/18f8d37e-0449-48d5-828a-5be4378cc7ce.png)

Correspondent Banking

Review Rating Score

Correspondent banking is a crucial practice in the global financial system that allows banks to provide services to clients operating in different parts of the world. At BizzLibrary.com, we understand the importance of having a clear and concise Correspondent Banking agreement in place to help mitigate risks and establish a mutually beneficial partnership between financial institutions.

What is Correspondent Banking?

Correspondent banking is a relationship established between two banks that allows them to provide services to each other's clients in different jurisdictions. It involves one bank (the "correspondent bank") holding deposits of another bank (the "respondent bank") in the correspondent bank's home country, and facilitating transactions on behalf of its respondent bank clients.

Why Do You Need a Correspondent Banking Agreement?

A correspondent banking agreement serves as a legally binding contract between two financial institutions entering into a correspondent banking relationship. It outlines the terms and conditions of their partnership, helping to manage risks and establish clear expectations for both parties. Here's why having a correspondent banking agreement is essential:

- Service Details and Responsibilities: The agreement clearly defines the services to be provided by the correspondent bank, including deposits, settlements, transactions, and others. It outlines the responsibilities of each party, specifying roles, and limitations to minimize exposure to legal and regulatory risks.

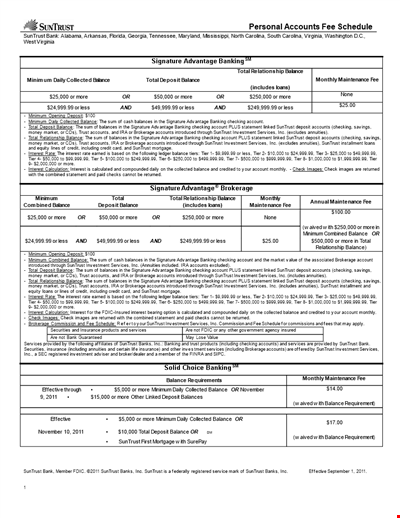

- Fee Schedule and Payment: The agreement establishes a fee schedule for services provided, including fees and expenses associated with transactions. It also provides details on payment terms, currency exchange rates, and methods of reimbursement to ensure transparency and prompt payment.

- Compliance and Regulatory Requirements: The agreement provides a framework for ensuring compliance with all applicable laws, regulations, and standards, including anti-money laundering and anti-terrorist financing requirements. It specifies the monitoring procedures, reporting requirements, and due diligence activities necessary to maintain regulatory compliance.

- Data Protection and Confidentiality: The agreement includes provisions for protecting sensitive financial information and data shared between banks to prevent unauthorized access or disclosure. It establishes confidentiality obligations, data retention policies, and data protection measures to ensure secure information sharing.

- Dispute Resolution and Termination: In the event of disputes or issues, the agreement provides procedures for resolving conflicts through negotiation, mediation, or arbitration. It also specifies the conditions under which the agreement can be terminated by either party.

Get Your Correspondent Banking Agreement Template

Don't leave your correspondent banking business vulnerable to uncertainties and potential risks. Download our professionally drafted Correspondent Banking agreement template in DOCX format today to secure your business interests. It's an essential tool for any financial institution looking to establish a solid foundation for their correspondent banking relationships.

Visit BizzLibrary.com now to access a wide range of business document templates, including legal contracts, sales agreements, and more. Take control of your correspondent banking business and ensure a successful and secure future!

Is the template content above helpful?

Thanks for letting us know!

Reviews

Marceline Salinas(7/8/2023) - AUS

I shared this letter with friends and bookmarked your site

Author. Content was provided by:

Elizabeth Davis

Elizabeth is from the sunny desert city of Phoenix, Arizona. She is thrilled to connect with professionals and like-minded individuals who share a passion for social technologies, content creation, and the exciting possibilities that AI brings to the world of social media. Her hobbies are hiking, climbing, and horse riding. Elizabeth has a master's degree in Social Technologies that she received at the ASU (Arizona State University). As a freelancer, she mostly contributes content related to IT. This includes articles on templates and forms provided by our community.

Follow Elizabeth

Last modified

Our Latest Blog

- The Importance of Vehicle Inspections in Rent-to-Own Car Agreements

- Setting Up Your E-mail Marketing for Your Business: The Blueprint to Skyrocketing Engagement and Sales

- The Power of Document Templates: Enhancing Efficiency and Streamlining Workflows

- Writing a Great Resume: Tips from a Professional Resume Writer

Template Tags

Need help?

We are standing by to assist you. Please keep in mind we are not licensed attorneys and cannot address any legal related questions.

-

Chat

Online - Email

Send a message

You May Also Like

Fund Transfer Letter Template for Account Members - Clearing

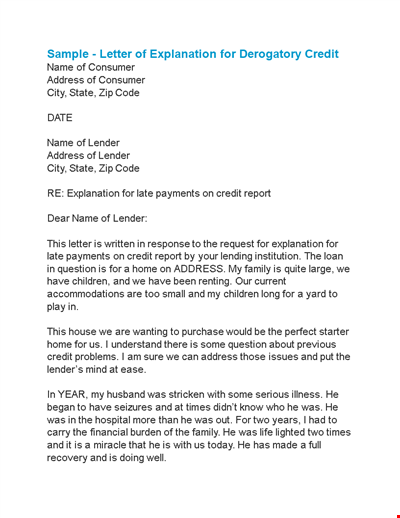

Letter of Explanation: Credit, Address, Consumer | SEO-Optimized Meta Title Solution

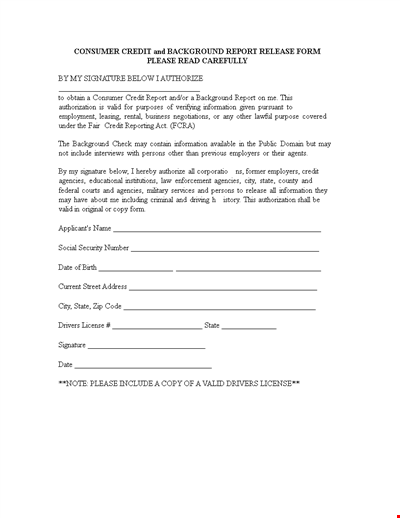

Validating Consumer Credit Background Report | Signature Required

Golden Credit Union Annual Report Template for Credit Union with Assets in Sacramento

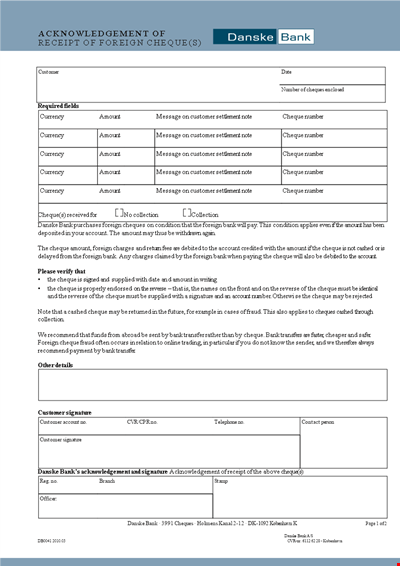

Acknowledging Cheques from Customers: Confirming the Amount Received

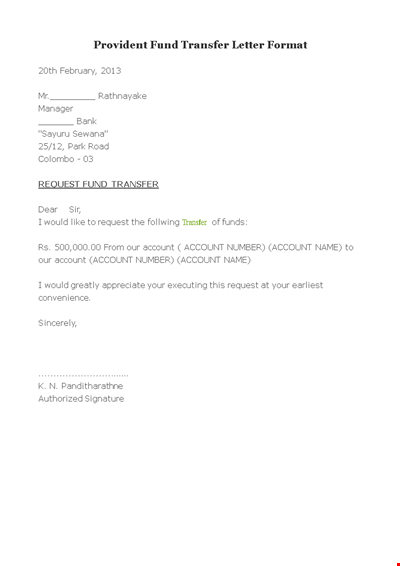

Provident Fund Transfer Letter Format

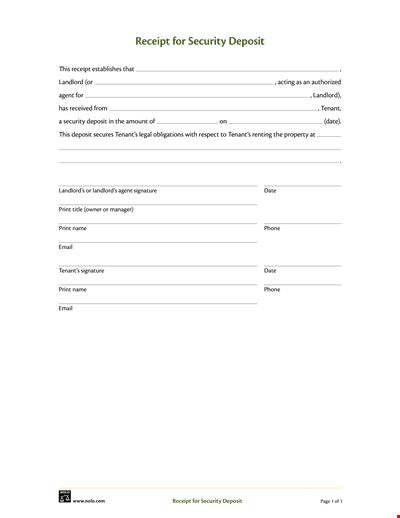

Simple Security Deposit

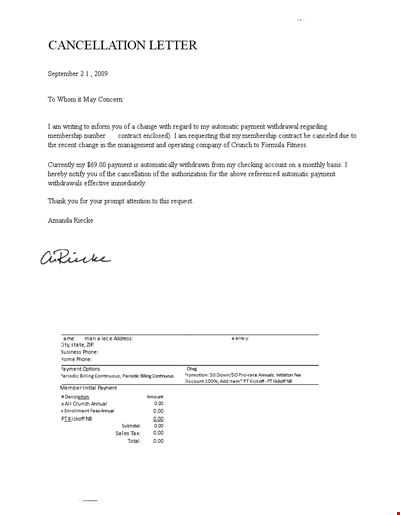

Fund Transfer Cancellation Letter Template

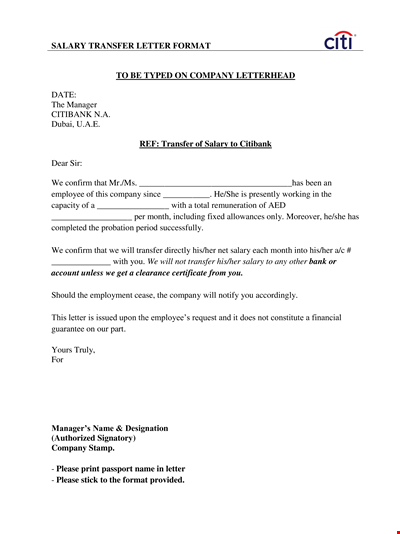

Salary Transfer Letter to Bank - Company's Letter for Employee's Salary Transfer

Experienced Retail Banking Executive | Branch Sales | Banking Leadership

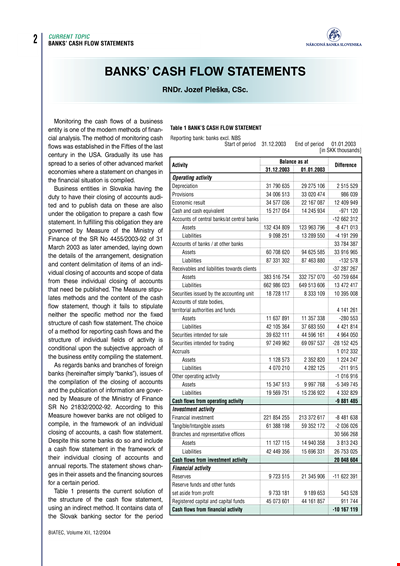

Bank Statement Template: Track Your Assets, Funds, and Banks

Chase Direct Deposit Form Template – Simple & Direct | Save Time & Money

SunTrust Personal Accounts Fee Schedule: Account Balance, Checking Accounts & More

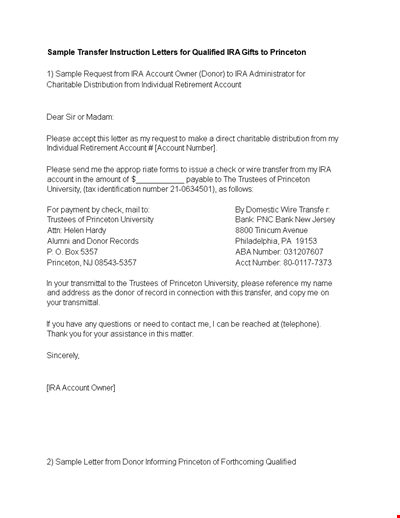

Example Fund Transfer Instruction Letter Template - Account Donor Princeton

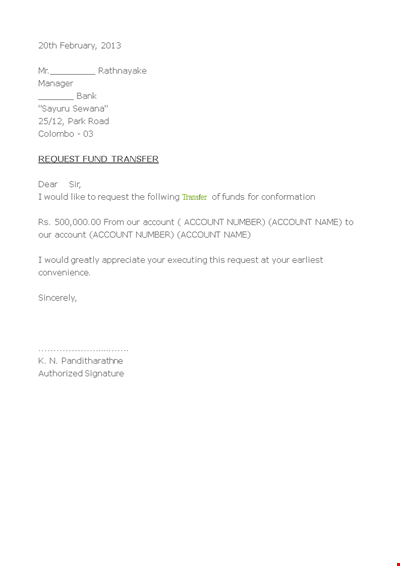

Fund Transfer Confirmation Letter Example

Credit Repair Letter Template