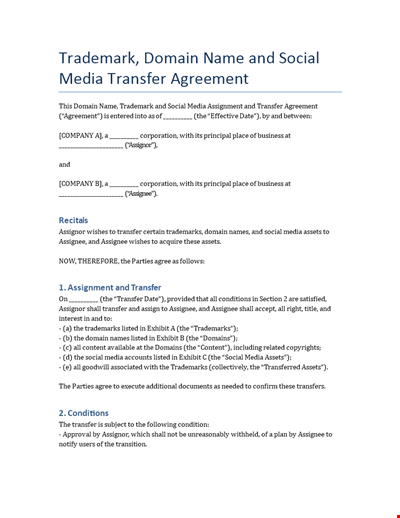

Trademark, Domain Name and Social Media Transfer Agreement

Professional Fresher Engineer Resume Example

Event Risk Management Plan

Sample Leadership Retreat

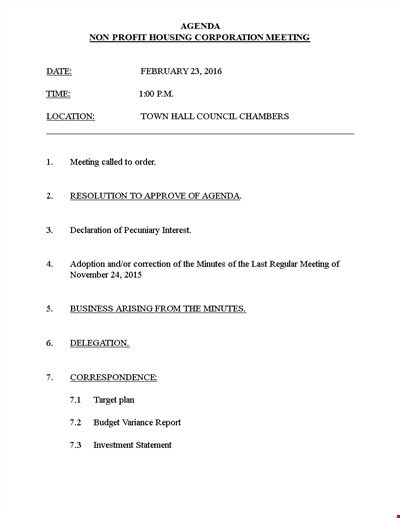

Non Profit Agenda Example

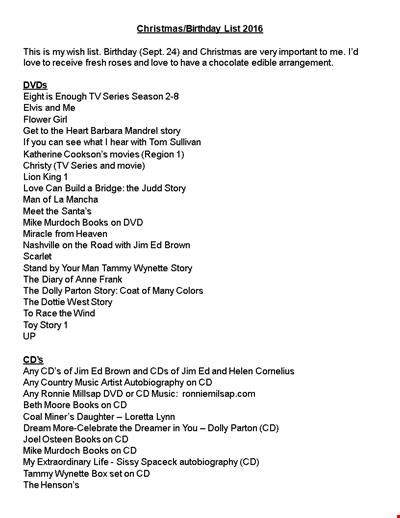

Perfect Christmas Birthday Gift List

Corporate Development Agenda Template - Streamline and Enhance Development Initiatives Globally

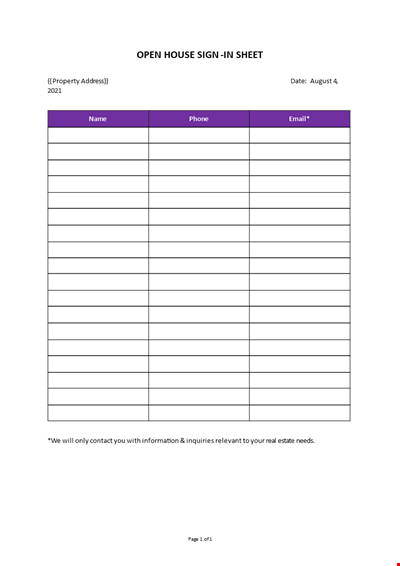

Open House Sign-in Sheet

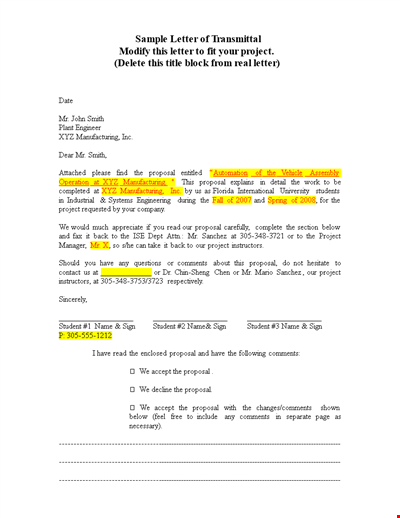

Letter Of Transmittal Template - Create a Professional Project Transmittal Letter

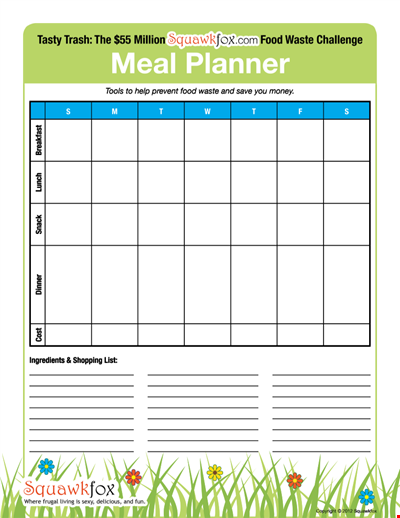

Create an Efficient Meal Planning Calendar for Easy Meal Preparation

Seedling Price List - Affordable Saplings for Your Garden | Buy Best Quality Seedlings Online

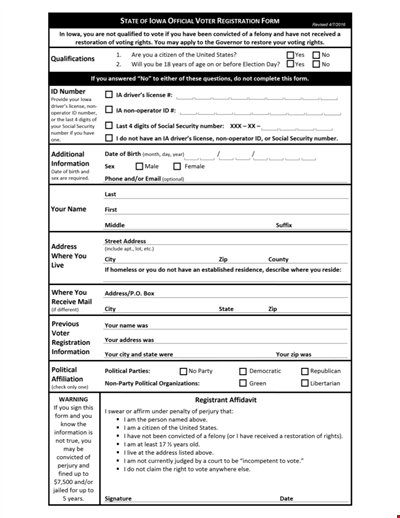

Printable Voter Registration Form

Department Material Requisition Form

Colored College Ruled Paper

College Ruled A Size Paper Template

Management Resume Us Letter