/a74a0967-27d5-426d-aae3-5d535d949c7d.png)

Property Depreciation Schedule

Review Rating Score

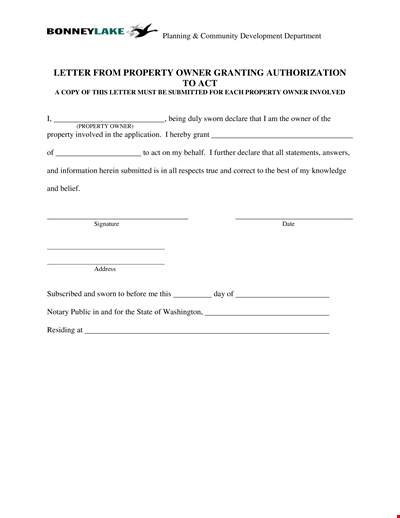

Are you a property owner or a business owner looking to accurately track and claim depreciation on your assets? Look no further! At BizzLibrary.com, we offer a comprehensive Property Depreciation Schedule template that will help you maximize your tax benefits and financial planning.

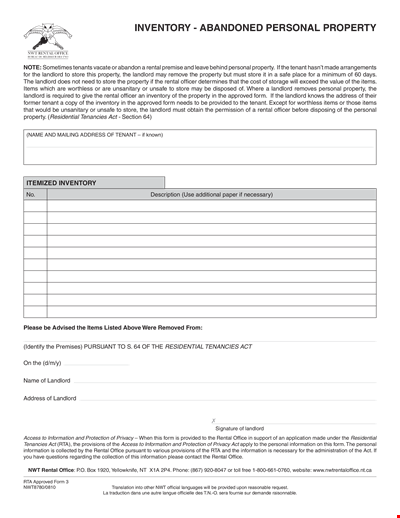

What is a Property Depreciation Schedule?

A Property Depreciation Schedule is a document that outlines the yearly depreciation of assets, such as buildings, equipment, or other industrial properties. It is essential for property owners to accurately calculate and claim depreciation as it allows them to minimize their tax liabilities and assess the true value of these assets over time.

Why Do You Need a Property Depreciation Schedule?

Having a Property Depreciation Schedule offers several benefits for property owners:

- Financial Planning: A depreciation schedule helps property owners plan for future expenses by providing a clear understanding of the value and lifespan of their assets. It allows for better budgeting and replacement strategies.

- Maximize Tax Deductions: By accurately tracking and claiming depreciation, property owners can maximize their tax deductions. This can lead to significant savings and improved cash flow.

- Property Valuation: A property's value is not static; it changes over time due to wear and tear or market conditions. A depreciation schedule provides an accurate assessment of the property's value, which can be crucial for decision-making or financial reporting.

- Asset Management: Keeping a property depreciation schedule helps property owners track and manage their assets effectively. It ensures that necessary repairs, upgrades, or replacements are planned and budgeted for accordingly.

How to Use Our Property Depreciation Schedule Template

Our user-friendly Property Depreciation Schedule template in DOCX format is designed to simplify the process of calculating and tracking asset depreciation. Simply download the template from BizzLibrary.com and follow these steps:

- Asset Details: Enter the details of each asset, such as the purchase date, acquisition cost, estimated useful life, and depreciation method.

- Annual Depreciation Calculation: The template automatically calculates the yearly depreciation amount based on the provided information. It provides a comprehensive schedule for each asset.

- Tax Deductions: Use the depreciation schedule to accurately claim tax deductions on your assets, maximizing your savings.

- Tracking and Reporting: Regularly update and maintain the depreciation schedule to track changes in asset values and prepare accurate financial reports.

Secure Your Financial Planning with a Property Depreciation Schedule

Don't miss out on potential tax deductions and financial planning opportunities. Download our Property Depreciation Schedule template in DOCX format today from BizzLibrary.com. Take control of your assets and ensure you make the most informed decisions for your property investments.

Is the template content above helpful?

Thanks for letting us know!

Reviews

Holly Rowland(7/24/2023) - AUS

Thank you!!

Last modified

Our Latest Blog

- A Guide to Make a Business Plan That Really Works

- The Importance of Vehicle Inspections in Rent-to-Own Car Agreements

- Setting Up Your E-mail Marketing for Your Business: The Blueprint to Skyrocketing Engagement and Sales

- The Power of Document Templates: Enhancing Efficiency and Streamlining Workflows

Template Tags

Need help?

We are standing by to assist you. Please keep in mind we are not licensed attorneys and cannot address any legal related questions.

-

Chat

Online - Email

Send a message

You May Also Like

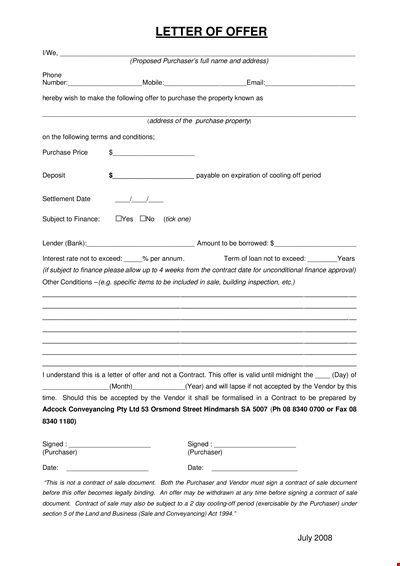

Formal Property Offer Letter Example Document

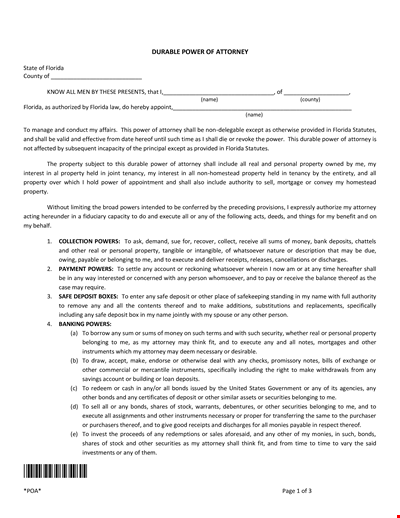

Property Power of Attorney: Shall Your Attorney Have the Powers?

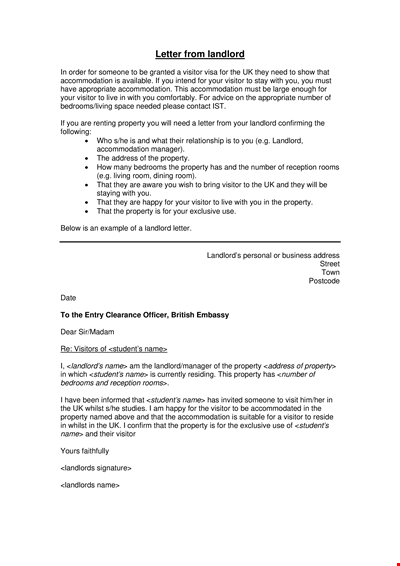

Letter Of Employment Verification For Landlord

Real Estate Introduction Letter

Ownership Transfer Letter Template | Streamline Office Ownership Transfers

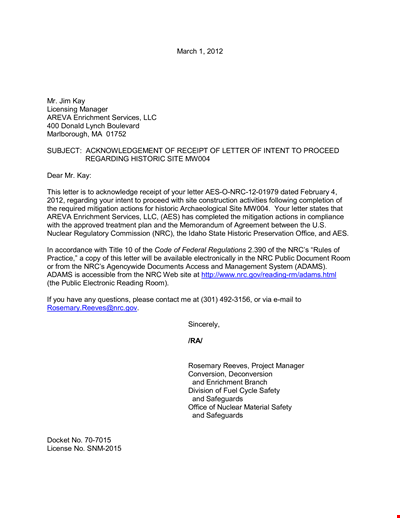

Property Receipt Acknowledgement - Enrichment Historic Letter

Transfer Property Ownership with Ease Using Our Letter Template

Rent Demand Letter for Formal Rental Lease

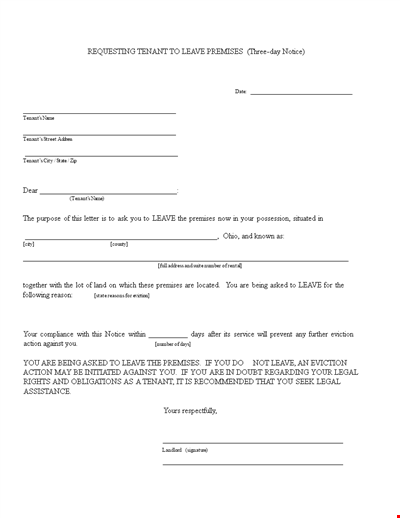

Legal Eviction Notice Template | Leave | Address | Tenant | Premises

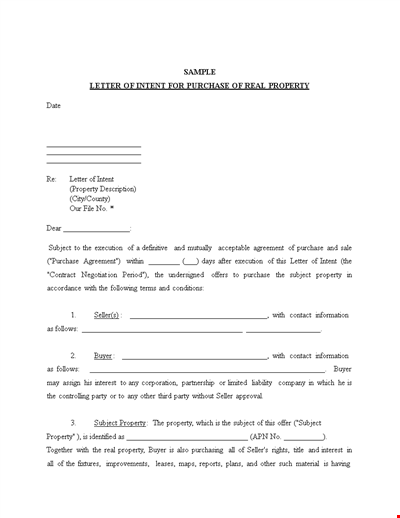

Simple Letter Of Intent for Property Purchase

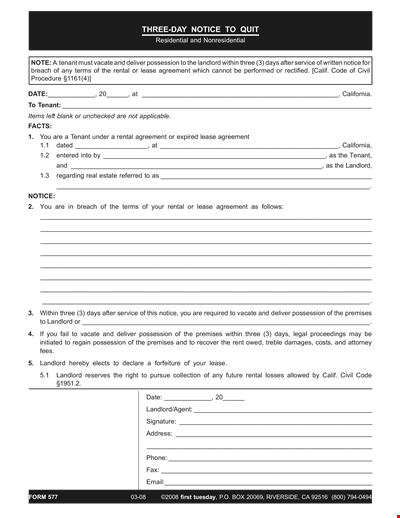

Residential Notice To Quit Template - Landlord, Possession, Rental, Tenant

House Rental: Find the Perfect Home for You | Landlord, Tenant, Tenancy & Boarding Options

Rental Property Information for Landlords and Personal Use

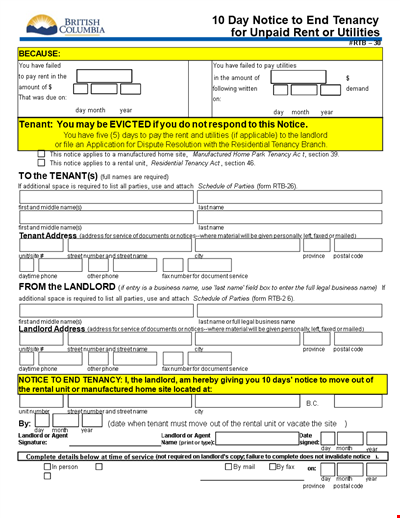

Printable Eviction Notice for Unpaid Rent - Notice for Landlord, Tenant, and Tenancy

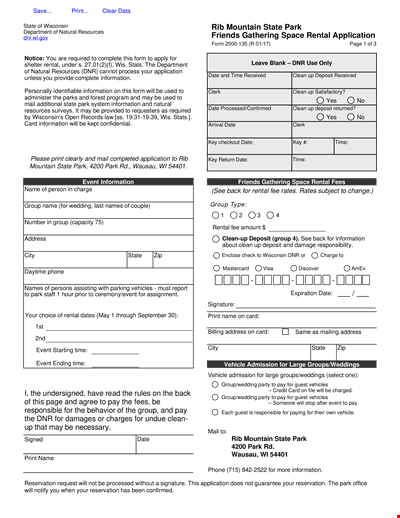

Rent a Space for Your Group Gathering - Easy Space Rental Application

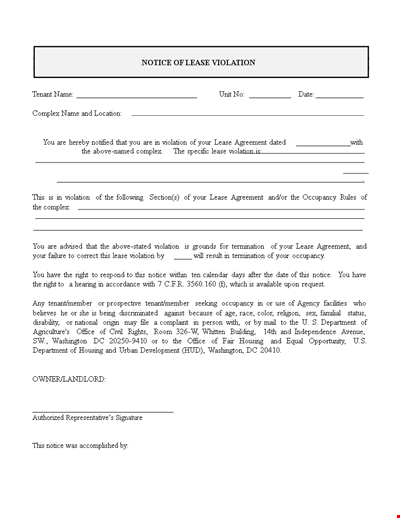

Notice of Lease Violation Template - Informing Complex Tenant of Lease Violation