/5bff7497-5c45-460d-834f-94b7e1bd2ff3.png)

Bonus Depreciation Calculator

Review Rating Score

If you're looking for a reliable tool to track and calculate depreciation for your business assets, our Depreciation Schedule Template is just what you need! With this easy-to-use template, you can efficiently manage your assets, calculate depreciation expenses, and make informed decisions about your business investments.

What is Depreciation?

Depreciation is an accounting concept that allows businesses to allocate the cost of an asset over its useful life. As assets like equipment, vehicles, or buildings lose value over time, depreciation helps account for this wear and tear, ensuring that expenses are properly recognized.

Why Use a Depreciation Schedule Template?

A Depreciation Schedule Template offers several benefits for your business:

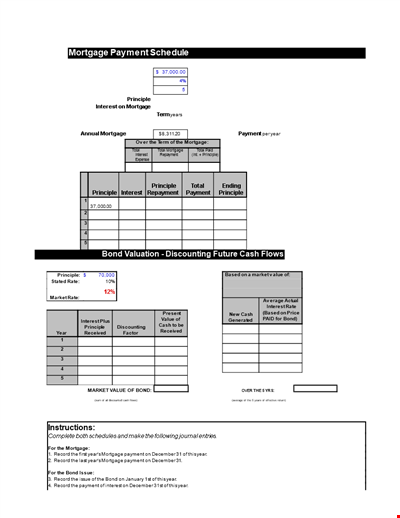

- Accurate Depreciation Calculation: Our template uses industry-accepted depreciation methods, such as straight-line, declining balance, or sum-of-years digits, to ensure accurate and consistent calculations.

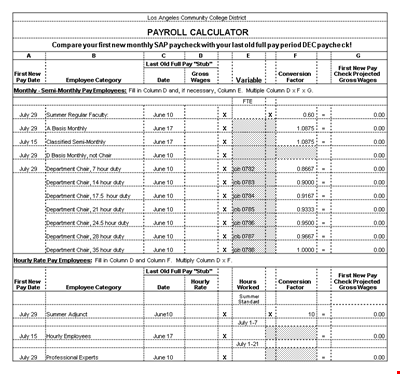

- Easy Asset Management: The template allows you to keep track of all your assets in one place. It provides fields to enter detailed information about each asset, including its purchase date, cost, salvage value, and useful life.

- Tax Compliance: Depreciation expenses can be tax-deductible. The Depreciation Schedule Template helps you determine the depreciation expense for each asset, ensuring you take advantage of tax benefits and comply with relevant tax laws.

- Financial Planning: By accurately calculating asset depreciation, the template provides insights into the expected decrease in asset value over time. This allows you to make informed decisions about future investments and budget allocations.

- Bonus Depreciation Calculations: In certain situations, businesses may be eligible for bonus depreciation, which allows for a higher percentage of immediate deductions in the year the asset is placed in service. Our template incorporates options to calculate bonus depreciation when applicable.

Download Our Depreciation Schedule Template

Ready to take control of your asset management and ensure accurate depreciation calculations? Download our Depreciation Schedule Template in XLSX format and start optimizing your business finances today!

Visit BizzLibrary.com now to explore our extensive collection of business templates, including financial and accounting documents, tax forms, and much more. Make informed financial decisions and streamline your business processes with our professionally designed templates. Download now!

Is the template content above helpful?

Thanks for letting us know!

Reviews

Gene Hunter(7/20/2023) - GBR

I can tell you this document will help you a lot

Last modified

Our Latest Blog

- The Importance of Vehicle Inspections in Rent-to-Own Car Agreements

- Setting Up Your E-mail Marketing for Your Business: The Blueprint to Skyrocketing Engagement and Sales

- The Power of Document Templates: Enhancing Efficiency and Streamlining Workflows

- Writing a Great Resume: Tips from a Professional Resume Writer

Template Tags

Need help?

We are standing by to assist you. Please keep in mind we are not licensed attorneys and cannot address any legal related questions.

-

Chat

Online - Email

Send a message