/66d4a722-7f2a-4ec6-a863-627d95a4b3cc.png)

In-kind Gift Receipt for Cancer Services - Please Support

Review Rating Score

If you have received a generous gift or donation in the form of goods or services for your cancer-related cause, it's crucial to provide an official acknowledgment to the giver. At BizzLibrary.com, we understand the importance of proper documentation, so we've created an In Kind Gift Receipt template for your convenience. Download our user-friendly DOCX template now to easily issue receipts for in-kind donations!

Why do you need an In Kind Gift Receipt?

When individuals or organizations donate goods or services to support your cancer-related cause, it's essential to provide them with an In Kind Gift Receipt. Here's why:

- Acknowledgment: An In Kind Gift Receipt serves as a formal acknowledgment and appreciation for the donation received. It demonstrates your gratitude and recognition for the giver's generosity.

- Record-Keeping: The receipt acts as a record of the donated items or services, along with their estimated value. It helps you maintain accurate financial records and facilitates reporting and tax compliance.

- Tax Deductibility: For the donor, an In Kind Gift Receipt can serve as proof of their charitable contribution, potentially allowing them to claim tax deductions. Consult with a tax professional or refer to the applicable tax regulations to understand the specific requirements and limitations.

- Transparency and Trust: Providing a detailed and professional In Kind Gift Receipt enhances transparency in your organization's financial practices. It builds trust with donors and reinforces their confidence in supporting your cancer-related cause.

Components of an In Kind Gift Receipt

Our customizable In Kind Gift Receipt template includes the following essential components:

- Organization Information: Include your organization's name, address, contact details, and tax-exempt identification, if applicable.

- Donor Information: Collect the donor's name, address, and contact information to maintain accurate donor records.

- Description of Gift/Service: Provide a detailed description of the donated item(s) or service(s) received. Be specific and include any relevant details, such as quantity, condition, or specifications.

- Estimated Value: Determine a reasonable estimated value for the donated item(s) or service(s). If necessary, consult with the donor or an independent appraiser to establish the fair market value.

- Signature and Date: Include a designated area for the authorized representative of your organization to sign and date the receipt.

Download Your In Kind Gift Receipt Template

Simplify your documentation process and ensure proper acknowledgment of in-kind gifts by downloading our professionally designed In Kind Gift Receipt template in DOCX format now. Visit BizzLibrary.com for more customizable document templates to support your organization's needs. Download, customize, and make a positive impact in the fight against cancer!

Is the template content above helpful?

Thanks for letting us know!

Reviews

Malvina Vasquez(11/7/2023) - NZL

Thank you for the letter!!

Last modified

Our Latest Blog

- A Guide to Make a Business Plan That Really Works

- The Importance of Vehicle Inspections in Rent-to-Own Car Agreements

- Setting Up Your E-mail Marketing for Your Business: The Blueprint to Skyrocketing Engagement and Sales

- The Power of Document Templates: Enhancing Efficiency and Streamlining Workflows

Template Tags

Need help?

We are standing by to assist you. Please keep in mind we are not licensed attorneys and cannot address any legal related questions.

-

Chat

Online - Email

Send a message

You May Also Like

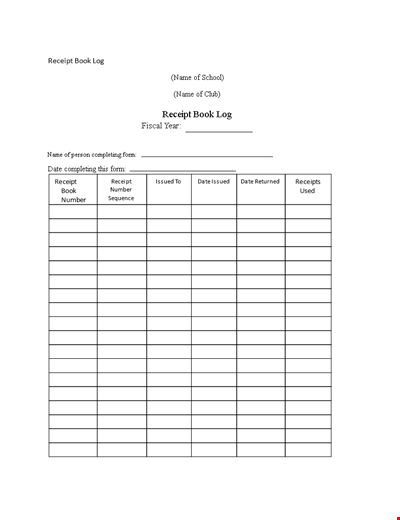

Buy School Book and Get a Receipt with Free Signature

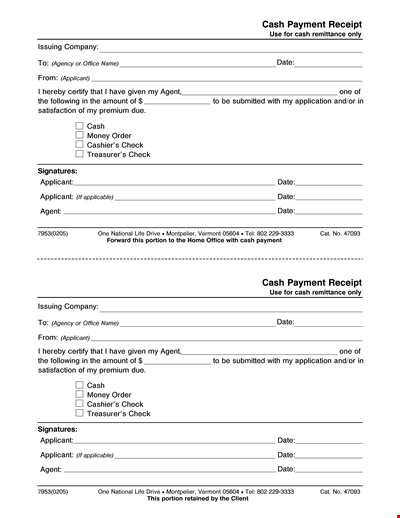

Simple Cash Payment Template | Easy-to-Use Payment Format | Instant Digital Download

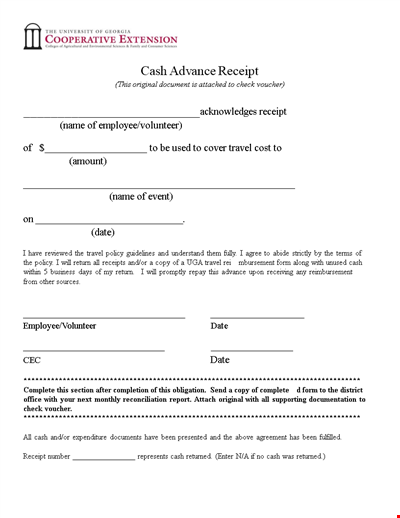

Cash Advance Receipt - Manage Travel Expense Advances

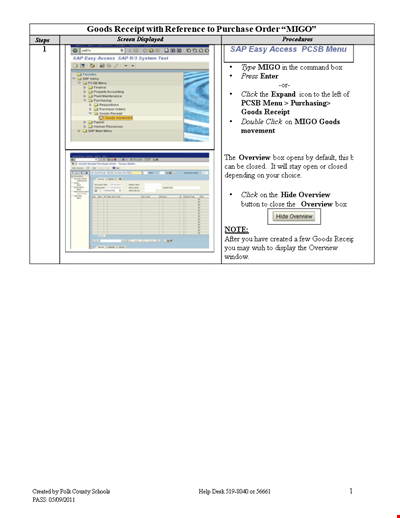

Goods Purchase Receipt - Fast & Convenient Shopping | Click to Get Yours

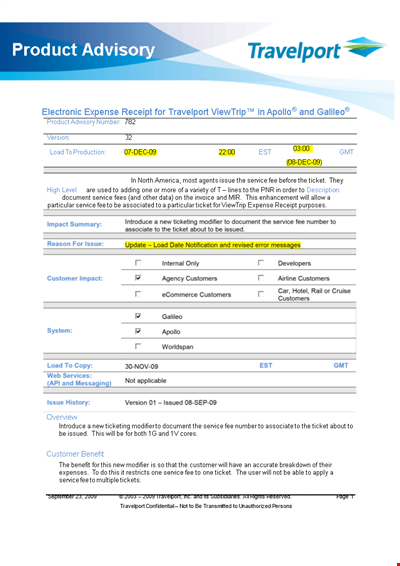

Electronic Expense Receipt - Create and Manage Service Documents and Tickets

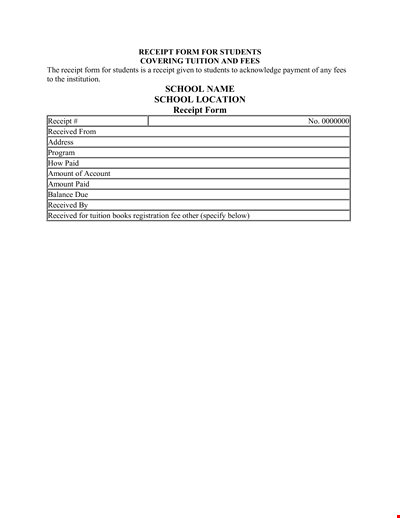

School Tuition Receipt - Get a Receipt for the Tuition Fees Received by Students

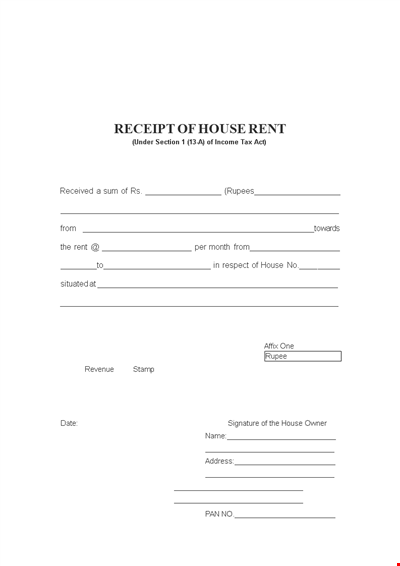

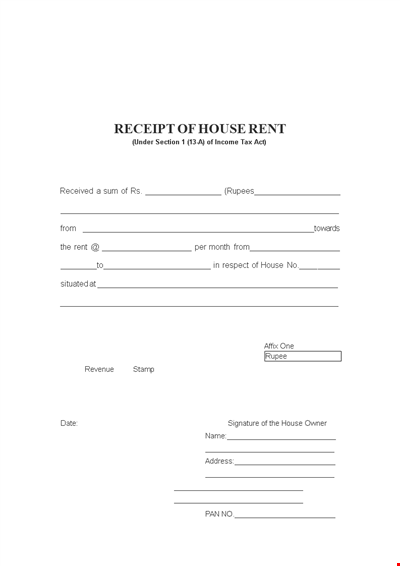

House Rent Receipt Template - Printable Receipt for Under a House

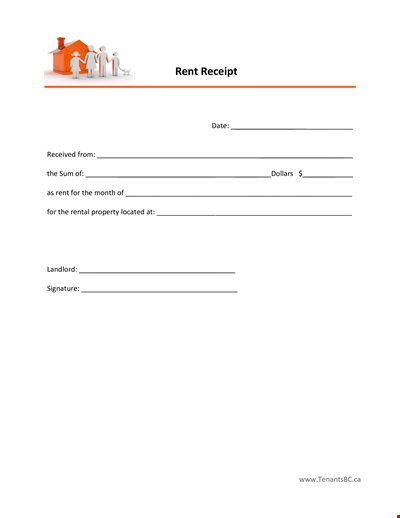

Rental Receipt - Easily Create and Manage Rental Property Receipts

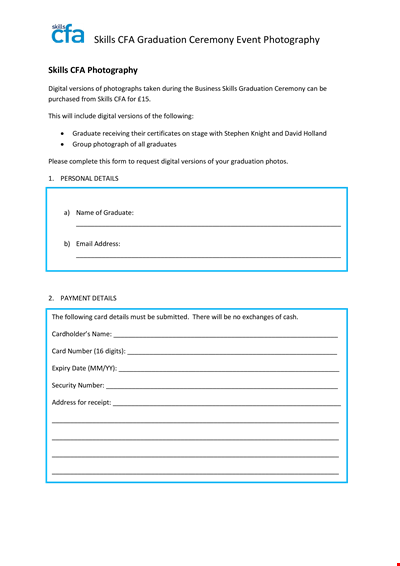

Event Photography Receipt - Buy Skills, Digital Versions | Graduation Special

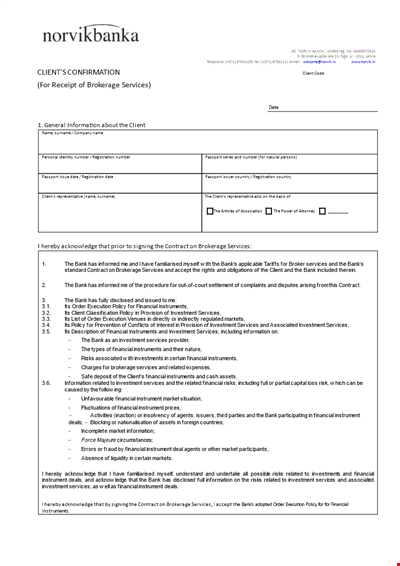

Client Confirmation Brokerage Receipt - Investment & Financial Services

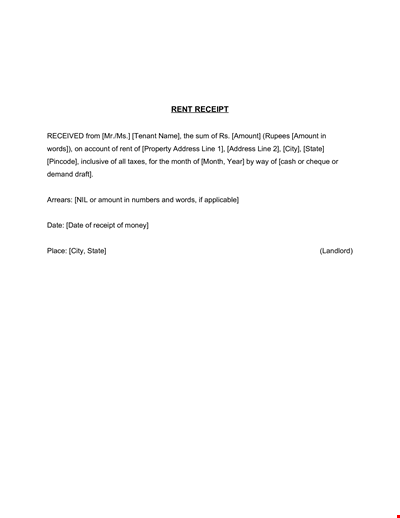

Download Rent Receipt Template - Keep Track of Your Payments

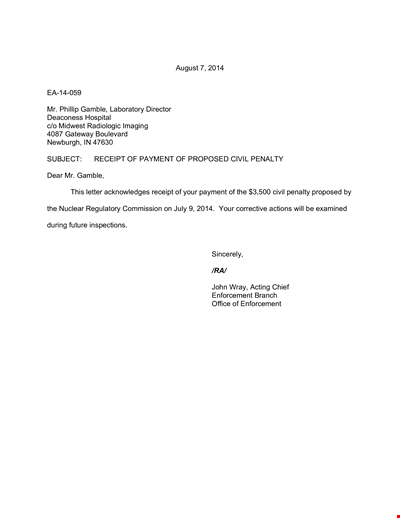

Proposed MLA Payment - Civil Receipt | Gamble

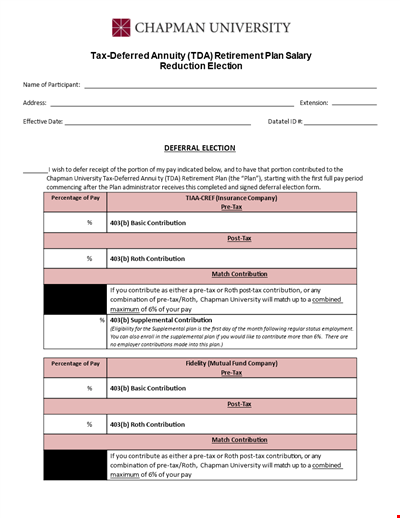

Salary Reduction Receipt - Claim Your Contribution Election

Rent Receipt Voucher Template for your House - Receipts Under Control

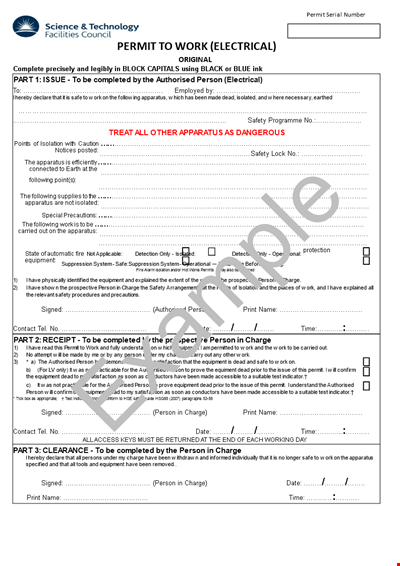

Electrical Work Receipt | Equipment, Person, Permit, Authorized

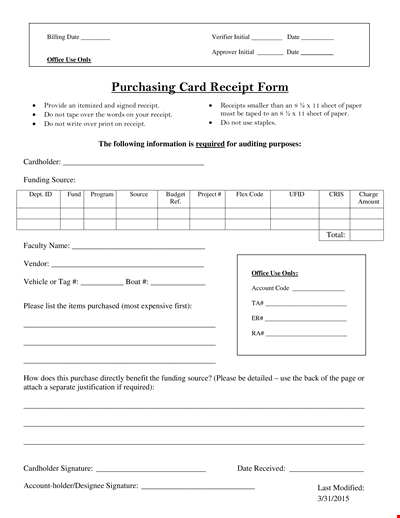

Purchase Cash Receipt Template - Source Your Receipt Easily