/1a5edad0-59e1-4440-8c22-f6d1b6e118af.png)

Mortgage Savings: Payments and Letter of Explanation

Review Rating Score

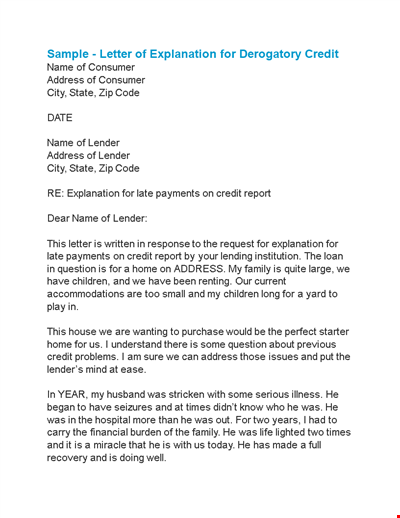

If you're applying for a mortgage and have some unusual or inconsistent financial circumstances, you'll likely be asked to provide a "Letter of Explanation." This request can be daunting, but at BizzLibrary.com, we've got you covered. Our professionally designed Letter of Explanation template in DOCX format can help you put all your financial information in one place and explain your situation to the lender concisely and effectively.

Why Do You Need a Letter of Explanation?

When applying for a mortgage, lenders look at several factors, including your credit score, income, and debt-to-income ratio. They want to ensure that you are capable of making payments on time and that you don't pose a significant risk of defaulting on your loan. A Letter of Explanation can help you address any financial concerns that the lender may have and prove that you're a responsible borrower.

When Should You Use a Letter of Explanation?

A Letter of Explanation can be used to explain any unusual or inconsistent financial circumstances, such as:

- Sudden changes in income or employment

- Large deposits or withdrawals from your bank account

- Recent delinquencies or late payments

- Discrepancies in your credit report

- Recent credit inquiries or new accounts

- Large purchases or loans

- Mortgage or rent payment history

How to Write a Letter of Explanation?

Writing a Letter of Explanation can be time-consuming and overwhelming, but it's crucial to put in the effort to ensure your loan application gets approved. Here are some tips on how to write an excellent Letter of Explanation:

- Be Honest and Transparent: Honesty is the best policy when it comes to writing a Letter of Explanation. Be upfront about your financial situation and explain any inconsistencies or red flags in detail.

- Provide Supporting Documents: Whenever possible, provide supporting documents to back up your claims. This can include bank statements, pay stubs, tax returns, and other financial records.

- Show Responsibility: Demonstrate to the lender that you are committed to making payments on time and that you've taken steps to improve your financial situation. For instance, if you've been saving more diligently, mention how much you've put away and how you've made changes to your spending habits.

- Be Concise: Your Letter of Explanation should be brief and to the point. Don't ramble or use jargon that the lender may not understand.

- Proofread: Before submitting your Letter of Explanation, make sure to proofread it carefully for grammar and spelling errors. A well-written and error-free letter can make a positive impression on the lender.

Download Your Letter of Explanation Template

Don't let the prospect of writing a Letter of Explanation stress you out. Our comprehensive and customizable Letter of Explanation template in DOCX format can help you provide lenders with clear and concise explanations of your financial circumstances. Download it now, and take the first step towards securing your dream home.

Visit BizzLibrary.com to access a wide range of document templates, including sales agreements, legal contracts, and more. It's never been easier to take control of your financial future.

Is the template content above helpful?

Thanks for letting us know!

Reviews

Buena Stevenson(8/13/2023) - DEU

Please continue the Excellent work, we all benefit from document templates you provide.

Laureen Dickson(8/13/2023) - NZL

Thank you for this!!

Last modified

Our Latest Blog

- The Importance of Vehicle Inspections in Rent-to-Own Car Agreements

- Setting Up Your E-mail Marketing for Your Business: The Blueprint to Skyrocketing Engagement and Sales

- The Power of Document Templates: Enhancing Efficiency and Streamlining Workflows

- Writing a Great Resume: Tips from a Professional Resume Writer

Template Tags

Need help?

We are standing by to assist you. Please keep in mind we are not licensed attorneys and cannot address any legal related questions.

-

Chat

Online - Email

Send a message

You May Also Like

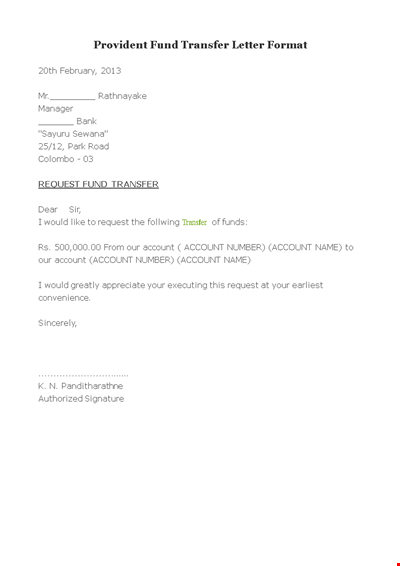

Fund Transfer Letter Template for Account Members - Clearing

Letter of Explanation: Credit, Address, Consumer | SEO-Optimized Meta Title Solution

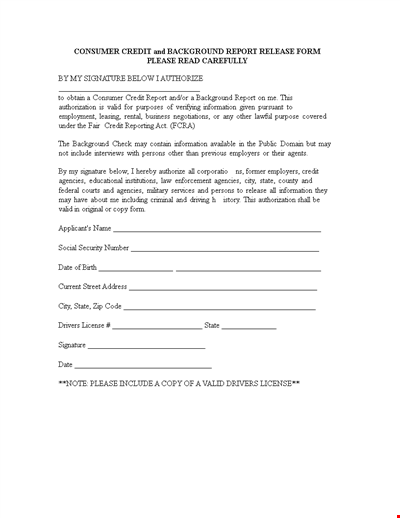

Validating Consumer Credit Background Report | Signature Required

Golden Credit Union Annual Report Template for Credit Union with Assets in Sacramento

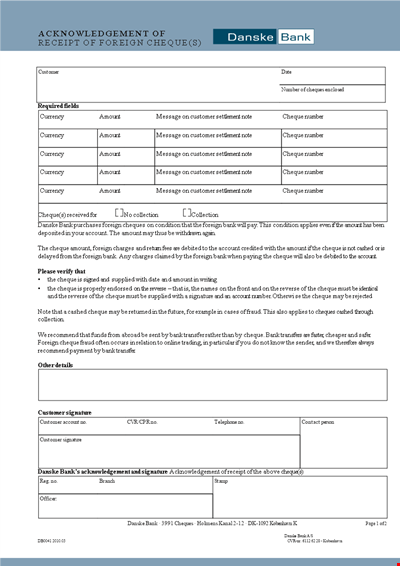

Acknowledging Cheques from Customers: Confirming the Amount Received

Provident Fund Transfer Letter Format

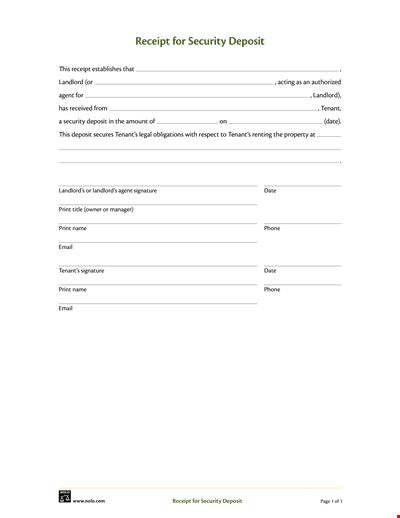

Simple Security Deposit

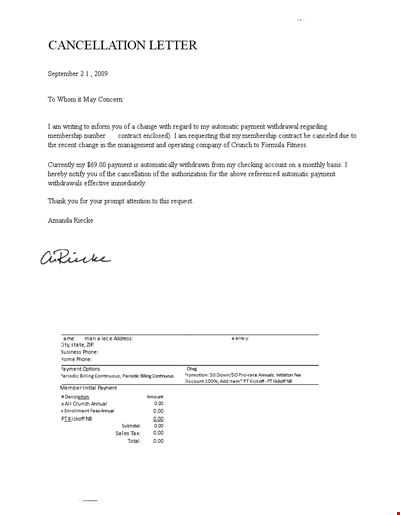

Fund Transfer Cancellation Letter Template

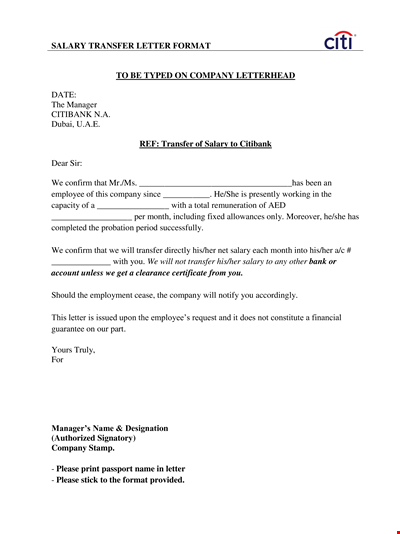

Salary Transfer Letter to Bank - Company's Letter for Employee's Salary Transfer

Experienced Retail Banking Executive | Branch Sales | Banking Leadership

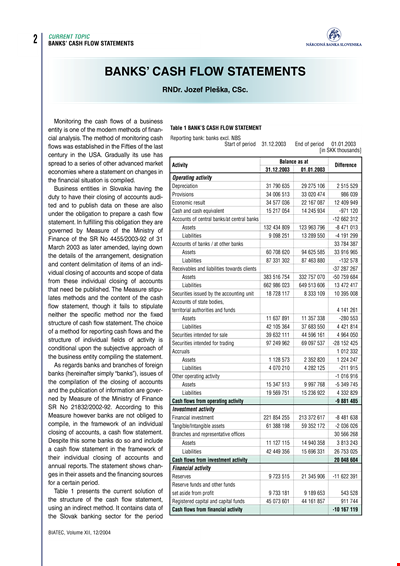

Bank Statement Template: Track Your Assets, Funds, and Banks

Chase Direct Deposit Form Template – Simple & Direct | Save Time & Money

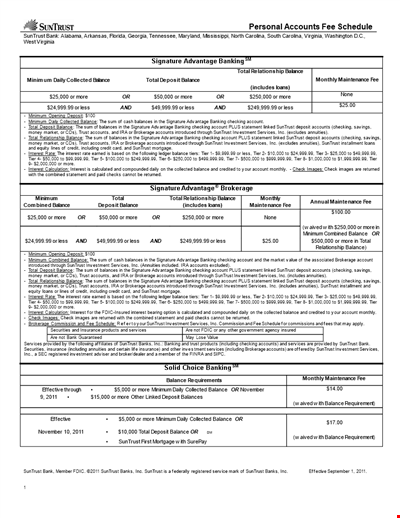

SunTrust Personal Accounts Fee Schedule: Account Balance, Checking Accounts & More

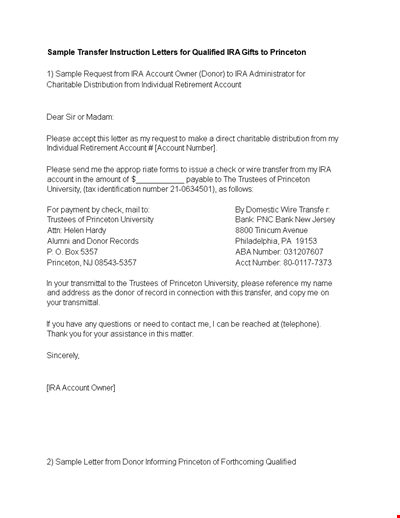

Example Fund Transfer Instruction Letter Template - Account Donor Princeton

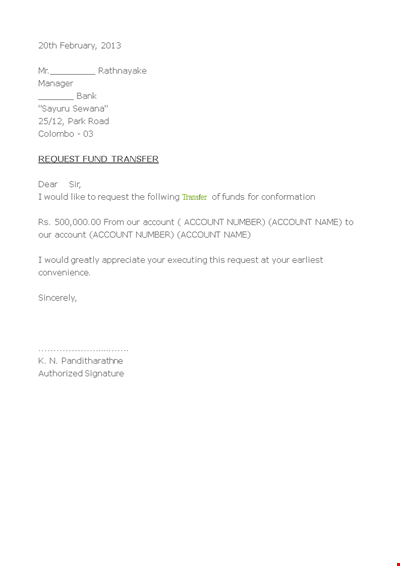

Fund Transfer Confirmation Letter Example

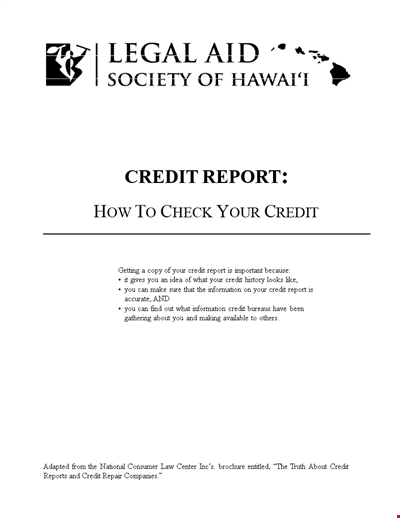

Credit Repair Letter Template