/4916e9f9-f5d4-4321-b896-2b7ee9fd7643.png)

Discounted Cash Flow Company Valuation Example

Review Rating Score

Understanding the value of a company is crucial for investors, potential buyers, and business owners. One popular and widely used method for company valuation is the Discounted Cash Flow (DCF) model. If you're interested in learning how this model works and how it can be applied, you're in the right place! At BizzLibrary.com, we not only provide a comprehensive guide on DCF valuation but also offer a downloadable Discounted Cash Flow Company Valuation Example in XLSX format to help you get started.

What is Discounted Cash Flow (DCF) Valuation?

DCF valuation is a financial analysis method used to estimate the value of an investment based on its projected future cash flows. It takes into account the time value of money, assuming that a dollar received in the future is worth less than a dollar today. The DCF model calculates the present value of all future cash flows generated by a company and discounts them back to the present to determine the company's intrinsic value.

Why Use the DCF Model for Company Valuation?

The DCF model offers several advantages over other company valuation methods:

- Focus on Cash Flow: The DCF model considers the cash flows generated by a company, which is a more reliable indicator of its value than other financial metrics like earnings or net profit.

- Future Projection: By projecting a company's future cash flows, the DCF model takes into account potential growth and performance factors, making it more forward-looking.

- Flexibility and Customization: The DCF model allows analysts to incorporate different assumptions, growth rates, and discount rates, making it adaptable to various scenarios.

- Comparable Analysis: DCF valuation can also be combined with other valuation methods, such as market multiples or comparable transaction analysis, to further refine the estimated value.

Get Your Discounted Cash Flow Company Valuation Example

Ready to dive into company valuation using the DCF model? Download our Discounted Cash Flow Company Valuation Example in XLSX format today. This comprehensive template provides step-by-step guidance on how to perform a DCF analysis and calculate the intrinsic value of a company.

Visit BizzLibrary.com now to access a vast collection of financial and business document templates, including cash flow models, business plans, and more. Enhance your financial analysis skills and make informed investment decisions with our easy-to-use and customizable valuation templates.

Is the template content above helpful?

Thanks for letting us know!

Reviews

Phuong Hunt(9/19/2023) - DEU

Thank you for this!!

Last modified

Our Latest Blog

- The Importance of Vehicle Inspections in Rent-to-Own Car Agreements

- Setting Up Your E-mail Marketing for Your Business: The Blueprint to Skyrocketing Engagement and Sales

- The Power of Document Templates: Enhancing Efficiency and Streamlining Workflows

- Writing a Great Resume: Tips from a Professional Resume Writer

Template Tags

Need help?

We are standing by to assist you. Please keep in mind we are not licensed attorneys and cannot address any legal related questions.

-

Chat

Online - Email

Send a message

You May Also Like

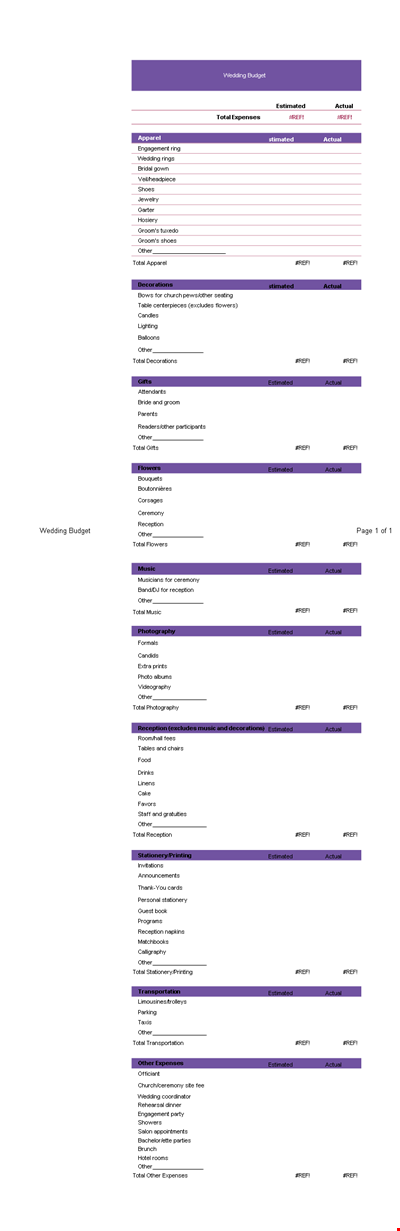

Wedding Budget Spreadsheet Template Dsrrddttt

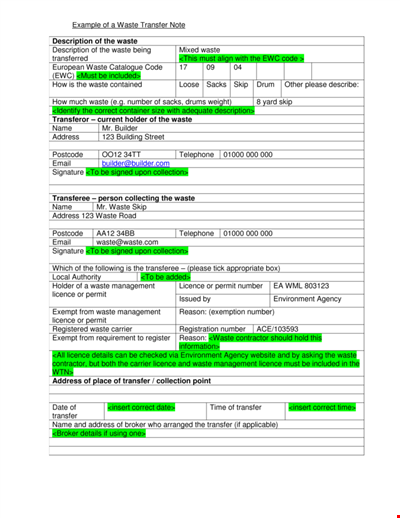

Transfer Note Template | Easy-to-Use Example for Employee Transfers

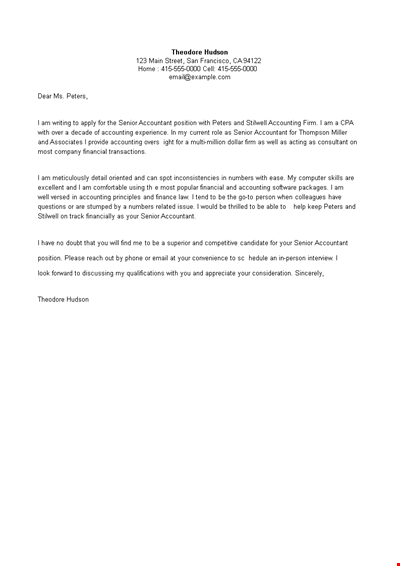

Senior Accountant Job Application Letter - Theodore Peters | Accounting

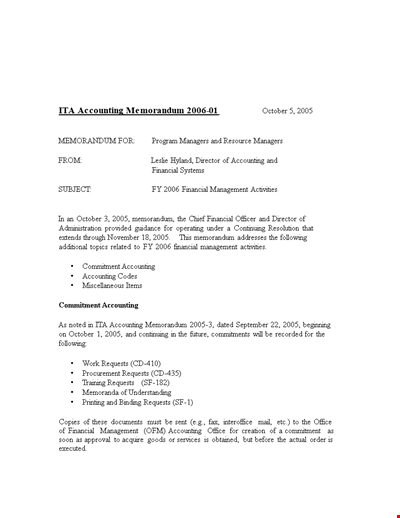

Business Accounting Memo Template: PDF | Accounting, Financial Memorandum & Requests

Printable Accounting Study Sheets - Master Account, Sales, Profit & Balance Concepts

Company Finance and Accounting | Financial Planning | Public Accounting

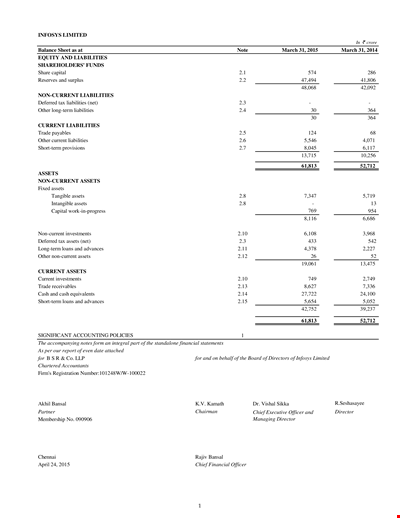

Printable Accounting Balance Sheets for Infosys Company - March (in crores)

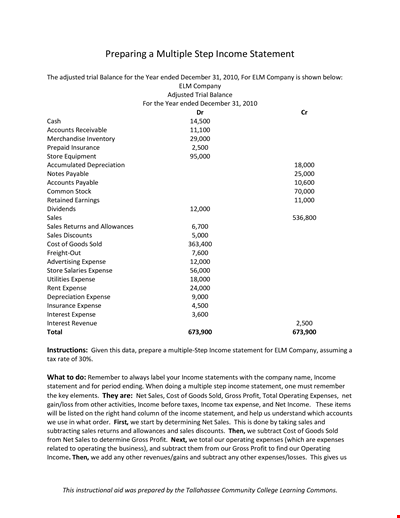

Simple Multi Step Income Statement | Expense Statement | Income | Retained

Journal Ledgers for Accounts - Trial Balance Sheet Balances

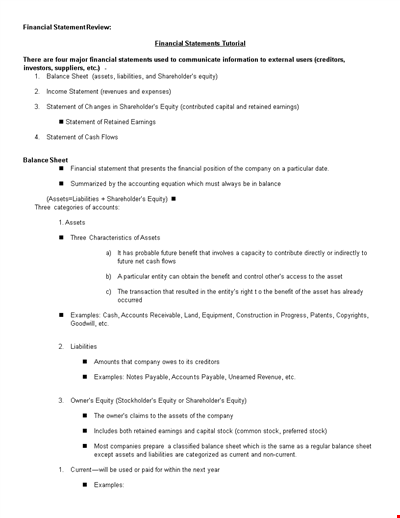

Printable Accounting Financial Sheets

Double Entry Ledger Paper Template - Keep Track of Your Accounts and Balances

Printable Monthly Accounting Sheets | Track Money, Expenses, Budget & Income

Accounting Scholarship Essay: Activities Completed

Accounting Strategic Plan: Inspections, Audit, Analysis for Firms and PCAOB

Multi Step Income Statement: Expenses, Sales, and Income Statement for a Corporation

Simple Accounting: Income Statement, Company, Balance, Assets, Income