/32ac6919-9845-4c2f-961b-6af433a7d679.png)

Easily Track and Manage Asset Depreciation with our Depreciation Schedule Template

Review Rating Score

Are you in need of a depreciation schedule template to effectively manage your assets and track their depreciation over time? Look no further! At BizzLibrary.com, we offer a comprehensive depreciation schedule template in DOCX format. Download it today and simplify your depreciation calculations.

Understanding Depreciation

Depreciation is an accounting method used to allocate the cost of an asset over its useful life. It recognizes that assets like machinery, equipment, vehicles, and buildings gradually lose value over time due to wear and tear, obsolescence, or other factors.

Why Use a Depreciation Schedule?

A depreciation schedule is a valuable tool for businesses as it provides a systematic way to track and record the depreciation of assets. Here are a few reasons why you should consider using a depreciation schedule:

- Accurate Financial Reporting: A depreciation schedule ensures that you accurately reflect the value of your assets on your financial statements. This helps in providing a true and fair view of your company's financial position.

- Compliance with Accounting Standards: Many accounting standards and regulations require businesses to account for the depreciation of their assets properly. A depreciation schedule helps you comply with these standards, ensuring transparency and accountability.

- Budgeting and Planning: By tracking the depreciation of your assets, you can better plan for their replacement or maintenance costs. This allows for more accurate budgeting and forecasting, helping you make informed financial decisions.

- Tax Planning and Reporting: Depreciation expenses can have tax implications for your business. A depreciation schedule provides a clear record of depreciation, facilitating tax planning and accurate tax reporting.

How to Use the Depreciation Schedule Template

Our depreciation schedule template simplifies the process of calculating and recording depreciation for your assets. Here's how to use it:

- Enter the year of the schedule and a brief description of the assets being depreciated.

- Provide the purchase date and cost of each asset.

- Specify the depreciation method you are using (e.g., straight-line, declining balance, sum of the years' digits).

- Fill in the useful life and salvage value of the assets.

- The template will automatically calculate the annual depreciation expense and the asset's net book value.

Download our user-friendly depreciation schedule template in DOCX format today and simplify your asset management and depreciation calculations. Take control of your finances and make informed decisions for your business.

Visit BizzLibrary.com now to access a wide range of business document templates, including financial spreadsheets, contracts, and more. Download our depreciation schedule template and experience the convenience and efficiency it offers.

Is the template content above helpful?

Thanks for letting us know!

Reviews

Petrina Thomas(7/20/2023) - GBR

Ueful!

Last modified

Our Latest Blog

- A Guide to Make a Business Plan That Really Works

- The Importance of Vehicle Inspections in Rent-to-Own Car Agreements

- Setting Up Your E-mail Marketing for Your Business: The Blueprint to Skyrocketing Engagement and Sales

- The Power of Document Templates: Enhancing Efficiency and Streamlining Workflows

Template Tags

Need help?

We are standing by to assist you. Please keep in mind we are not licensed attorneys and cannot address any legal related questions.

-

Chat

Online - Email

Send a message

You May Also Like

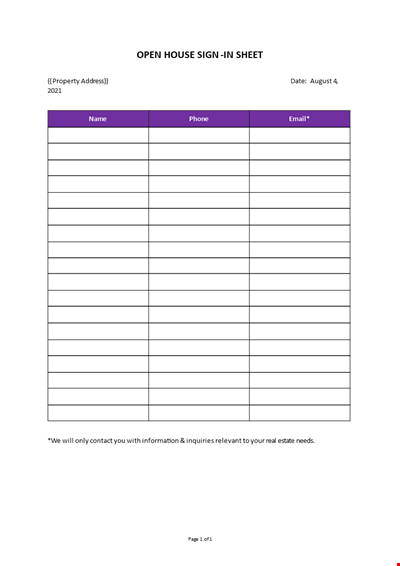

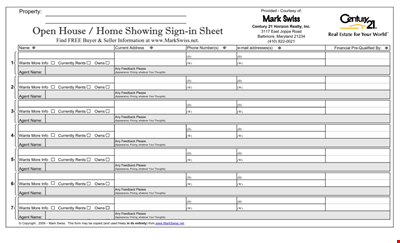

Open House Sign-in Sheet

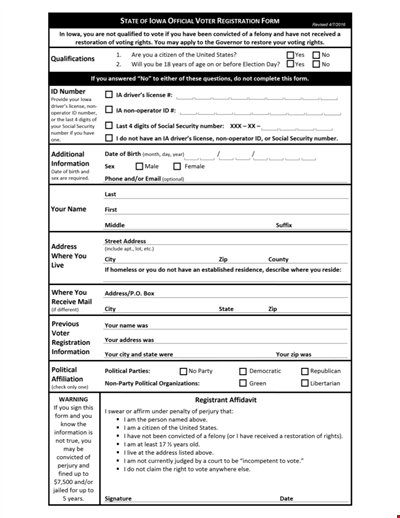

Printable Voter Registration Form

Department Material Requisition Form

Softball Box Score Sheet Template - Track game stats efficiently

Manage Your Finances with Our Free Printable Bill Payment Schedule Template

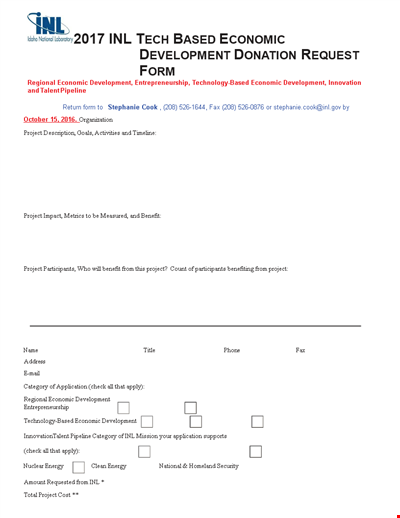

Tech-Based Economic Development Donation Request

Business Commercial Lease Rental Application Form - Apply for a Lease

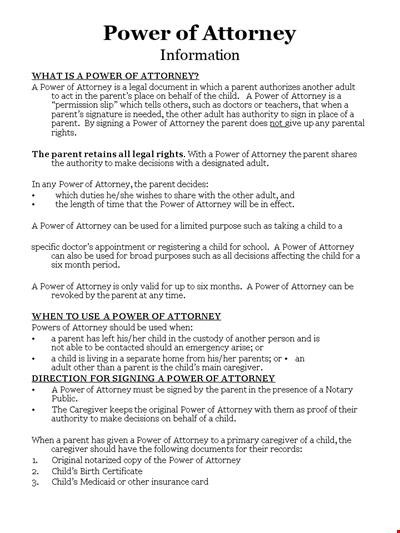

Child Medical Power of Attorney Form - Granting Parental Rights to Caregiver

Easter Social Media Post

Get the Best Open House Showing Sign In Sheet Template Here

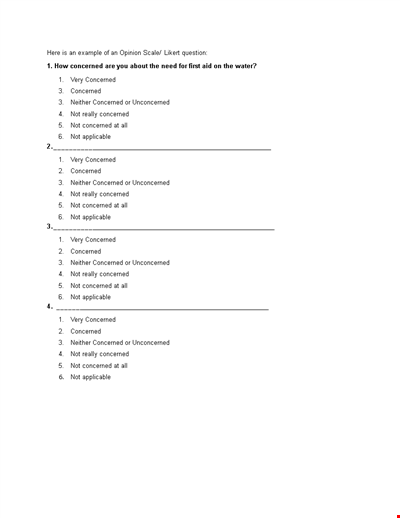

Understanding the Likert Scale: Neither Concerned nor Unconcerned

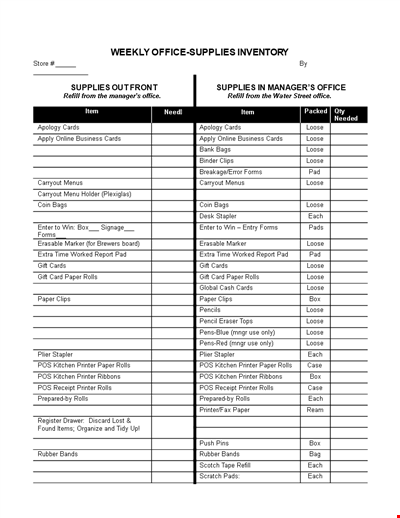

Weekly Office Supply Inventory List Example

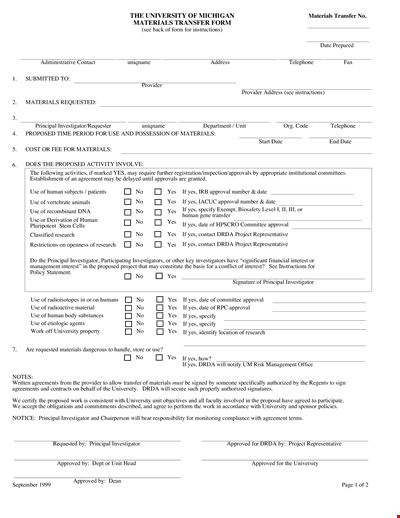

Material Transfer Form (University)

Design Work Order Form

Printable Large Oblique Graph Paper

Modern School Technology: Enhancing Education through Innovative Tools and Solutions