/75f08c11-825e-4c6f-85ed-1996ad2a85c0.png)

Payment Letter of Explanation - Resolve Payment Issues Quickly

Review Rating Score

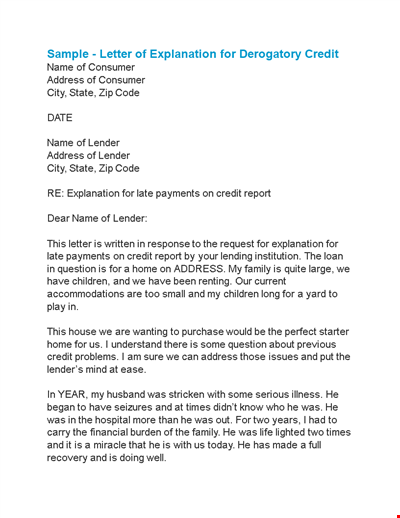

Have you ever been asked to provide a letter of explanation for a loan? It's a common request from lenders when you've had late payments or missed payments on your credit report. A letter of explanation serves to provide context for the lender and explain any extenuating circumstances that may have contributed to your financial difficulties. At BizzLibrary.com, we offer a professionally drafted letter of explanation template in DOCX format, which you can download today.

Why Do You Need a Letter of Explanation?

If you've had late or missed payments on a loan, your credit report may raise red flags for lenders when you apply for another loan. A letter of explanation can help clarify the situation and provide context for your financial difficulties. It shows the lender that you're taking responsibility for your actions and that you're willing to address the problem to improve your credit history. Here's why a letter of explanation is an important tool:

- Explain Any Extenuating Circumstances: A letter of explanation gives you an opportunity to provide a detailed account of any extenuating circumstances that may have caused you to be late with payments or miss them altogether. This could include a job loss, medical issues, or other unforeseen events that affected your ability to make payments on time.

- Show Your Commitment to Repayment: By submitting a letter of explanation, you're demonstrating your willingness to take responsibility for your financial difficulties and make changes to improve your situation. This can help alleviate some of the concerns that lenders may have about your ability to make timely payments in the future.

- Provide Additional Information: A letter of explanation is also an opportunity to provide any additional information that may be relevant to your loan application, such as income changes, financial assistance, or other factors that may have affected your ability to make payments on time.

Key Components of a Letter of Explanation

While the details of a letter of explanation will vary depending on your circumstances, there are some key components that should be included:

- The date

- Your name and address

- The lender's name and address

- A brief summary of the situation

- An explanation of what happened and why it occurred

- What steps you're taking to rectify the situation, such as establishing a payment plan or seeking financial counseling

- Your signature and contact information

Get Your Letter of Explanation Template

If you've been asked to provide a letter of explanation for a loan, don't panic. Our professionally drafted letter of explanation template in DOCX format can save you time and stress. Download our template today and modify it to fit your specific situation. It's an essential tool for taking control of your finances and addressing past financial difficulties. Visit BizzLibrary.com now to access a wide range of business document templates, including loan agreements, payment plans, and more.

Is the template content above helpful?

Thanks for letting us know!

Reviews

Sherice Conley(6/25/2023) - NZL

Great file, thanks

Last modified

Our Latest Blog

- The Importance of Vehicle Inspections in Rent-to-Own Car Agreements

- Setting Up Your E-mail Marketing for Your Business: The Blueprint to Skyrocketing Engagement and Sales

- The Power of Document Templates: Enhancing Efficiency and Streamlining Workflows

- Writing a Great Resume: Tips from a Professional Resume Writer

Template Tags

Need help?

We are standing by to assist you. Please keep in mind we are not licensed attorneys and cannot address any legal related questions.

-

Chat

Online - Email

Send a message

You May Also Like

Fund Transfer Letter Template for Account Members - Clearing

Letter of Explanation: Credit, Address, Consumer | SEO-Optimized Meta Title Solution

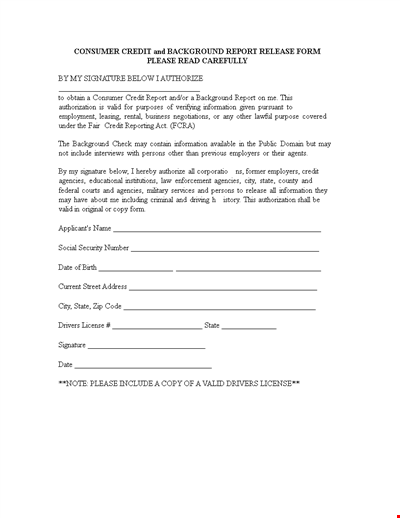

Validating Consumer Credit Background Report | Signature Required

Golden Credit Union Annual Report Template for Credit Union with Assets in Sacramento

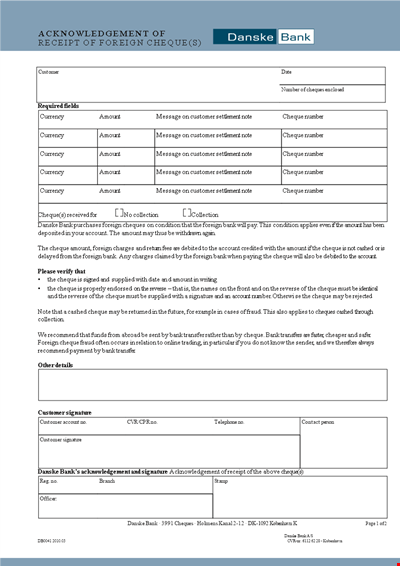

Acknowledging Cheques from Customers: Confirming the Amount Received

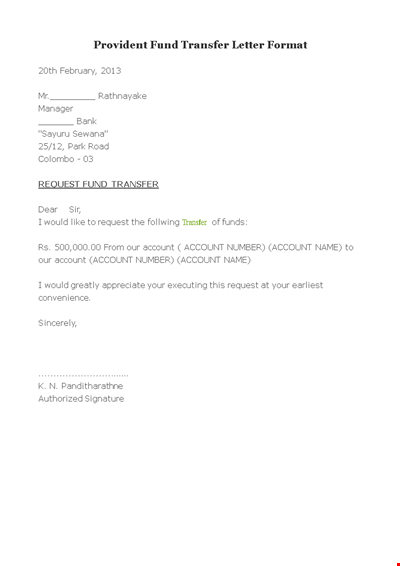

Provident Fund Transfer Letter Format

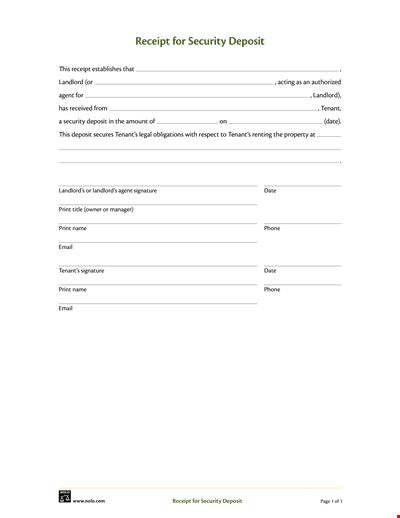

Simple Security Deposit

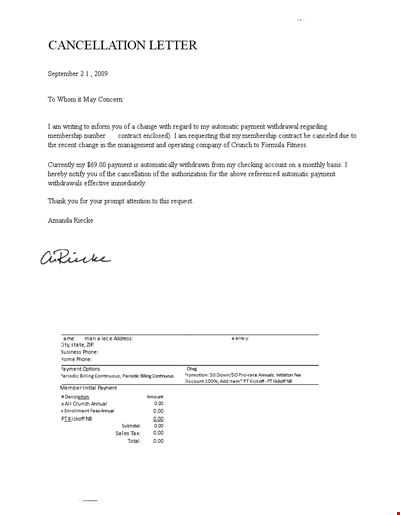

Fund Transfer Cancellation Letter Template

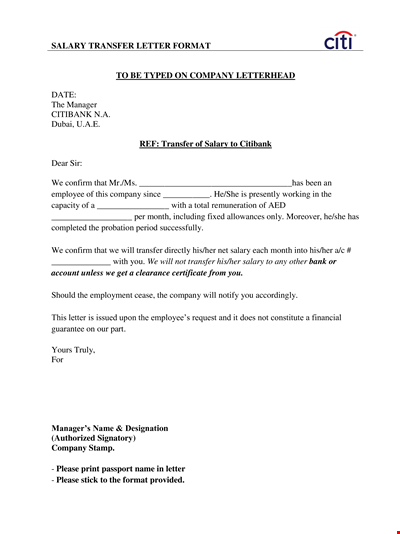

Salary Transfer Letter to Bank - Company's Letter for Employee's Salary Transfer

Experienced Retail Banking Executive | Branch Sales | Banking Leadership

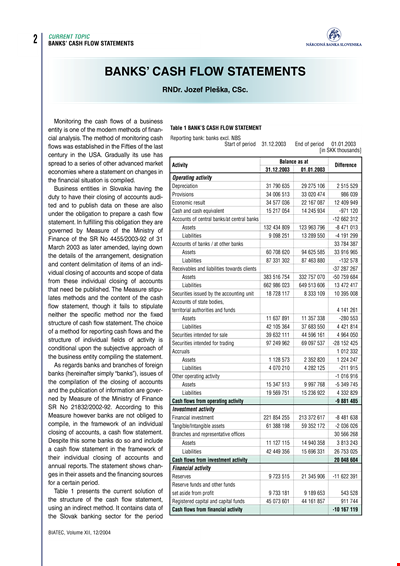

Bank Statement Template: Track Your Assets, Funds, and Banks

Chase Direct Deposit Form Template – Simple & Direct | Save Time & Money

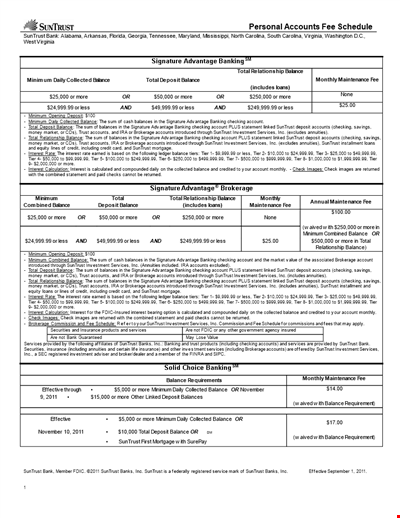

SunTrust Personal Accounts Fee Schedule: Account Balance, Checking Accounts & More

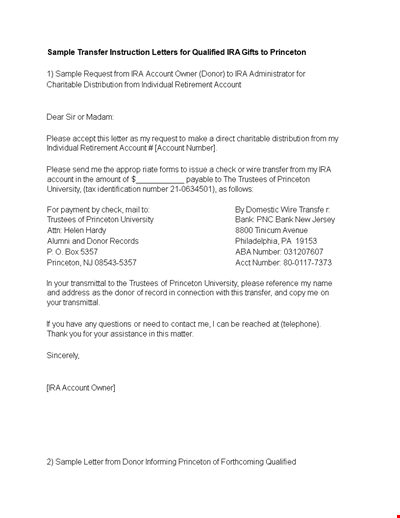

Example Fund Transfer Instruction Letter Template - Account Donor Princeton

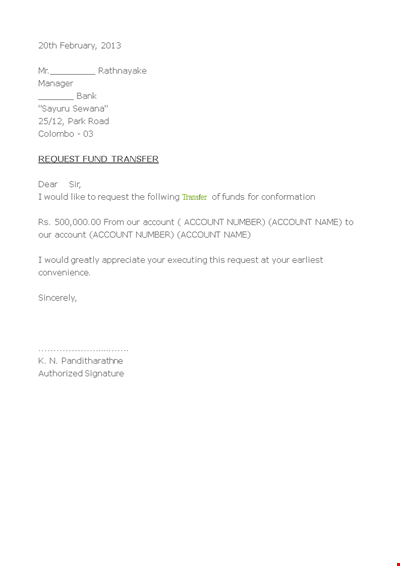

Fund Transfer Confirmation Letter Example

Credit Repair Letter Template