/13fc3bc5-5038-4a01-b1e8-7c2b70cbb495.png)

Public Company Valuation Example

Review Rating Score

Are you interested in understanding how public companies are valued? Look no further! At BizzLibrary.com, we have an informative example of a public company valuation that can help you gain insights into the valuation process. Our valuation example showcases how cash, equity, and other factors are considered to determine the overall value of a public company.

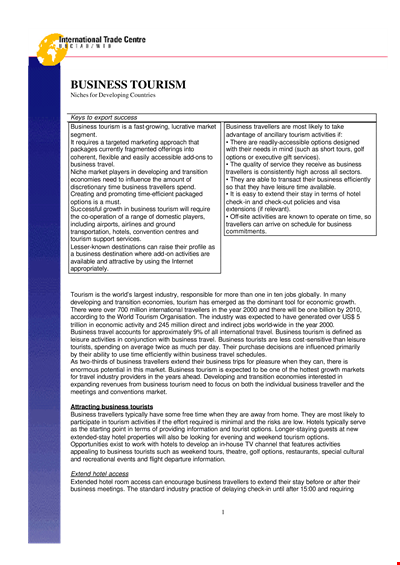

Understanding Public Company Valuation

Valuing a public company involves assessing its worth in the market by considering various financial factors. This process is crucial for investors, analysts, and potential buyers who want to determine if a company is a good investment. Here's an overview of the key elements involved in public company valuation:

- Cash and Cash Equivalents: Cash held by the company is an important asset in valuation. It includes not only physical cash but also highly liquid assets such as short-term investments and marketable securities.

- Equity Value: The equity value represents the residual interest in the assets of the company after deducting liabilities. It reflects the value available to shareholders if all the company's debts were to be paid off.

- Financial Statements: Financial statements, such as the balance sheet, income statement, and cash flow statement, provide crucial information for valuation. Analysts analyze these statements to assess a company's financial health and performance.

- Market Capitalization: Market capitalization, or market cap, is a common metric to gauge the value of a public company. It is calculated by multiplying the company's share price by the number of its outstanding shares.

- Comparable Companies: Valuation can also be done by comparing the target company to similar publicly-traded companies in the same industry. This involves analyzing financial ratios, growth prospects, and market trends of the comparable companies.

Example of Public Company Valuation

To better understand the valuation process, download our comprehensive PDF example of a public company valuation. This example presents a step-by-step analysis, taking into account various financial factors and methodologies commonly used in the industry.

Visit BizzLibrary.com now to download this valuable resource and gain insights into how public companies are valued. We offer a wide range of downloadable documents, including financial templates, business plans, and more. Enhance your knowledge and make informed decisions with BizzLibrary.com!

Is the template content above helpful?

Thanks for letting us know!

Reviews

Elli Richardson(7/24/2023) - NZL

Very good file, I will check your documents more often

Last modified

Our Latest Blog

- The Importance of Vehicle Inspections in Rent-to-Own Car Agreements

- Setting Up Your E-mail Marketing for Your Business: The Blueprint to Skyrocketing Engagement and Sales

- The Power of Document Templates: Enhancing Efficiency and Streamlining Workflows

- Writing a Great Resume: Tips from a Professional Resume Writer

Template Tags

Need help?

We are standing by to assist you. Please keep in mind we are not licensed attorneys and cannot address any legal related questions.

-

Chat

Online - Email

Send a message

You May Also Like

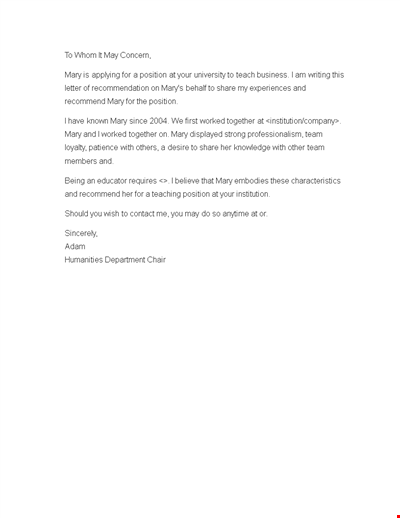

Recommendation Letter for a Position

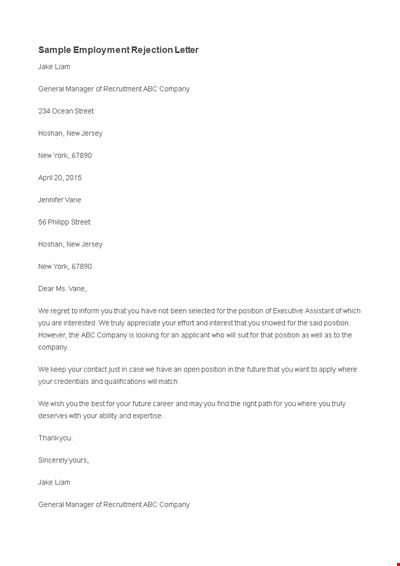

Sample Employment Rejection Letter

Good news letter example

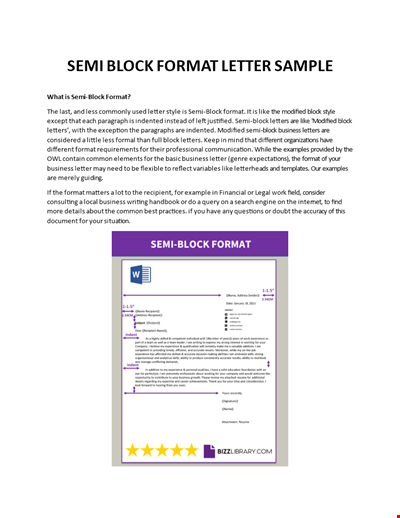

Semi Block Format Letter Template

Clean corporate Presentation Template

Letterhead Business Word

Include and Format Your Formal Business Letter Correctly

Travel Business Letterhead Format

Formal Letter For Change Of Address Format

Basic Customer Service Letter Text

White Hat Eulogy Example

Complaint Letter Format for Poor Internet Service - Improve Your Network, Internet, and Router

Childcare Voucher Template | Get Discounts on Childcare with Vouchers

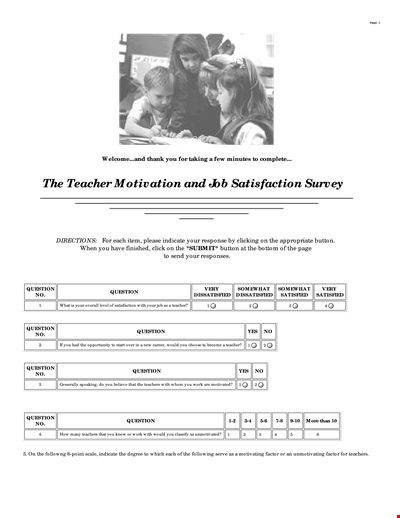

School Teacher Satisfaction Survey: Evaluating Teacher-Student Experience and Years of Service

Final Corporate Strategic Plan for Community Strategic County Norfolk

Company and Financial Management - Iberia Group