/00f44902-24df-4ad7-89f2-ea8cdc1109ce.png)

Financial Budget Planner Template - Track Expenses, Insurance, and Monthly Total Income

Review Rating Score

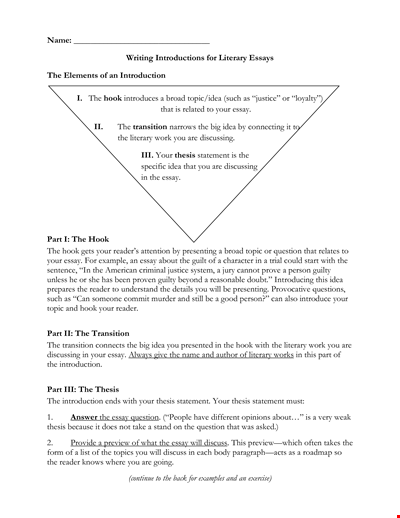

Managing your finances effectively is crucial for achieving your financial goals and maintaining financial stability. Whether you're looking to track your monthly expenses, plan for future expenses, or create a budget for your business, our Financial Budget Planner Template can be a valuable tool.

Why Use a Financial Budget Planner Template?

A Financial Budget Planner Template is designed to help you track your income and expenses, analyze your spending habits, and make informed financial decisions. Here are some key benefits of using our template:

- Total Financial Overview: Our Financial Budget Planner Template offers a comprehensive view of your financial situation. It allows you to track your total income and expenses, giving you a clear picture of your financial health.

- Expense Management: By categorizing your expenses, you can easily identify areas where you can make adjustments and save money. This template enables you to track your monthly expenses and identify any patterns or trends.

- Income Tracking: Keeping track of your income is just as important as tracking expenses. With our template, you can input and monitor your monthly income, ensuring that you have an accurate understanding of your cash flow.

- Budget Planning: Our Financial Budget Planner Template allows you to set financial goals and allocate funds accordingly. By planning and sticking to a budget, you can save money, manage debt, and achieve your financial objectives.

How to Use the Financial Budget Planner Template

Using our Financial Budget Planner Template is simple and straightforward. Just follow these steps:

- Download our Financial Budget Planner Template in PDF format from BizzLibrary.com.

- Open the PDF file using your preferred software or application.

- Input your total income for the month in the designated field.

- Record your monthly expenses under appropriate expense categories, such as insurance, utilities, groceries, and transportation.

- Review and analyze your income and expenses to identify areas for improvement or potential savings.

- Repeat the process monthly to maintain an accurate and up-to-date view of your finances.

Ready to take control of your finances and achieve your financial goals? Download our Financial Budget Planner Template in PDF format now. Visit BizzLibrary.com for a wide range of financial and business document templates to support your personal and professional needs.

Is the template content above helpful?

Thanks for letting us know!

Reviews

Julietta Hurley(8/1/2023) - AUS

**** Thanks! This letter provided me the solution

Last modified

Our Latest Blog

- A Guide to Make a Business Plan That Really Works

- The Importance of Vehicle Inspections in Rent-to-Own Car Agreements

- Setting Up Your E-mail Marketing for Your Business: The Blueprint to Skyrocketing Engagement and Sales

- The Power of Document Templates: Enhancing Efficiency and Streamlining Workflows

Template Tags

Need help?

We are standing by to assist you. Please keep in mind we are not licensed attorneys and cannot address any legal related questions.

-

Chat

Online - Email

Send a message

You May Also Like

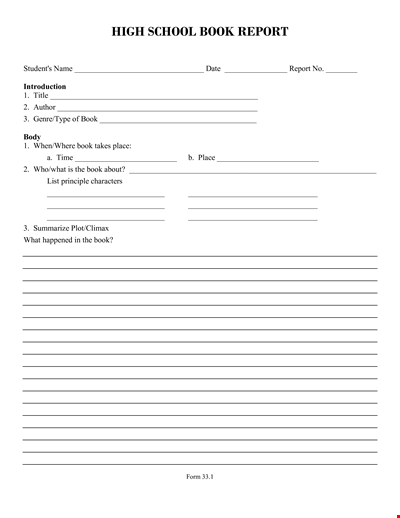

High School Book Report - Expert Tips for Writing an Engaging Report by Author

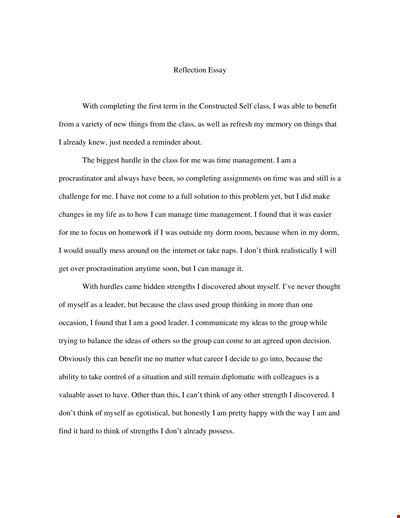

Personal Reflective Essay Template: A Comprehensive Guide to Reflect on Myself and Class

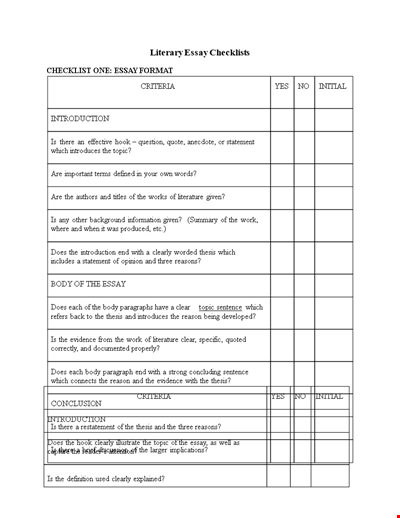

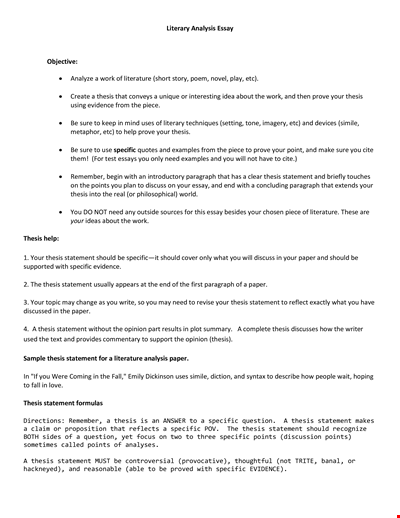

Checklist for Writing a Literary Essay | Essay, Thesis, Topics, Literature

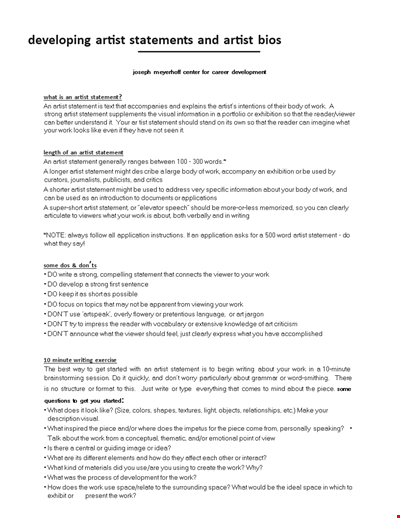

Developing Artist Statements and Bios for Artistic Development

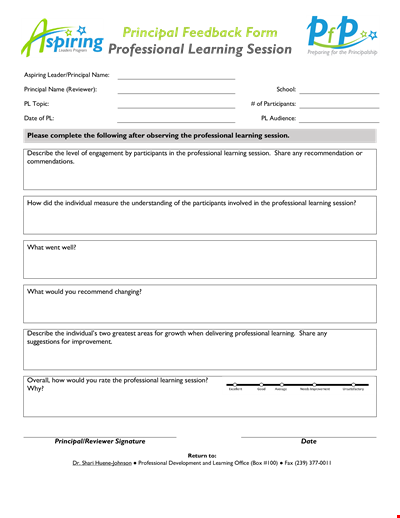

Professional Learning Form | Principal Session | Boost Your Professional Growth

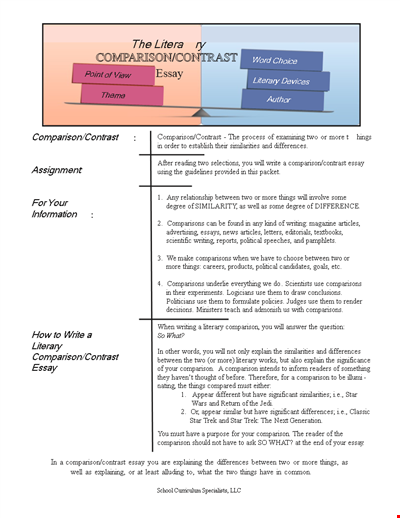

Comparing and Contrasting Literary Themes: A Reader's Perspective on Walker and Angelou

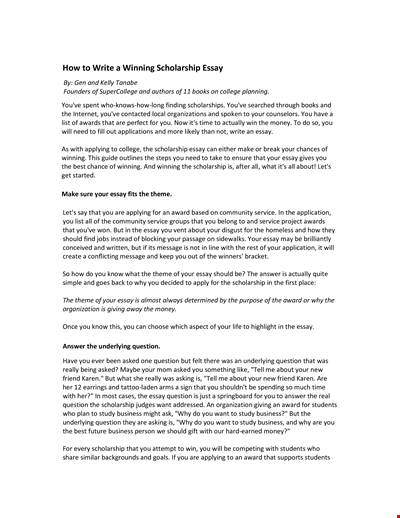

Writing a Winning Scholarship Essay - Tips for Scholarship Essay Writing

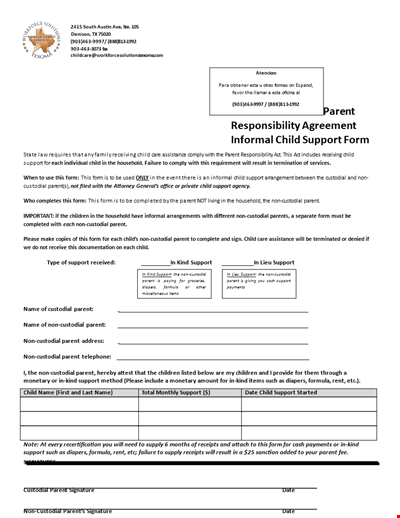

Child Support Agreement Template - Support Your Child and Protect Parental Rights

Sample Introduction Literary Essay

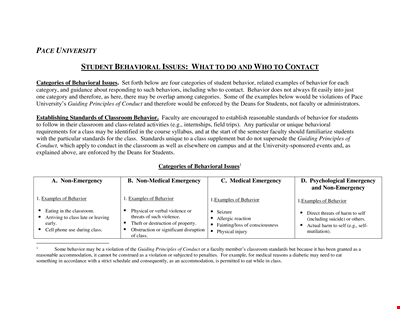

Student Daily Behavior Chart Template

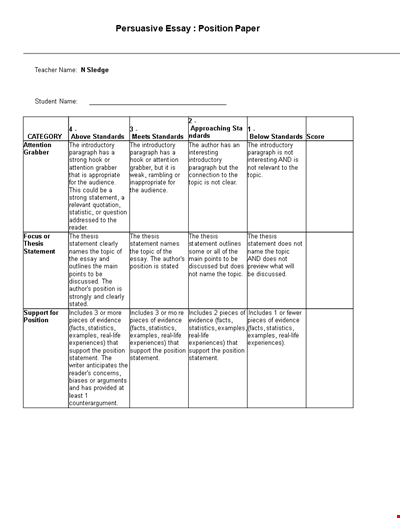

Persuasive Essay Template | Scholastic: Statement, Position, Author & Evidence

Commercial Property Photography - Permitted Vizcaya | Document Templates

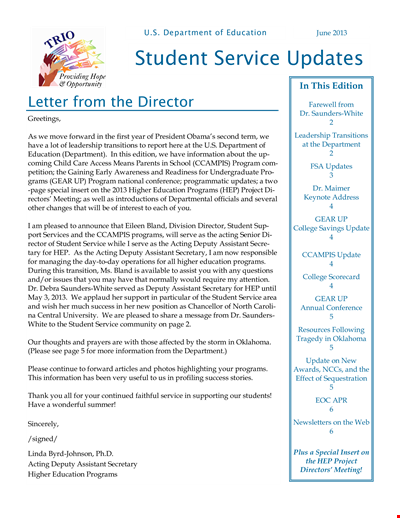

Education Service: Student Programs - Jun Newsletter

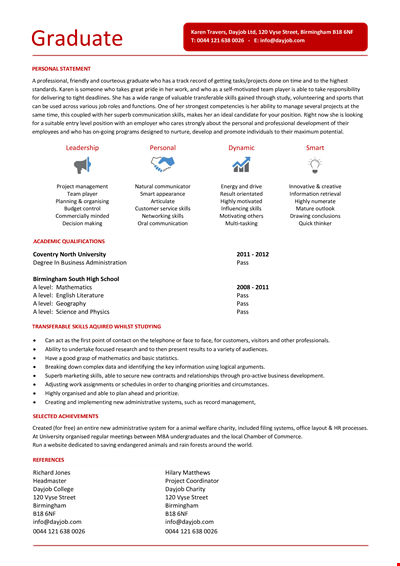

College Student Resume Template: Skills for Day Job | Level | Birmingham

Writing a Specific Literary Analysis Essay: Objective, Paragraph, and Thesis Statement

High School Reflective Essay Template for Reflection on an Occasion | Expert Essay Writer