/5e1e2abb-17cd-46dc-b886-904fdc532036.png)

Projected Balance Sheet Format

Review Rating Score

If you are looking to create a projected balance sheet for your business, you're in the right place. At BizzLibrary.com, we offer a user-friendly and comprehensive Projected Balance Sheet Format template that can assist you in analyzing and planning your company's financial health. With this template, you can forecast your assets, liabilities, and equity for a specified period, providing valuable insights into your business's future performance.

Understanding a Projected Balance Sheet

A projected balance sheet is a financial statement that estimates a company's assets, liabilities, and shareholder's equity at a specific point in the future. It serves as an essential tool for budgeting, financial planning, and assessing the financial viability of your business. By projecting these figures, you can better understand how your company's balance sheet may evolve over time and make informed decisions accordingly.

Key Components of a Projected Balance Sheet

A projected balance sheet typically consists of three main sections: assets, liabilities, and equity. Let's take a closer look at each:

1. Assets

Assets represent the resources owned by your business. They can be categorized into current assets and long-term assets:

- Current Assets: These are assets that are expected to be converted into cash or used up within one year. Examples include cash, accounts receivable, inventory, and prepaid expenses.

- Long-term Assets: These are assets that provide benefits to your business over an extended period, typically more than one year. Examples include property, plant, and equipment, investments, and intangible assets.

2. Liabilities

Liabilities represent your business's obligations and debts. Like assets, they can be divided into current liabilities and long-term liabilities:

- Current Liabilities: These are debts that are expected to be paid off within one year. Examples include accounts payable, short-term loans, and accrued expenses.

- Long-term Liabilities: These are debts that extend beyond one year. Examples include long-term loans, mortgages, and bonds payable.

3. Equity

Equity, also known as net worth or owner's equity, represents the residual interest in the company's assets after deducting liabilities. It represents the owner's share of the business. Equity can be calculated by subtracting total liabilities from total assets.

Download Your Projected Balance Sheet Format Template

To help you streamline the process of creating a projected balance sheet, we offer a professionally designed Projected Balance Sheet Format template in DOCX format. With our template, you can easily input your projected figures, analyze your balance sheet, and make well-informed financial decisions for your business.

Visit BizzLibrary.com now to access our range of business document templates, including the Projected Balance Sheet Format. Download our template and take control of your financial planning today!

Is the template content above helpful?

Thanks for letting us know!

Reviews

Tenisha Bender(7/24/2023) - AUS

I share a suggestion: Please continue the Excellent work, we all benefit from it.

Last modified

Our Latest Blog

- The Importance of Vehicle Inspections in Rent-to-Own Car Agreements

- Setting Up Your E-mail Marketing for Your Business: The Blueprint to Skyrocketing Engagement and Sales

- The Power of Document Templates: Enhancing Efficiency and Streamlining Workflows

- Writing a Great Resume: Tips from a Professional Resume Writer

Template Tags

Need help?

We are standing by to assist you. Please keep in mind we are not licensed attorneys and cannot address any legal related questions.

-

Chat

Online - Email

Send a message

You May Also Like

Event Risk Management Plan

Sample Leadership Retreat

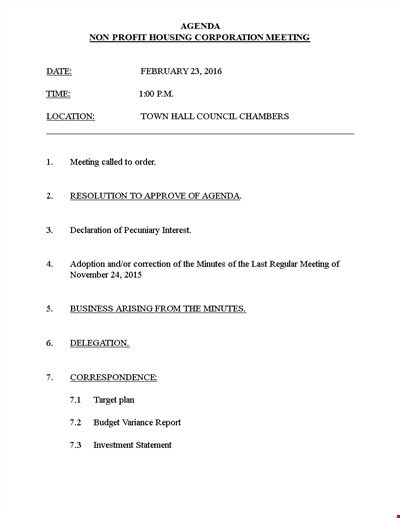

Non Profit Agenda Example

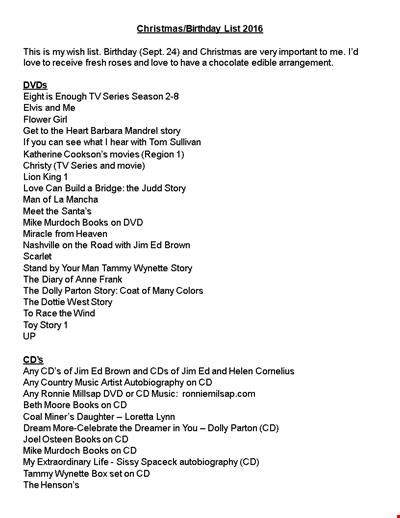

Perfect Christmas Birthday Gift List

Corporate Development Agenda Template - Streamline and Enhance Development Initiatives Globally

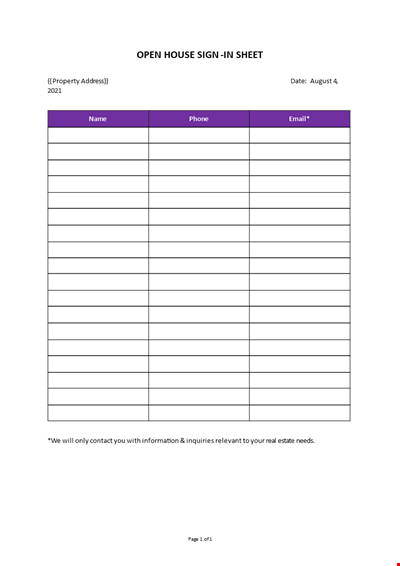

Open House Sign-in Sheet

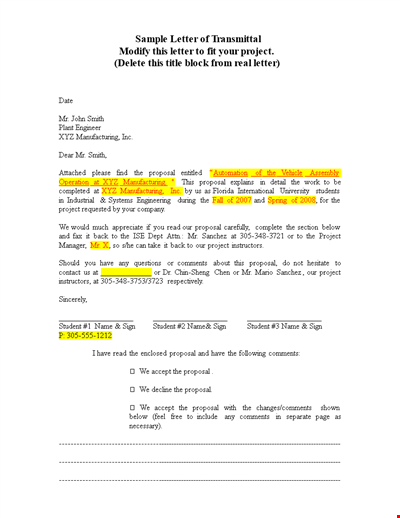

Letter Of Transmittal Template - Create a Professional Project Transmittal Letter

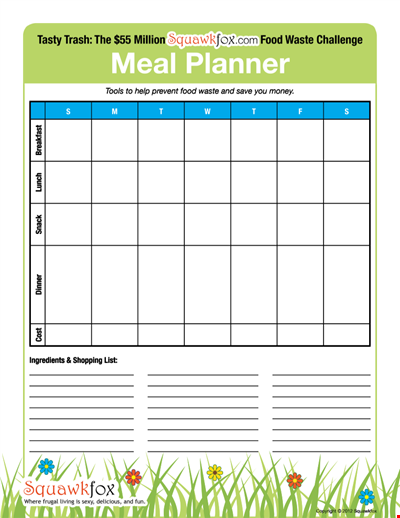

Create an Efficient Meal Planning Calendar for Easy Meal Preparation

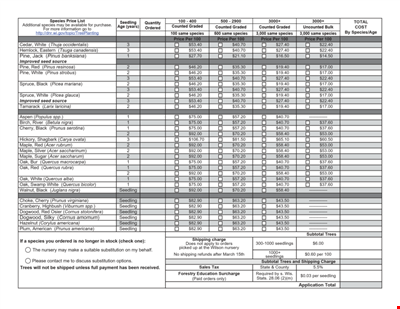

Seedling Price List - Affordable Saplings for Your Garden | Buy Best Quality Seedlings Online

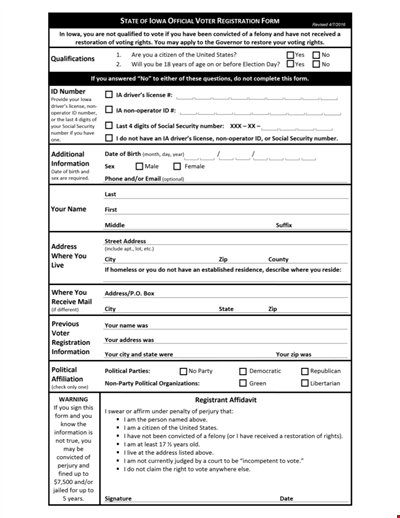

Printable Voter Registration Form

Department Material Requisition Form

Colored College Ruled Paper

College Ruled A Size Paper Template

Management Resume Us Letter

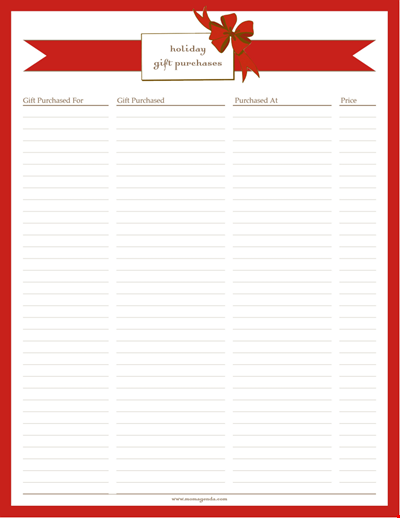

Organize Your Holiday Gift Purchases with our Template

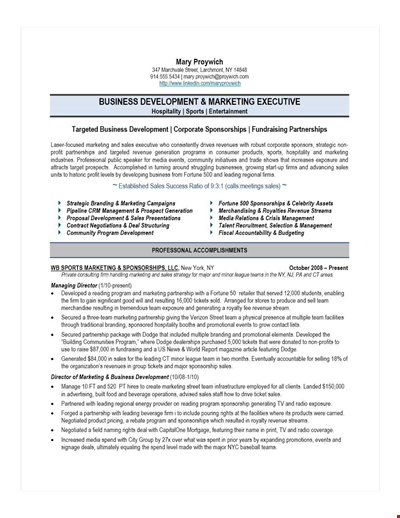

Experienced Corporate Sponsorship Sales Resume - Boost Your Career Today!