/d5388b18-3bad-4bdc-910a-c69be2c0194c.png)

Loan Offer Letter Format

Review Rating Score

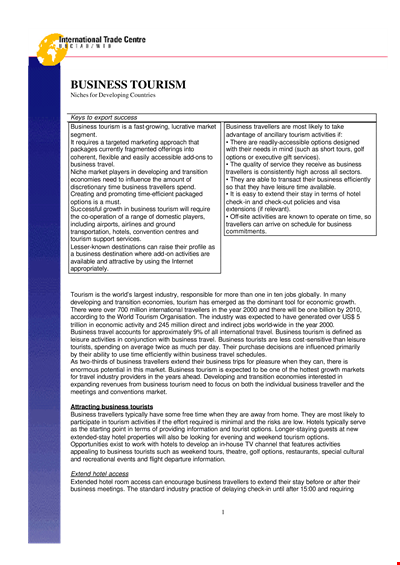

If you are in need of a loan and have successfully obtained one from a bank or other financial institution, it is important to have a formal loan offer letter in place. This letter serves as a document that outlines the terms and conditions of the loan, establishing a legally binding agreement between the borrower and the lender. At BizzLibrary.com, we offer a comprehensive loan offer letter format that you can easily download in DOCX format to customize and use for your specific situation.

What is a Loan Offer Letter?

A loan offer letter is a formal communication sent by a lender to a borrower, providing them with an official offer to grant the requested loan amount. This letter contains all the necessary details regarding the loan, including the loan amount, interest rate, repayment terms, and any additional fees or conditions that may apply. It serves as a legally binding agreement between both parties, ensuring that both the borrower and the lender are aware of their rights and responsibilities.

Key Elements of a Loan Offer Letter

A comprehensive loan offer letter should include the following key elements:

- Loan Amount: Clearly state the amount that the lender is willing to lend to the borrower. This is the principal amount that the borrower is expected to repay.

- Interest Rate: Specify the interest rate that will be applied to the loan amount. This determines the cost of borrowing for the borrower and the amount of interest that will need to be paid over the loan term.

- Repayment Terms: Outline the repayment terms, including the frequency of repayments (monthly, quarterly, etc.) and the duration of the loan. This includes the number of installments required to fully repay the loan.

- Collateral: If the loan requires collateral, clearly mention the details of the collateral and any specific requirements or conditions related to it.

- Additional Fees: Describe any additional fees or charges that may apply, such as processing fees, late payment fees, or prepayment penalties.

- Conditions and Obligations: State any specific conditions or obligations that the borrower must fulfill in order to obtain and maintain the loan, such as providing regular financial statements or maintaining a minimum balance in a specified account.

Download your Loan Offer Letter Format

At BizzLibrary.com, we understand the importance of having a professionally drafted loan offer letter. Whether you are obtaining a loan for personal or commercial purposes, our loan offer letter format is designed to meet your needs. Download our customizable DOCX template today, and easily create a tailored loan offer letter that accurately reflects your loan terms and conditions.

Visit BizzLibrary.com now to access a wide range of business document templates, including loan agreements, promissory notes, and more. Take control of your financial agreements and confidently proceed with your borrowing needs!

Is the template content above helpful?

Thanks for letting us know!

Reviews

Joycelyn Orozco(7/24/2023) - AUS

Very good!!

Last modified

Our Latest Blog

- A Guide to Make a Business Plan That Really Works

- The Importance of Vehicle Inspections in Rent-to-Own Car Agreements

- Setting Up Your E-mail Marketing for Your Business: The Blueprint to Skyrocketing Engagement and Sales

- The Power of Document Templates: Enhancing Efficiency and Streamlining Workflows

Template Tags

Need help?

We are standing by to assist you. Please keep in mind we are not licensed attorneys and cannot address any legal related questions.

-

Chat

Online - Email

Send a message

You May Also Like

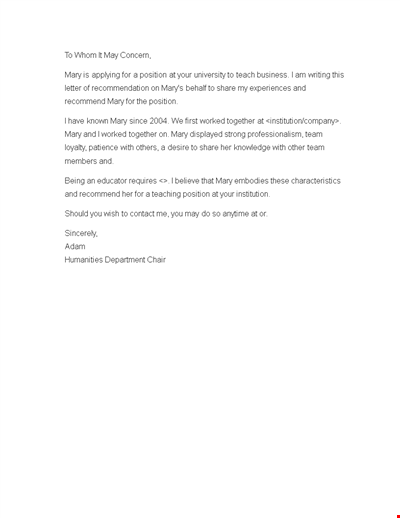

Recommendation Letter for a Position

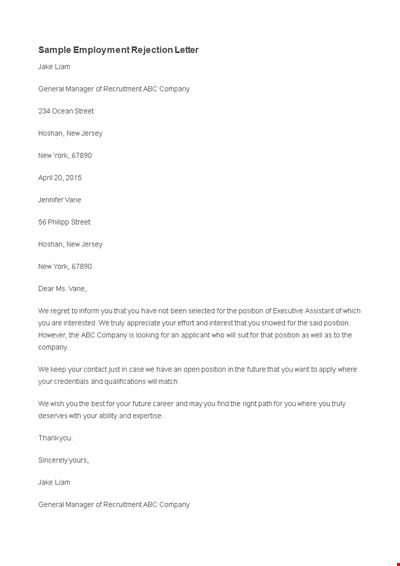

Sample Employment Rejection Letter

Good news letter example

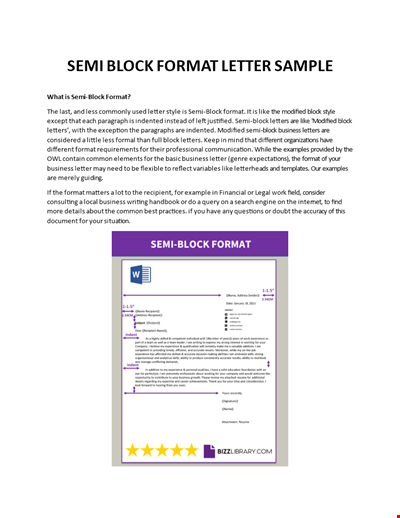

Semi Block Format Letter Template

Clean corporate Presentation Template

Letterhead Business Word

Include and Format Your Formal Business Letter Correctly

Travel Business Letterhead Format

Formal Letter For Change Of Address Format

Basic Customer Service Letter Text

White Hat Eulogy Example

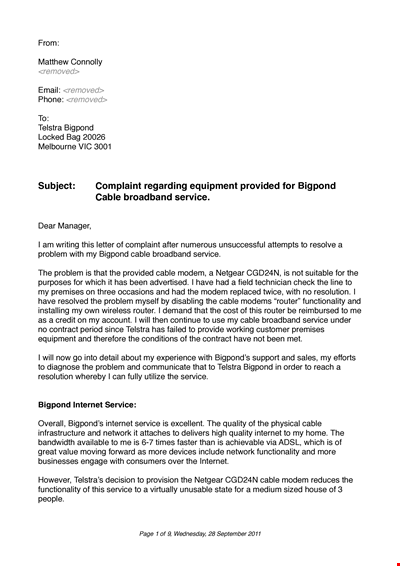

Complaint Letter Format for Poor Internet Service - Improve Your Network, Internet, and Router

Childcare Voucher Template | Get Discounts on Childcare with Vouchers

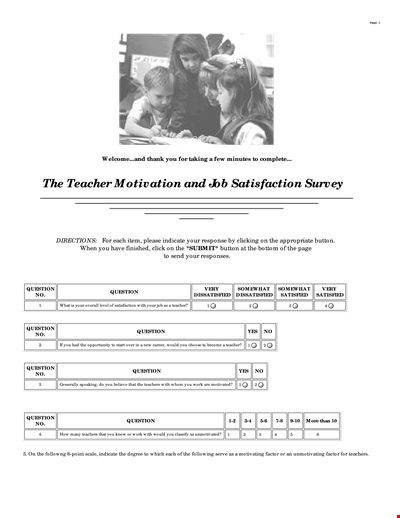

School Teacher Satisfaction Survey: Evaluating Teacher-Student Experience and Years of Service

Final Corporate Strategic Plan for Community Strategic County Norfolk

Company and Financial Management - Iberia Group