/ed052dae-3c62-4d9e-a461-ed2c6890b478.png)

Mortgage Settlement Statement Example - Insurance & Title Services

Review Rating Score

Are you in the process of finalizing a mortgage settlement and need an example to understand how the statement should look? Look no further! BizzLibrary.com provides a comprehensive Mortgage Settlement Statement Example that will help you understand the components of a typical settlement statement.

What is a Mortgage Settlement Statement?

A mortgage settlement statement is a legal document that outlines the final details of a mortgage transaction. It is also known as a closing statement or a HUD-1 settlement statement. This statement provides a detailed breakdown of all the costs and fees associated with the mortgage, allowing the borrower and the seller to understand the financial aspects of the transaction.

Why Do You Need a Mortgage Settlement Statement?

A mortgage settlement statement is essential for both the buyer and the seller involved in a real estate transaction. Here's why it is important:

- Transparency: The settlement statement provides transparency by detailing all the financial aspects of the mortgage. It shows the final purchase price, any applicable fees, prorated taxes, insurance costs, and any other expenses to be paid at closing.

- Verification of Costs: It allows the buyer and seller to verify that the costs and fees mentioned in the settlement statement align with what was agreed upon. This helps to ensure that there are no discrepancies or unexpected expenses.

- Understanding Loan Terms: The settlement statement explains the terms of the loan, including the loan amount, interest rate, and the length of the mortgage. This helps the borrower understand the financial commitment associated with their purchase.

- Insurance and Title Information: The statement includes information about the insurance policies being obtained, such as homeowner's insurance or private mortgage insurance (PMI). Additionally, it provides details about the title insurance, protecting against any potential issues with the property's ownership.

- Compliance with Regulations: Mortgage settlement statements must comply with applicable laws and regulations, such as the Real Estate Settlement Procedures Act (RESPA). This ensures that the statement adheres to legal requirements and provides accurate information.

Download Your Mortgage Settlement Statement Example

To better understand the components and structure of a mortgage settlement statement, we offer a customizable example in DOCX format for you to download. This example will guide you through the various sections, including a breakdown of costs, insurance details, and title information.

Visit BizzLibrary.com now, explore our wide range of document templates, and download your Mortgage Settlement Statement Example today. With our example, you'll gain a clear understanding of the settlement process and ensure a smooth closing for your mortgage transaction.

Is the template content above helpful?

Thanks for letting us know!

Reviews

Rona Kidd(7/24/2023) - DEU

Thanks for the help

Last modified

Our Latest Blog

- A Guide to Make a Business Plan That Really Works

- The Importance of Vehicle Inspections in Rent-to-Own Car Agreements

- Setting Up Your E-mail Marketing for Your Business: The Blueprint to Skyrocketing Engagement and Sales

- The Power of Document Templates: Enhancing Efficiency and Streamlining Workflows

Template Tags

Need help?

We are standing by to assist you. Please keep in mind we are not licensed attorneys and cannot address any legal related questions.

-

Chat

Online - Email

Send a message

You May Also Like

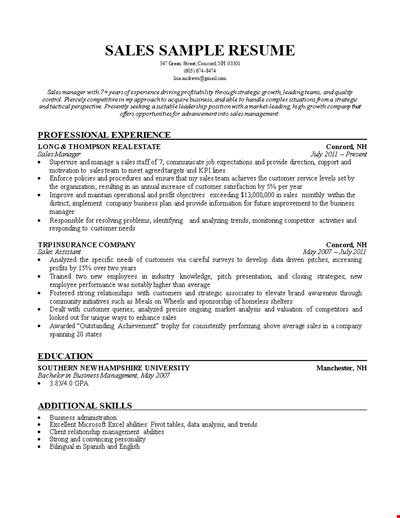

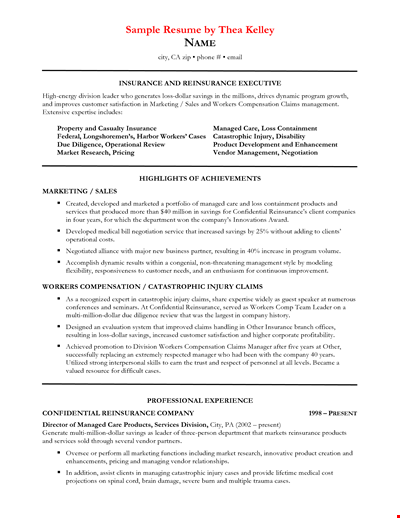

Sales Insurance Agent Resume

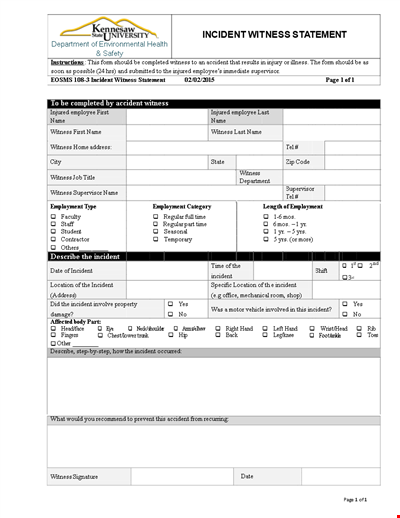

Witness Statement Form in Word

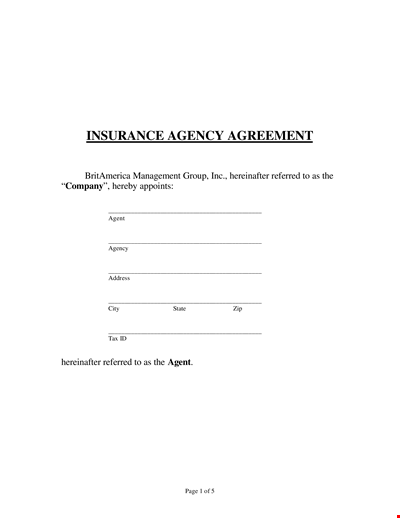

Insurance Agent Agreement Template

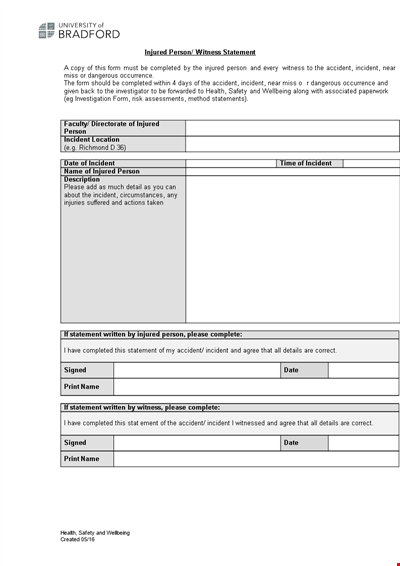

Injury Witness Statement

Medical Insurance Complaint Letter Template

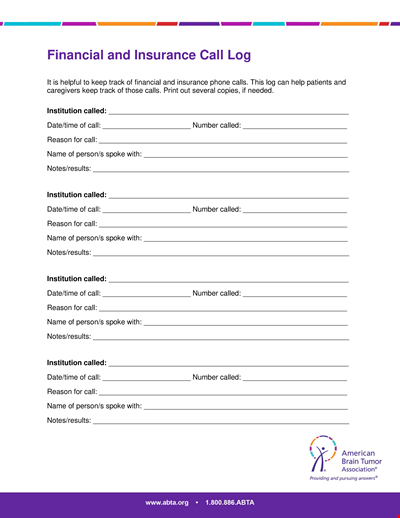

Financial And Insurance Call Log

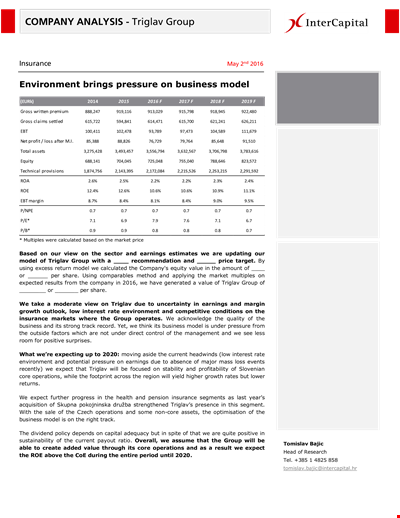

Insurance Company Analysis Template

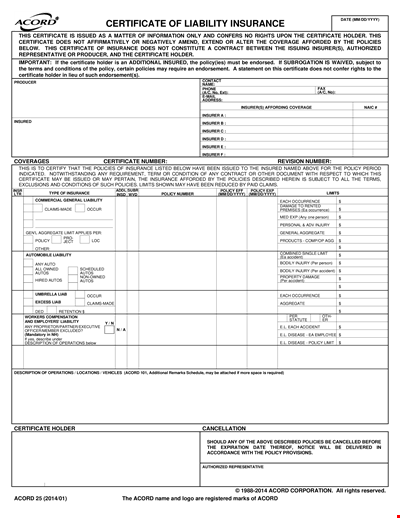

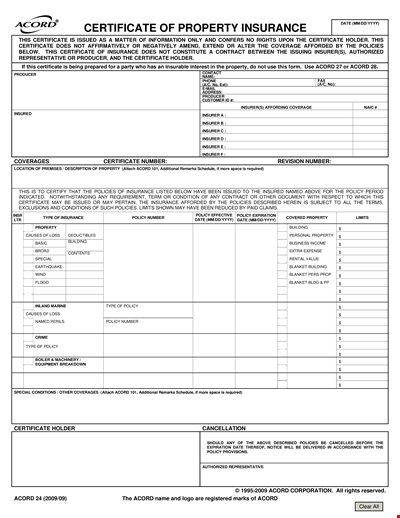

Insurance Acord Form - Get the Best Insurance Certificates and Policies from Top Insurers

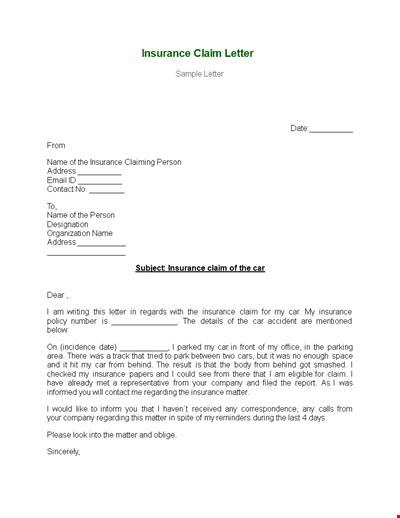

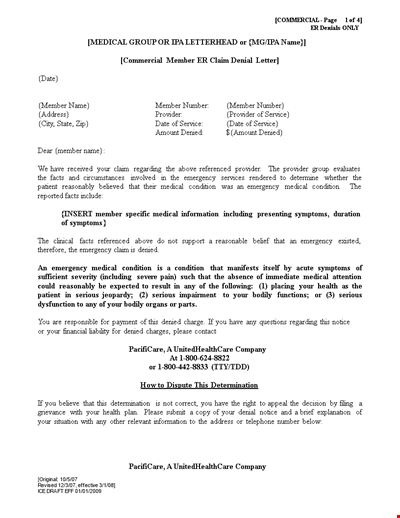

Claim Letters for Insurance Purposes

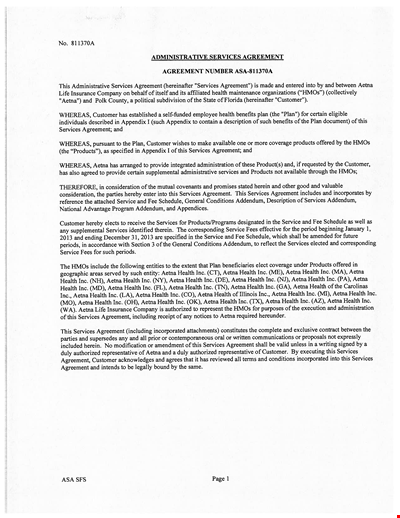

Insurance Administrative Services Agreement Template

Insurance Executive

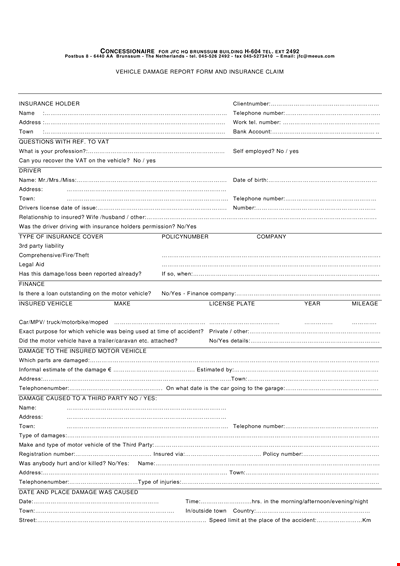

Insurance Damage

Medical Claim

Certificate Of Property Insurance

Medical Insurance Claim Letter Template for Patient Treatment

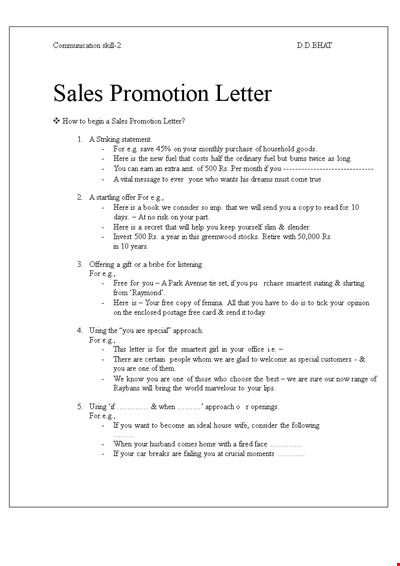

Insurance Sales Promotion Letter