/e2245ef7-8904-4509-86bd-b5f15b494531.png)

Get Out of Debt Faster with Our Debt Snowball Spreadsheet

Review Rating Score

Are you struggling to manage your debts and looking for an effective solution? Look no further than our Debt Snowball Spreadsheet at BizzLibrary.com! Our spreadsheet is designed to help you take charge of your finances and pay off debts faster.

What is the Debt Snowball Method?

Debt snowball is a proven debt repayment strategy that involves paying off debts in order from smallest to largest, regardless of interest rates. The idea is to create momentum as you move from one debt to the next, building up confidence and motivation along the way. By focusing on one debt at a time, you can eliminate your debts faster and save money in interest charges.

How Our Debt Snowball Spreadsheet Can Help You?

Our Debt Snowball Spreadsheet is a simple yet effective tool that helps you implement the debt snowball method. It allows you to:

- Track Your Debts: The spreadsheet allows you to input all of your debts in one place, including the outstanding balance, interest rate, minimum payment, and monthly payment amount.

- Identify Your Smallest Debt: The spreadsheet automatically sorts your debts by balance, highlighting your smallest debt - the one you'll target first.

- Monitor Your Progress: As you start making payments, the spreadsheet will track your progress, updating your balances and time to payoff.

- Model Different Scenarios: The spreadsheet allows you to model different scenarios, such as increasing your monthly payments or applying a lump sum payment, to see how they affect your payoff timeline.

Get Your Debt Snowball Spreadsheet

Ready to take control of your finances and start paying off your debts faster? Download our Debt Snowball Spreadsheet in DOCX format today and get started on your debt-free journey!

Visit BizzLibrary.com now to access a wide range of personal finance templates, including budget worksheets, loan calculators, and more. Don't let debt hold you back any longer - take the first step today!

Is the template content above helpful?

Thanks for letting us know!

Reviews

Domenic Armstrong(6/25/2023) - USA

Your file provided me a solution for the situation I am in

Last modified

Our Latest Blog

- The Importance of Vehicle Inspections in Rent-to-Own Car Agreements

- Setting Up Your E-mail Marketing for Your Business: The Blueprint to Skyrocketing Engagement and Sales

- The Power of Document Templates: Enhancing Efficiency and Streamlining Workflows

- Writing a Great Resume: Tips from a Professional Resume Writer

Template Tags

Need help?

We are standing by to assist you. Please keep in mind we are not licensed attorneys and cannot address any legal related questions.

-

Chat

Online - Email

Send a message

You May Also Like

Event Risk Management Plan

Sample Leadership Retreat

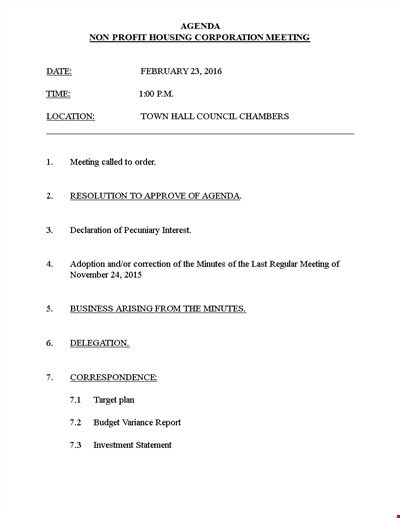

Non Profit Agenda Example

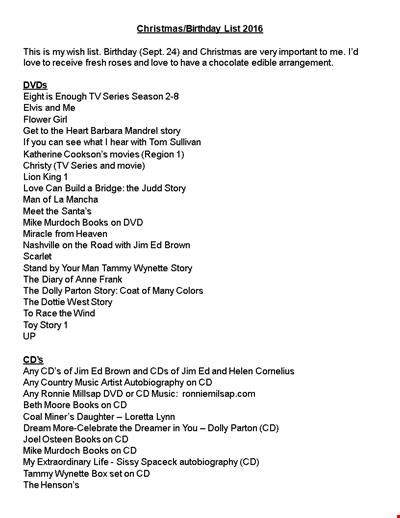

Perfect Christmas Birthday Gift List

Corporate Development Agenda Template - Streamline and Enhance Development Initiatives Globally

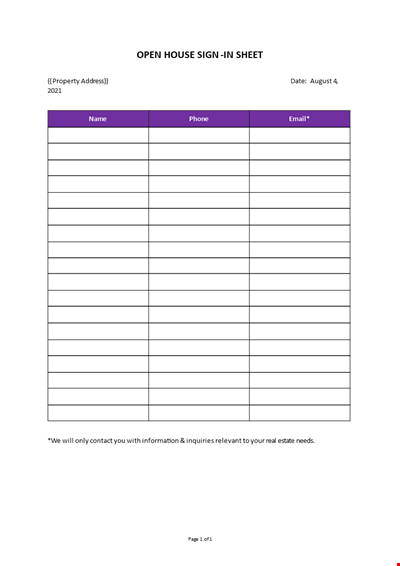

Open House Sign-in Sheet

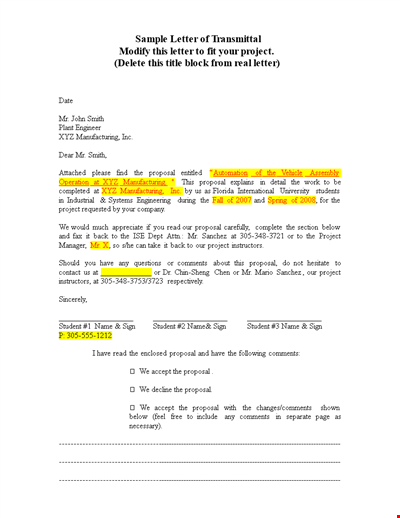

Letter Of Transmittal Template - Create a Professional Project Transmittal Letter

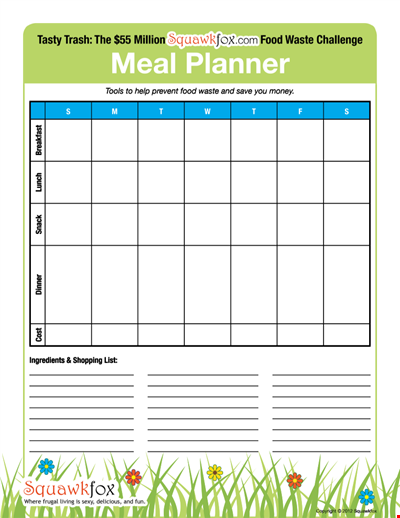

Create an Efficient Meal Planning Calendar for Easy Meal Preparation

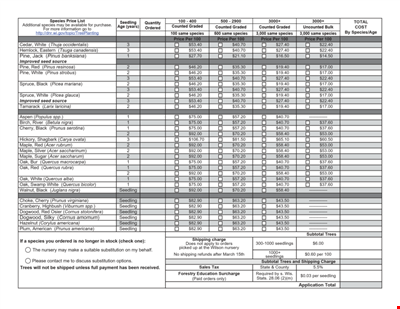

Seedling Price List - Affordable Saplings for Your Garden | Buy Best Quality Seedlings Online

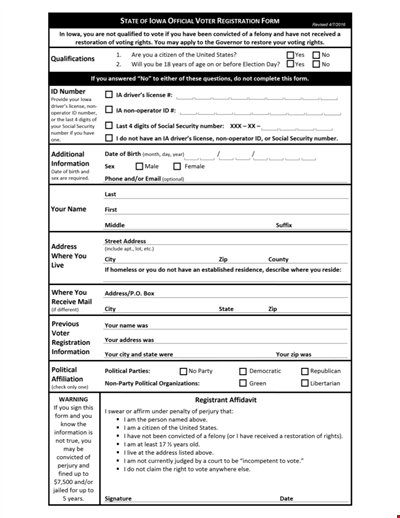

Printable Voter Registration Form

Department Material Requisition Form

Colored College Ruled Paper

College Ruled A Size Paper Template

Management Resume Us Letter

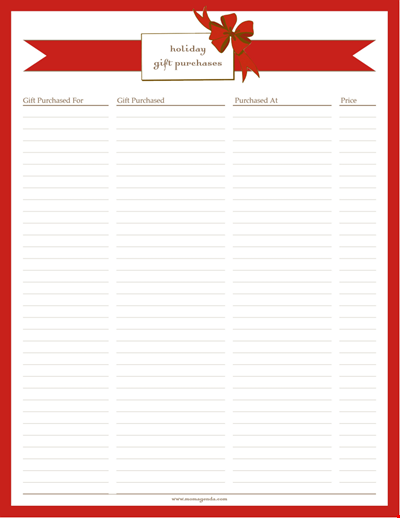

Organize Your Holiday Gift Purchases with our Template

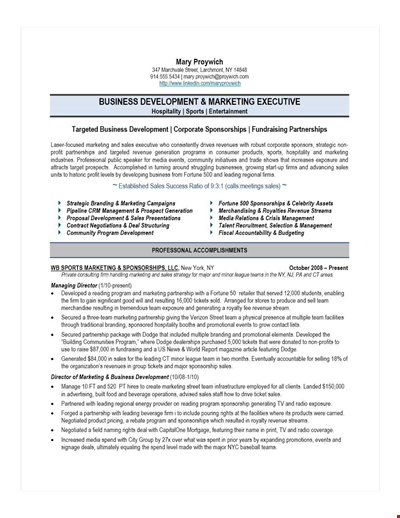

Experienced Corporate Sponsorship Sales Resume - Boost Your Career Today!