/0b571c21-90be-4cc8-8d3f-f032974ebd8a.png)

Small Business Administration Budget: Supporting Small Businesses with Loans

Review Rating Score

Are you a small business owner looking for information on the Small Business Administration (SBA) budget? Look no further! At BizzLibrary.com, we provide valuable resources to help small businesses understand the SBA budget and its implications. Download our comprehensive Small Business Administration Budget document in DOCX format to gain insights into funding programs, loans, and resources available for small businesses.

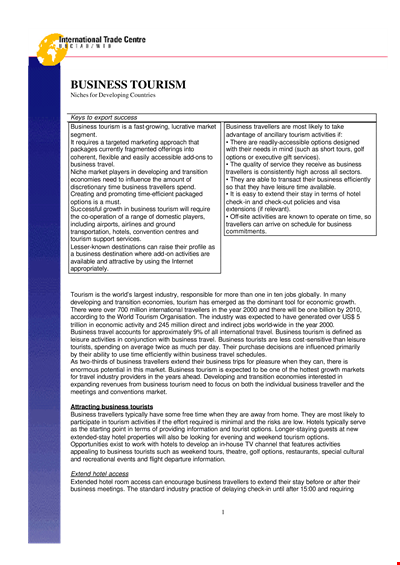

What is the Small Business Administration Budget?

The Small Business Administration (SBA) is a government agency in the United States dedicated to supporting and assisting small businesses. Each year, the SBA receives a budget allocation to fund various programs and initiatives aimed at helping entrepreneurs and small business owners succeed.

Why is the SBA Budget Important for Small Businesses?

The SBA budget plays a crucial role in supporting small businesses by providing funding and resources to promote growth and development. Here are some reasons why the SBA budget is vital:

- Funding Programs: The SBA budget supports various funding programs, including loans, grants, and venture capital, which can provide critical financial support to small businesses.

- Access to Loans: The SBA budget contributes to the availability of loans specifically designed for small businesses, making it easier for them to secure financing.

- Training and Counseling: Funds from the SBA budget are allocated to provide training and counseling services to entrepreneurs and small business owners, equipping them with essential skills and knowledge to succeed.

- Government Contracting Opportunities: The SBA budget enables small businesses to compete for government contracts, providing them with potential opportunities for growth and increased revenue.

- Disaster Assistance: In times of disaster, the SBA budget ensures that small businesses have access to financial assistance, loans, and resources to recover and rebuild.

Download Your Small Business Administration Budget Document

Gain valuable insights into the SBA budget and its impact on small businesses with our professionally crafted Small Business Administration Budget document. This comprehensive resource is available in DOCX format, ready to download and assist you in understanding the funding and opportunities offered by the SBA.

Visit BizzLibrary.com today, where you can browse and access a wide range of small business documents, including business plans, financial templates, and legal contracts. Take your small business to the next level with the resources offered by BizzLibrary.com!

Is the template content above helpful?

Thanks for letting us know!

Reviews

Bridgett Mclean(8/1/2023) - AUS

Grateful again, we couldn't have pulled this without this document

Last modified

Our Latest Blog

- The Importance of Vehicle Inspections in Rent-to-Own Car Agreements

- Setting Up Your E-mail Marketing for Your Business: The Blueprint to Skyrocketing Engagement and Sales

- The Power of Document Templates: Enhancing Efficiency and Streamlining Workflows

- Writing a Great Resume: Tips from a Professional Resume Writer

Template Tags

Need help?

We are standing by to assist you. Please keep in mind we are not licensed attorneys and cannot address any legal related questions.

-

Chat

Online - Email

Send a message

You May Also Like

Recommendation Letter for a Position

Sample Employment Rejection Letter

Good news letter example

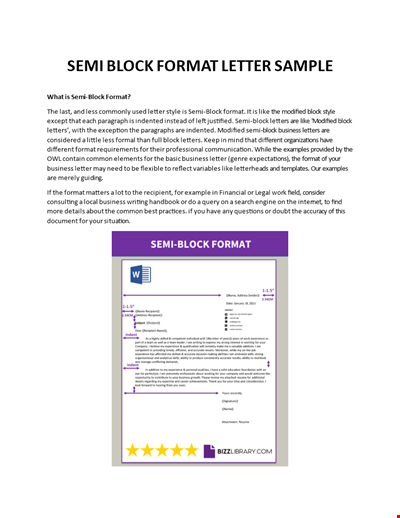

Semi Block Format Letter Template

Clean corporate Presentation Template

Letterhead Business Word

Include and Format Your Formal Business Letter Correctly

Travel Business Letterhead Format

Formal Letter For Change Of Address Format

Basic Customer Service Letter Text

White Hat Eulogy Example

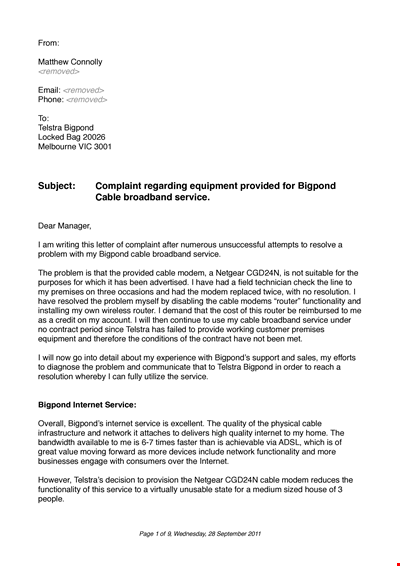

Complaint Letter Format for Poor Internet Service - Improve Your Network, Internet, and Router

Childcare Voucher Template | Get Discounts on Childcare with Vouchers

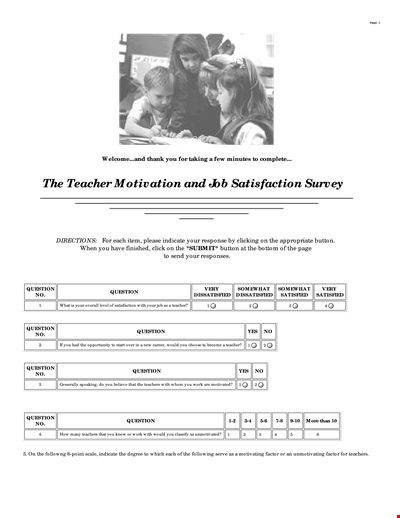

School Teacher Satisfaction Survey: Evaluating Teacher-Student Experience and Years of Service

Final Corporate Strategic Plan for Community Strategic County Norfolk

Company and Financial Management - Iberia Group