/c669b776-e3fe-4fa9-a89b-fa42efe28063.png)

Depreciation Schedule Template

Review Rating Score

If you're managing a business or multiple assets, you know the importance of keeping accurate and up-to-date records of your assets' depreciation. A depreciation schedule is a critical tool that helps you track your assets' decreasing values over time, enabling you to budget and plan for future replacements or upgrades. At BizzLibrary.com, we offer a professional and customizable depreciation schedule template that simplifies the process and ensures accurate record-keeping.

What is Depreciation & Why Is It Important?

Depreciation refers to the gradual decline in the value of an asset over its useful life. Assets such as machinery, vehicles, equipment, and buildings all experience wear and tear or become obsolete as they age. As a result, their value decreases over time, which affects your business's financial statements.

Depreciation is important because it allows businesses to accurately calculate their taxable income by factoring in the cost of an asset into their financial statements over time. It also helps businesses plan for future repairs, upgrades, or purchases of replacement assets.

Straight-Line Depreciation

Straight-line depreciation is the most common method used by businesses to calculate their assets' depreciation value over time. The method takes into account the asset's initial cost, useful life, and estimated residual value to come up with an equal depreciation amount each period. The straight-line depreciation method is straightforward, easy to calculate, and widely accepted for financial reporting.

What is a Depreciation Schedule Template?

A depreciation schedule template is a pre-built spreadsheet that businesses can use to input their assets' values, useful life, and depreciation method to accurately calculate the depreciation amount. The template provides a clear and organized record of each asset and its depreciation values over time.

At BizzLibrary.com, we offer a customizable and easy-to-use depreciation schedule template in XLSX format, designed to simplify the calculation process. Our template includes:

- Asset Name & Description

- Depreciation Method & Start Date

- Initial Cost & Residual Value

- Useful Life, Depreciation Rate, and Depreciation Amount

- Ending Book Value & Accumulated Depreciation

- Monthly Depreciation Projections for Future Years

- Auto-Calculations for Easy Record-Keeping

Download the Depreciation Schedule Template

Don't risk inaccurate record-keeping and future financial problems. Download our premium depreciation schedule template today for free and ensure accurate and up-to-date records of your assets' values. Our template is fully customizable and easy to use for any business, big or small.

Visit BizzLibrary.com now to explore our vast collection of business document templates, including sales agreements, legal contracts, and more. Choose ours to take control of your assets and ensure a secure financial future!

Is the template content above helpful?

Thanks for letting us know!

Reviews

Christel Melendez(7/8/2023) - USA

I think this document is useful.

Last modified

Our Latest Blog

- The Importance of Vehicle Inspections in Rent-to-Own Car Agreements

- Setting Up Your E-mail Marketing for Your Business: The Blueprint to Skyrocketing Engagement and Sales

- The Power of Document Templates: Enhancing Efficiency and Streamlining Workflows

- Writing a Great Resume: Tips from a Professional Resume Writer

Template Tags

Need help?

We are standing by to assist you. Please keep in mind we are not licensed attorneys and cannot address any legal related questions.

-

Chat

Online - Email

Send a message

You May Also Like

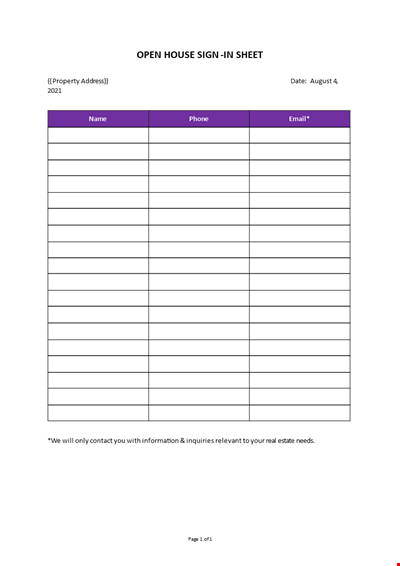

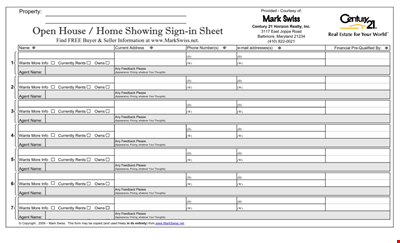

Open House Sign-in Sheet

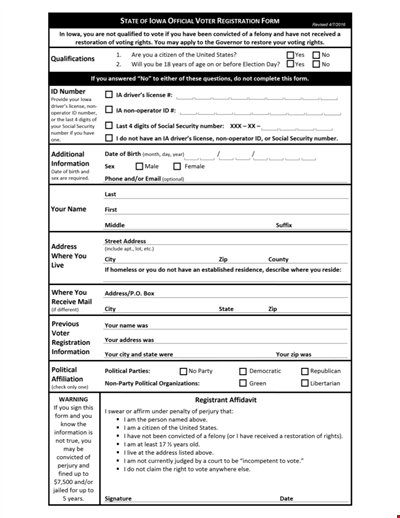

Printable Voter Registration Form

Department Material Requisition Form

Softball Box Score Sheet Template - Track game stats efficiently

Manage Your Finances with Our Free Printable Bill Payment Schedule Template

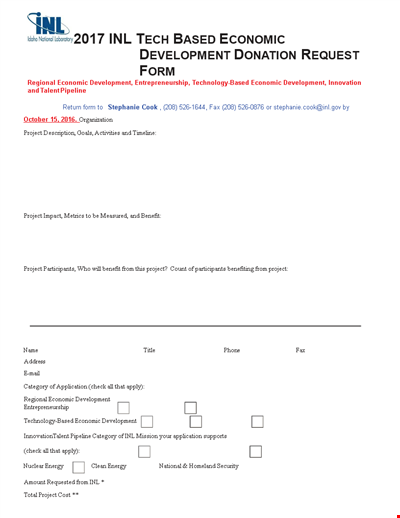

Tech-Based Economic Development Donation Request

Business Commercial Lease Rental Application Form - Apply for a Lease

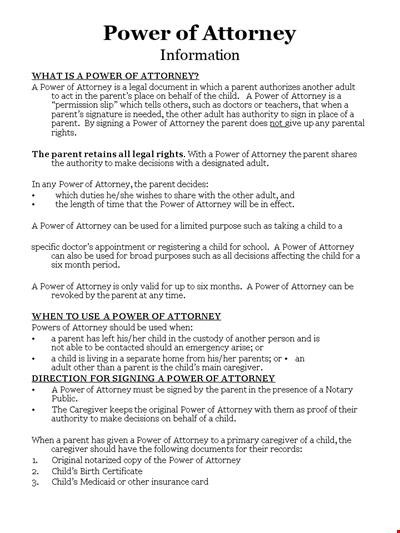

Child Medical Power of Attorney Form - Granting Parental Rights to Caregiver

Easter Social Media Post

Get the Best Open House Showing Sign In Sheet Template Here

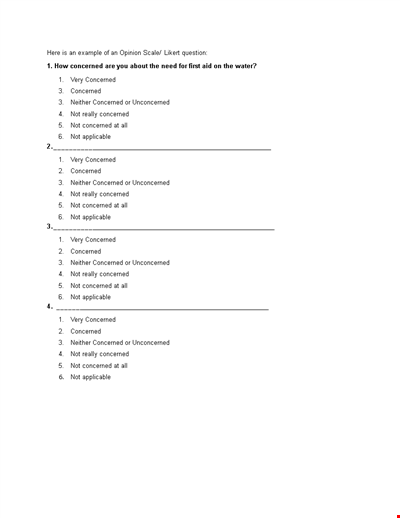

Understanding the Likert Scale: Neither Concerned nor Unconcerned

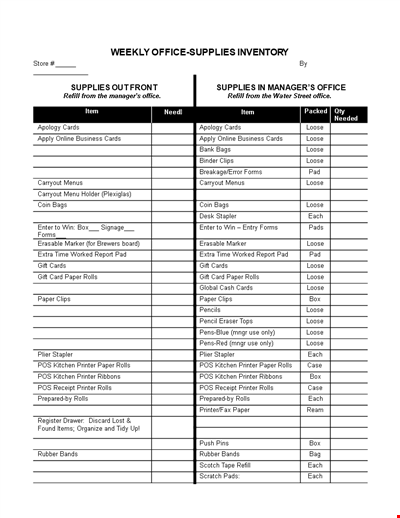

Weekly Office Supply Inventory List Example

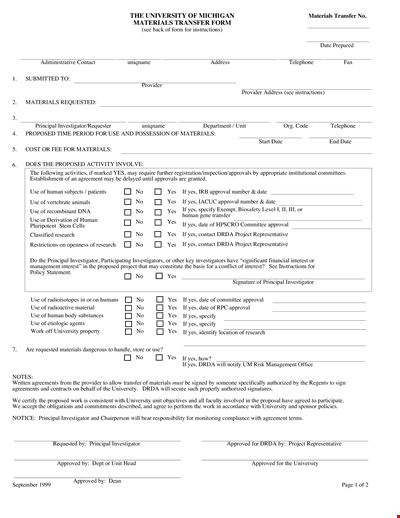

Material Transfer Form (University)

Design Work Order Form

Printable Large Oblique Graph Paper

Modern School Technology: Enhancing Education through Innovative Tools and Solutions