/ce24b733-afae-4f76-ad26-f5b690fd6aa4.png)

Free Budget Calendar

Review Rating Score

Are you looking for an effective way to manage your budget? Look no further! At BizzLibrary.com, we offer a free budget calendar template that can help you stay organized and on track with your financial goals. Our budget calendar is designed to assist you in tracking your income and expenses, creating a comprehensive overview of your finances.

Why Use a Budget Calendar?

A budget calendar is a valuable tool for individuals, families, and businesses alike. Here's why using a budget calendar can be beneficial:

- Track Income and Expenses: A budget calendar allows you to record and monitor your income and expenses thoroughly. It helps you visualize your cash flow and identify areas where you can save or cut expenses.

- Plan for Future Expenses: By using a budget calendar, you can anticipate upcoming expenses and plan for them in advance. This ensures that you have enough funds allocated for important financial obligations.

- Set Financial Goals: A budget calendar enables you to set and track financial goals. Whether you want to save for a vacation, pay off debt, or invest in a new venture, a budget calendar helps you stay focused and motivated.

- Gain Control of Your Finances: With a clear overview of your income and expenses, a budget calendar allows you to take control of your finances. It helps you make informed financial decisions and avoid unnecessary debt or overspending.

Using Our Free Budget Calendar Template

Our free budget calendar template is available for download in DOCX format, making it easy to customize and use. Here's how you can make the most of our template:

- Choose the Appropriate Calendar: Our template comes with pre-designed calendars for each month of the year. Choose the calendar that corresponds to your desired budget period, such as June or March.

- Record Income and Expenses: Fill in the calendar with your estimated and actual income, as well as your planned and actual expenses. Categorize your expenses to get a detailed overview of your spending habits.

- Review and Adjust: Regularly review your budget calendar and compare your actual expenses to your planned ones. Make adjustments as needed to ensure you stay within your financial limits.

- Track Progress and Set Goals: Use the budget calendar to track your progress and set achievable financial goals. Celebrate milestones along the way to stay motivated and committed.

Download Our Free Budget Calendar Template

Ready to take control of your finances and improve your budgeting skills? Download our free budget calendar template in DOCX format today and get started on your financial journey. Visit BizzLibrary.com now and explore our wide range of business and personal document templates to support your organizational and planning needs.

Is the template content above helpful?

Thanks for letting us know!

Reviews

Armida Bass(7/20/2023) - USA

**** Thanks for the document

Last modified

Our Latest Blog

- A Guide to Make a Business Plan That Really Works

- The Importance of Vehicle Inspections in Rent-to-Own Car Agreements

- Setting Up Your E-mail Marketing for Your Business: The Blueprint to Skyrocketing Engagement and Sales

- The Power of Document Templates: Enhancing Efficiency and Streamlining Workflows

Template Tags

Need help?

We are standing by to assist you. Please keep in mind we are not licensed attorneys and cannot address any legal related questions.

-

Chat

Online - Email

Send a message

You May Also Like

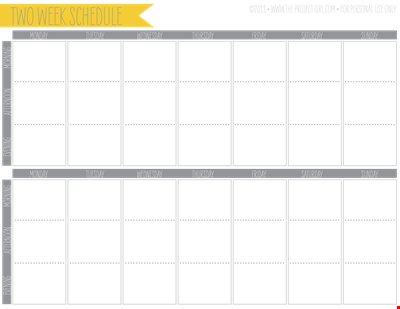

Week Schedule Calendar Template

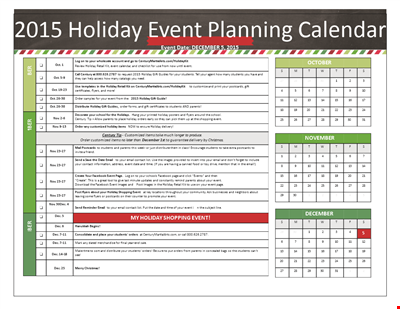

Example Holiday Calendar: Plan Your Events and Holidays for Students

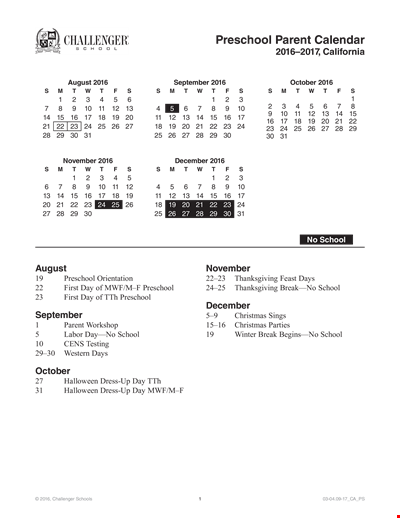

Parent Calendar Template

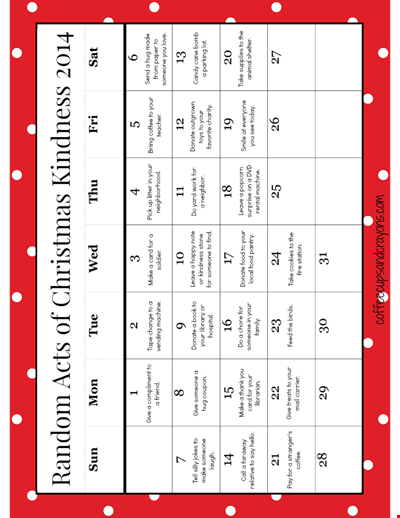

Free Printable Calendar Template For Kids

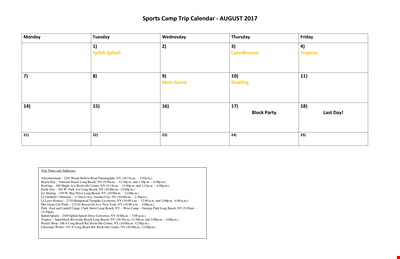

August Sports Calendar: Get Ready to Hit the Beach!

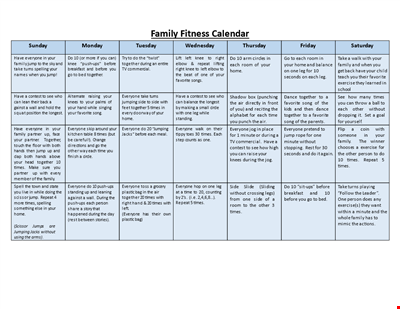

Create a Healthy Lifestyle for Your Family with our Family Fitness Calendar Template

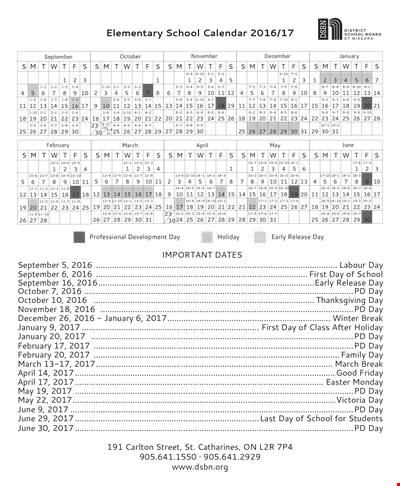

Elementary School Calendar - September to January

Plan Your Week with Ease - Weekly Calendar Template

Printable Weekly Student Calendar - Organize Your Periods and Semesters

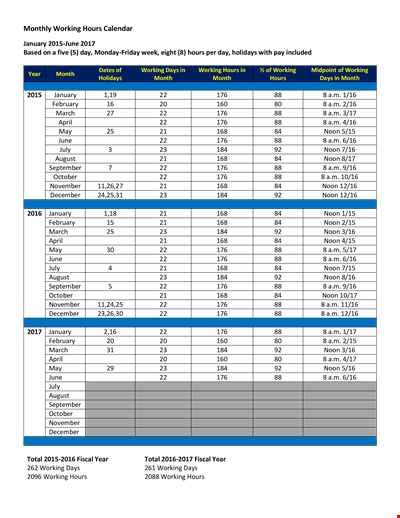

January Working Hours Calendar Template | Plan and Track Your Monthly Working Hours

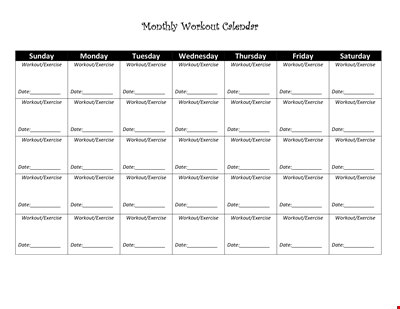

Monthly Workout Calendar - Plan Your Workout Routine for Success

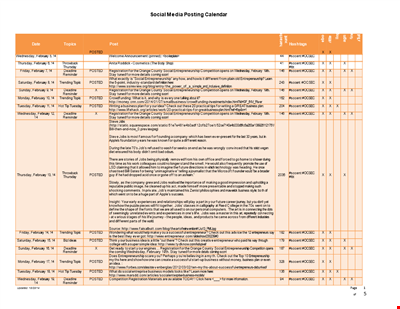

Free Social Media Posting Calendar Template - Plan, Organize and Schedule Your Posts Effortlessly!

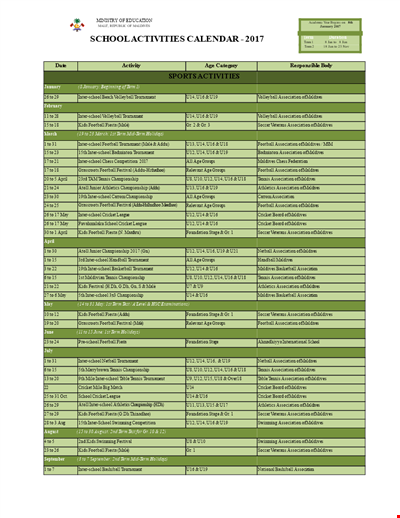

School Calendar - Plan Your Academic Year with our School Association in Maldives

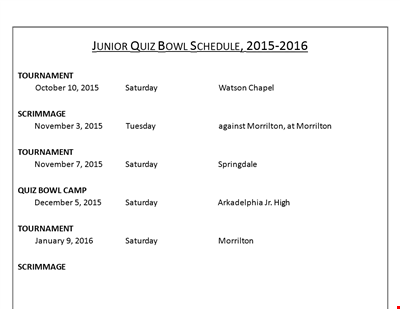

Printable Quiz Bowl Schedule - Saturday January Tournament for Junior Morrilton

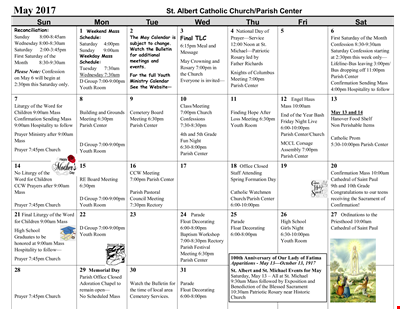

Sample Publisher Calendar for Parish Community Center

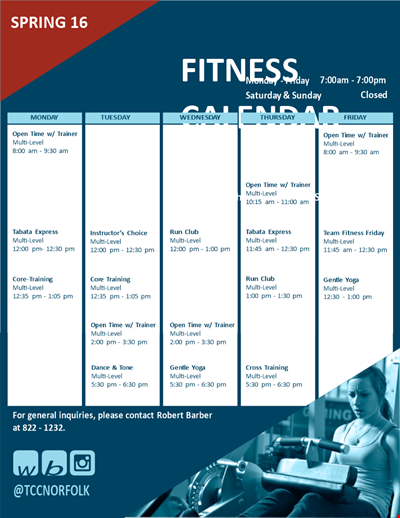

Get Fit with Our Fitness Spring Calendar Template - Training, Workout, Fitness