/2635b859-25ca-4cee-8411-2c0aa323daf9.png)

Apply for Credit: Easy-to-Use Application Form | Company Name

Review Rating Score

A credit application form is an important document used by businesses to determine the creditworthiness of a potential client before extending credit. At BizzLibrary.com, we understand the significance of having a well-crafted, comprehensive credit application form in place. Our template is designed to meet the needs of businesses from various industries and can be easily customized to meet your specific requirements.

What is a Credit Application Form?

A credit application form is a document that requests information from potential clients, including their name, address, phone number, fax number, and other essential details. The form also asks for information about the applicant's financial history, employment status, and other relevant details that help businesses assess their ability to repay credit in a timely manner.

Why Do You Need a Credit Application Form?

A credit application form serves as a risk management tool for businesses that rely on extending credit to their clients. It helps establish a clear understanding of the business relationship between the lender and borrower, mitigating the potential risks of non-payment or delayed payment. Here are a few reasons why having a credit application form is essential:

- Determine Creditworthiness: The form helps businesses evaluate the creditworthiness of potential clients by collecting information about their financial background, credit history, and other relevant details. This assists organizations in making informed decisions about whether to extend credit and under what terms.

- Establish Terms and Conditions: The form outlines the terms and conditions under which credit is extended, providing a framework for the business relationship between the lender and borrower. This helps reduce misunderstandings or disputes later on.

- Reduce Risk of Late or Non-Payment: By evaluating the creditworthiness of potential clients, it helps reduce the risk of late or non-payment. This is particularly important for small businesses that rely on cash flow to maintain their operations and meet their financial obligations.

- Maintain Accurate Records: The form serves as a record-keeping tool for businesses, allowing them to maintain accurate records of clients' credit applications, payment histories, and other relevant information. This helps with financial reporting, auditing, and regulatory compliance.

Download Your Credit Application Form Template

At BizzLibrary.com, we offer a professionally designed credit application form template that can be easily downloaded in DOCX format. Our template includes fields for collecting essential information about the applicant, such as name, address, phone number, and fax number, as well as a section for financial and employment information. It's customizable and can be tailored to meet the specific needs of your business.

Don't put your business at risk by extending credit to unknown clients without proper evaluation. Download our credit application form template now and take control of your credit management process.

Visit our website to access a range of business document templates, including legal contracts, sales agreements, and more. Download today and take your business to the next level!

Is the template content above helpful?

Thanks for letting us know!

Reviews

Flor Byrd(7/8/2023) - USA

I normally don t leave reviews, today I made an execption for this lettr.

Last modified

Our Latest Blog

- The Importance of Vehicle Inspections in Rent-to-Own Car Agreements

- Setting Up Your E-mail Marketing for Your Business: The Blueprint to Skyrocketing Engagement and Sales

- The Power of Document Templates: Enhancing Efficiency and Streamlining Workflows

- Writing a Great Resume: Tips from a Professional Resume Writer

Template Tags

Need help?

We are standing by to assist you. Please keep in mind we are not licensed attorneys and cannot address any legal related questions.

-

Chat

Online - Email

Send a message

You May Also Like

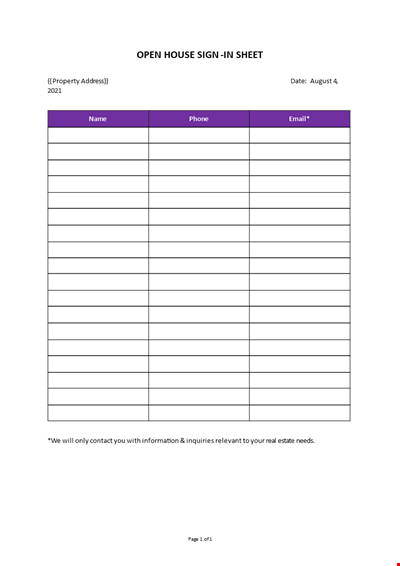

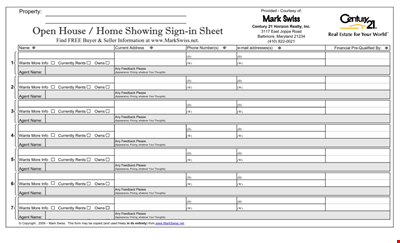

Open House Sign-in Sheet

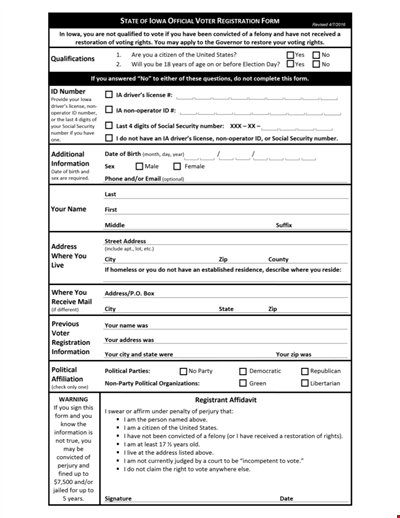

Printable Voter Registration Form

Department Material Requisition Form

Softball Box Score Sheet Template - Track game stats efficiently

Manage Your Finances with Our Free Printable Bill Payment Schedule Template

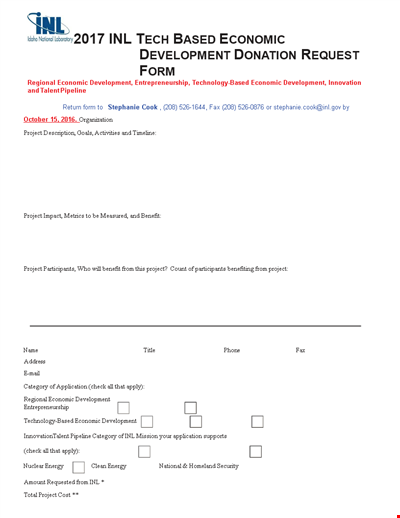

Tech-Based Economic Development Donation Request

Business Commercial Lease Rental Application Form - Apply for a Lease

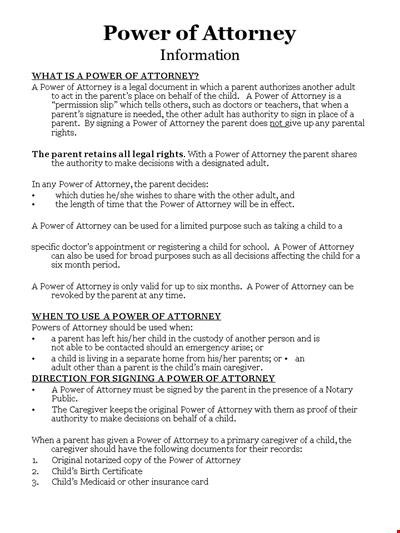

Child Medical Power of Attorney Form - Granting Parental Rights to Caregiver

Easter Social Media Post

Get the Best Open House Showing Sign In Sheet Template Here

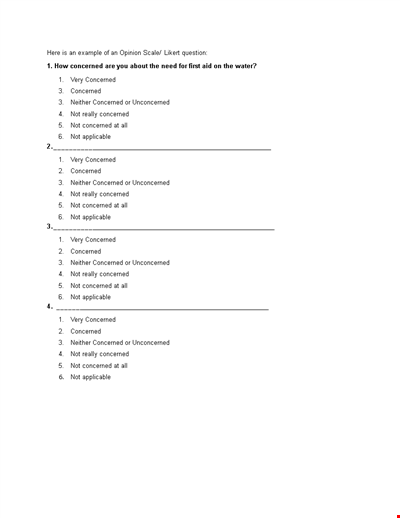

Understanding the Likert Scale: Neither Concerned nor Unconcerned

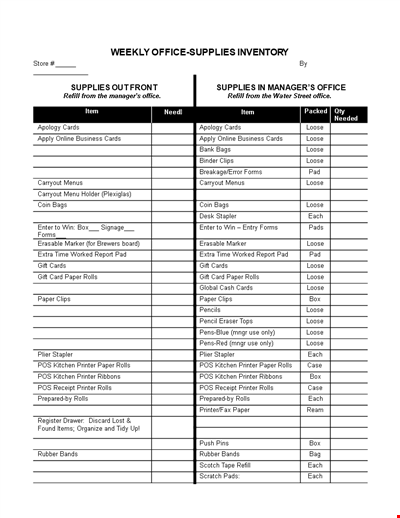

Weekly Office Supply Inventory List Example

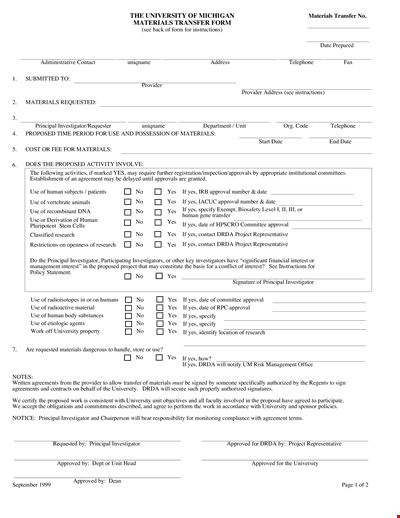

Material Transfer Form (University)

Design Work Order Form

Printable Large Oblique Graph Paper

Modern School Technology: Enhancing Education through Innovative Tools and Solutions