/ae47aeda-a4f4-4954-9e2a-a6a25b5f03df_1.png)

Loan Officer Job Description

Review Rating Score

An effective job description is essential when recruiting new staff, and it helps doing a preselection of the right job candidates. This will save you effort and time. By using this sample job description template, you do not need to start from scratch. This will give you a head start.

How do you write a Loan Officer job description?

A Loan Officer is responsible for evaluating and processing credit and loan applications within specified limits. Their duties include visiting clients to identify their needs and determine their creditworthiness, researching applicants’ financial status, and recommending the approval or rejection of loan applications. This sample Job description explainer offers guidance on key sections that are important to include for clarity, as well as suggestions for promoting the position. It provides a list of duties, responsibilities, tasks, requirements, demands for setting job expectations and the employee's ability to perform the work as described. However, it’s often not construed as an exhaustive list of all functions, responsibilities, skills and abilities. The following is included in job descriptions:

- Job title: highlight the accurate job title;

- Brief description: provide a brief summary or introduction that provides an overview of the job;

- Responsibilities: specify the relevant job duties and responsibilities that are necessary for this position;

- Company mission or company introduction;

- Requirements: demands that are important to do the job successfully;

- Qualifications; List essential qualifications;

- Compensation; Total funds and benefits that are provided to the employee in exchange for the work.

- Be clear and concise;

- Have someone proofread it;

- Make sure that HR and the hiring manager will sign off before publishing it;

- Define what success looks like in the position after 30 days, the first quarter, and the first year;

- Provide direct contact details of the manager or HR department who will follow up on the candidates;

- Publish it via several social media platforms, or offline media, so you are sure that in-house employees also can get easy access to it.

What are the job responsibilities of a Loan Officer?

Responsibilities:

- Meet with loan applicants to identify their needs and collect information for loan applications.

- Analyze active loan files on a regular basis and recommend solutions to speed up the loan process.

- Complete loan contracts and teach clients on policies and regulations.

- Interview applicants to define financial eligibility and establish debt payment plans.

- Monitor and update account records.

- Submit loan applications in a timely manner.

- Prepare detailed loan proposals.

- Reject loan applications and explain deficiencies to applicants.

- Respond to applicants' questions and resolve any loan-related issues.

- Operate in compliance with laws and regulations.

Qualifications:

- Bachelor’s degree in finance or a similar field.

- A minimum of 3 years’ experience as a loan officer.

- Solid understanding of local, state, and federal loan regulations.

- In-depth knowledge of computers and banking software.

- Outstanding interpersonal and communication skills.

- Customer service-oriented with exceptional sales skills.

By using this Loan Officer job description sample, modifying it to your needs, and then posting it, you will soon start receiving Resumes and Cover letter from suitable candidates.

Get this printable file now and personalize it according to your needs. Just download this ready-made Loan Officer job description template in Google Docs, MS Word or Apple Pages format and you are ready to go!

Is the template content above helpful?

Thanks for letting us know!

Reviews

Elvia Roach(12/28/2021) - GBR

Great!!

Jolynn Morris(12/28/2021) - AUS

Best file today

Lesha Foster(12/28/2021) - NZL

Not disapointing, I am glad to find this page

Last modified

Our Latest Blog

- The Importance of Vehicle Inspections in Rent-to-Own Car Agreements

- Setting Up Your E-mail Marketing for Your Business: The Blueprint to Skyrocketing Engagement and Sales

- The Power of Document Templates: Enhancing Efficiency and Streamlining Workflows

- Writing a Great Resume: Tips from a Professional Resume Writer

Template Tags

Need help?

We are standing by to assist you. Please keep in mind we are not licensed attorneys and cannot address any legal related questions.

-

Chat

Online - Email

Send a message

You May Also Like

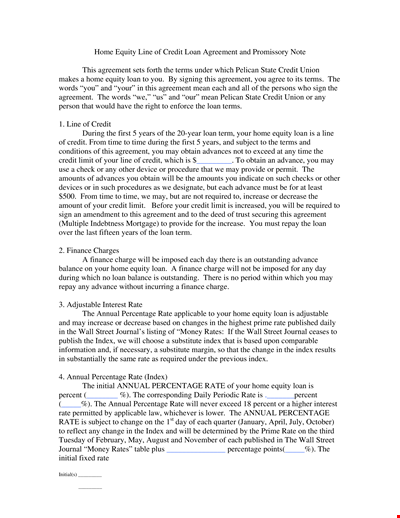

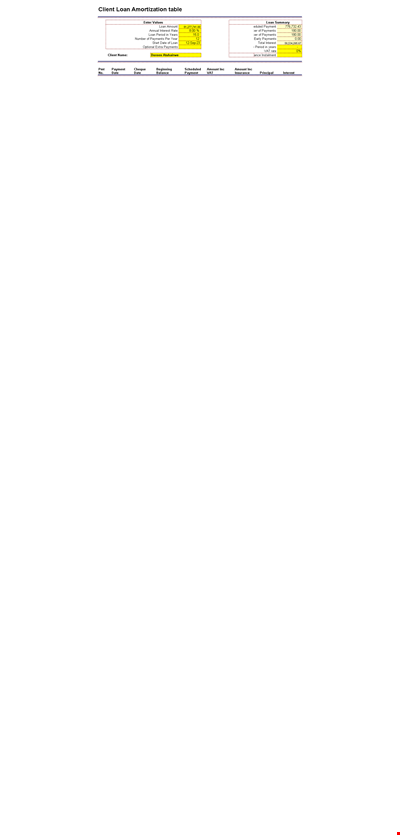

Free Home Loan Amortization Schedule Template | Manage Your Mortgage Payments, Interest, Principal

Loan Offer Acceptance Agreement Template for Applicant

Sample Promissory Note Template with Interest for Principal Maker

Example of Loan Settlement Statement - Insurance and Title included

Personal Loan Agreement Form for Promissory Note | Easy Agreement | Credit Terms Under Control

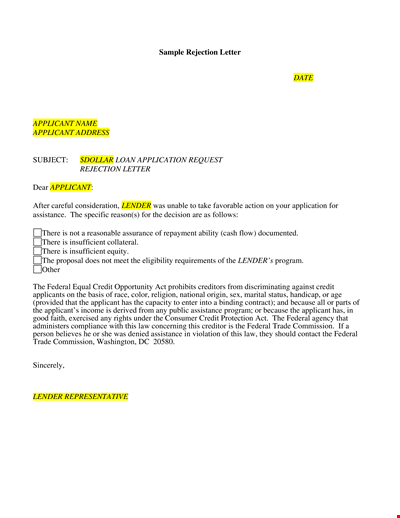

Loan Rejection Letter: Formal Assistance for Applicant from Federal Lender

Loan Amortization Template: Easily Track Scheduled Payments and Payment Amounts

Personal Installment Loan Agreement Template | Secure Payments | Check Amounts

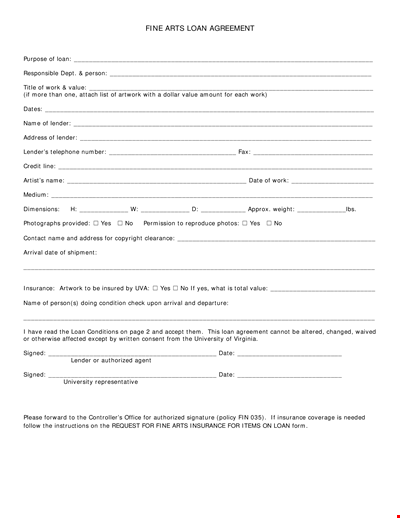

Fine Arts Loan Agreement | University Lender | Virginia

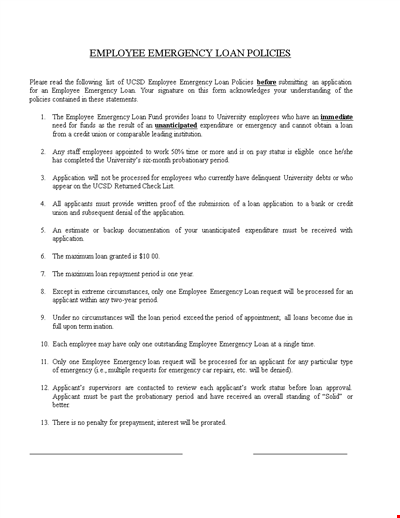

Employee Emergency Loan Policy: Quick & Convenient Solutions for Employee Emergencies

Loan Amortization Template - Calculate Payment, Total Payments

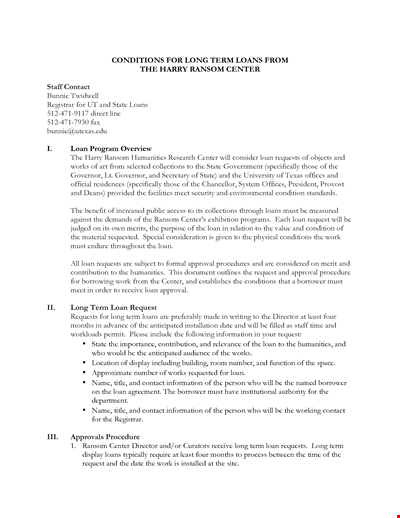

HRC Long Term Loan - Center for Borrower Ransom

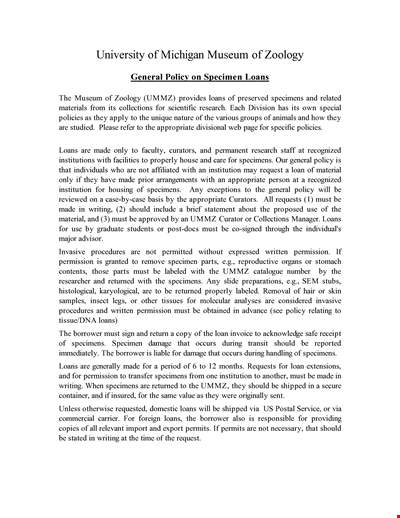

Ummz Loan Policy

Medical Loan Application Letter Template

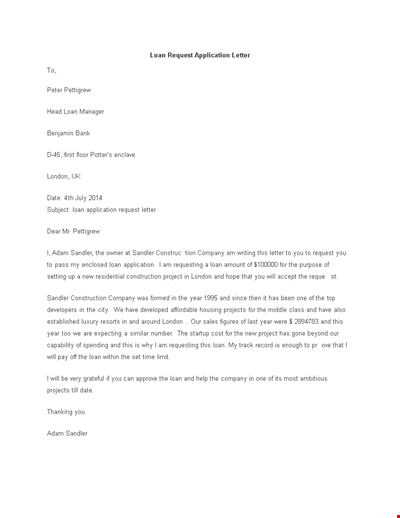

Loan Request Application Letter

Home Loan Amortization Schedule Template