/7e7095d2-74ee-4c52-845e-0196424dc67d.png)

Debt Snowball Spreadsheet

Review Rating Score

Dealing with multiple debts can be overwhelming and frustrating, but it doesn't have to be. The debt snowball method is a proven strategy for paying off debts quickly and effectively, and now you can take control of your finances with our Debt Snowball Spreadsheet.

What is the Debt Snowball Method?

The debt snowball method is a debt repayment strategy that focuses on paying off the smallest debts first to gain momentum and motivation. Here's how it works:

- List Your Debts: Start by listing all your debts, including their balances, minimum monthly payments, and interest rates.

- Order Your Debts: Arrange your debts in order from the smallest balance to the largest balance.

- Pay Your Minimums: Make the minimum payment on each debt except for the one with the smallest balance.

- Pay Extra: Put any extra money you have toward the debt with the smallest balance, paying as much as you can afford each month.

- Repeat: Once you've paid off the first debt, take the money you were paying toward it (minimum payment + extra) and apply it to the debt with the next smallest balance. Repeat this cycle until you've paid off all your debts.

Why Use a Debt Snowball Spreadsheet?

Using a debt snowball spreadsheet can help you visualize your debts and track your progress as you work toward becoming debt-free. Our spreadsheet is a customizable tool that allows you to:

- Easily list all your debts and their details

- See the total amount of debt and minimum payments

- Automatically calculate the debt payoff order

- Track your progress with monthly payments and remaining balances

Get Your Debt Snowball Spreadsheet

Ready to take control of your debts and achieve financial freedom? Our Debt Snowball Spreadsheet is available for download in PDF format and can be customized to suit your needs. Plus, it's completely free!

Visit BizzLibrary.com now to download your Debt Snowball Spreadsheet and start your journey toward becoming debt-free. We offer a wide range of financial document templates, including budget spreadsheets, savings goals trackers, and more. Take the first step toward a brighter financial future today!

Is the template content above helpful?

Thanks for letting us know!

Reviews

Michiko Fry(6/24/2023) - USA

I just wanted to write to say thanks for the letter.

Last modified

Our Latest Blog

- The Importance of Vehicle Inspections in Rent-to-Own Car Agreements

- Setting Up Your E-mail Marketing for Your Business: The Blueprint to Skyrocketing Engagement and Sales

- The Power of Document Templates: Enhancing Efficiency and Streamlining Workflows

- Writing a Great Resume: Tips from a Professional Resume Writer

Template Tags

Need help?

We are standing by to assist you. Please keep in mind we are not licensed attorneys and cannot address any legal related questions.

-

Chat

Online - Email

Send a message

You May Also Like

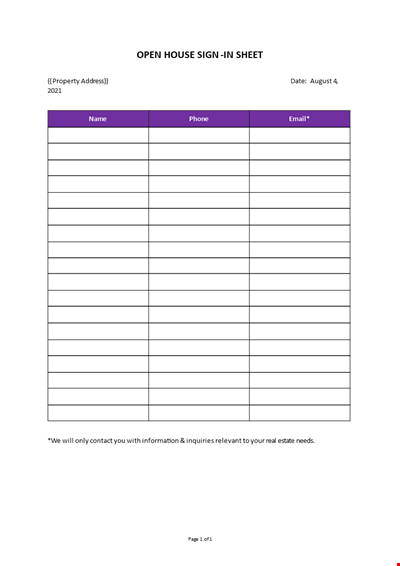

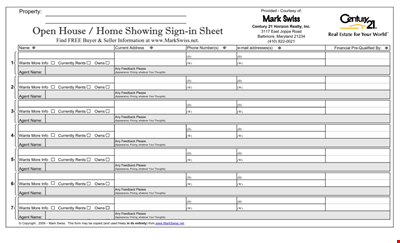

Open House Sign-in Sheet

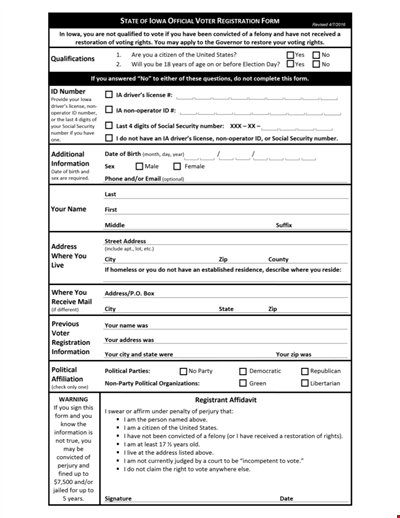

Printable Voter Registration Form

Department Material Requisition Form

Softball Box Score Sheet Template - Track game stats efficiently

Manage Your Finances with Our Free Printable Bill Payment Schedule Template

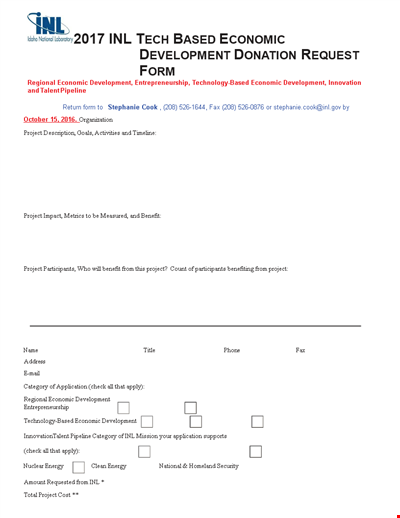

Tech-Based Economic Development Donation Request

Business Commercial Lease Rental Application Form - Apply for a Lease

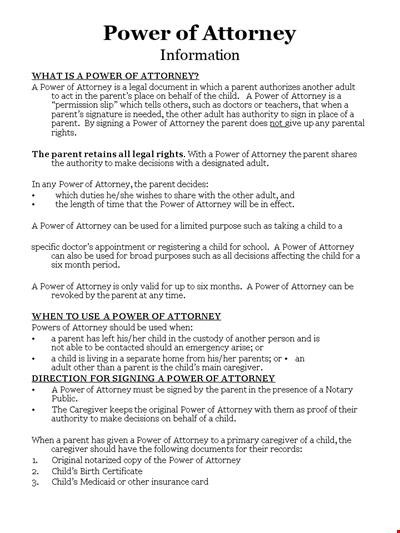

Child Medical Power of Attorney Form - Granting Parental Rights to Caregiver

Easter Social Media Post

Get the Best Open House Showing Sign In Sheet Template Here

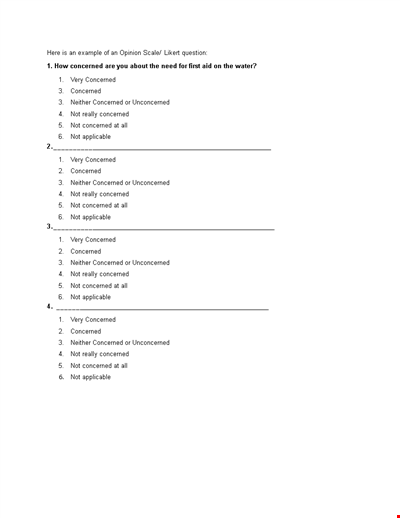

Understanding the Likert Scale: Neither Concerned nor Unconcerned

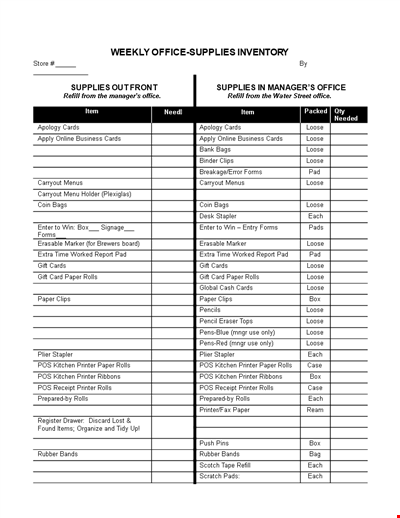

Weekly Office Supply Inventory List Example

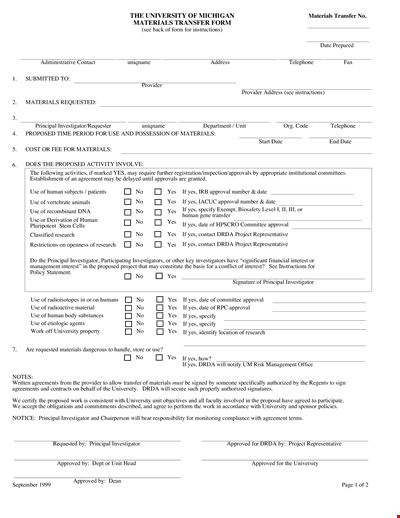

Material Transfer Form (University)

Design Work Order Form

Printable Large Oblique Graph Paper

Modern School Technology: Enhancing Education through Innovative Tools and Solutions